Cyber Insurance in M&A Due Diligence - Evaluating Data Breach Risk Through Coverage Analysis

How sophisticated buyers assess cyber insurance coverage to evaluate data security posture and breach liability exposure during M&A due diligence

The first question a private equity buyer asked during our client’s management presentation wasn’t about revenue growth, customer concentration, or EBITDA margins. It was about their cyber insurance claims history over the past three years and whether their current coverage limits reflected actual data breach exposure or simply what they could afford when the policy was written.

Executive Summary

Cyber insurance coverage has become a critical due diligence lens through which sophisticated buyers evaluate data security posture, breach liability exposure, and incident response capability. What was once routine insurance verification has transformed into a substantive assessment tool, with buyers treating cyber coverage characteristics as probabilistic indicators (though not deterministic proof) of overall security program maturity.

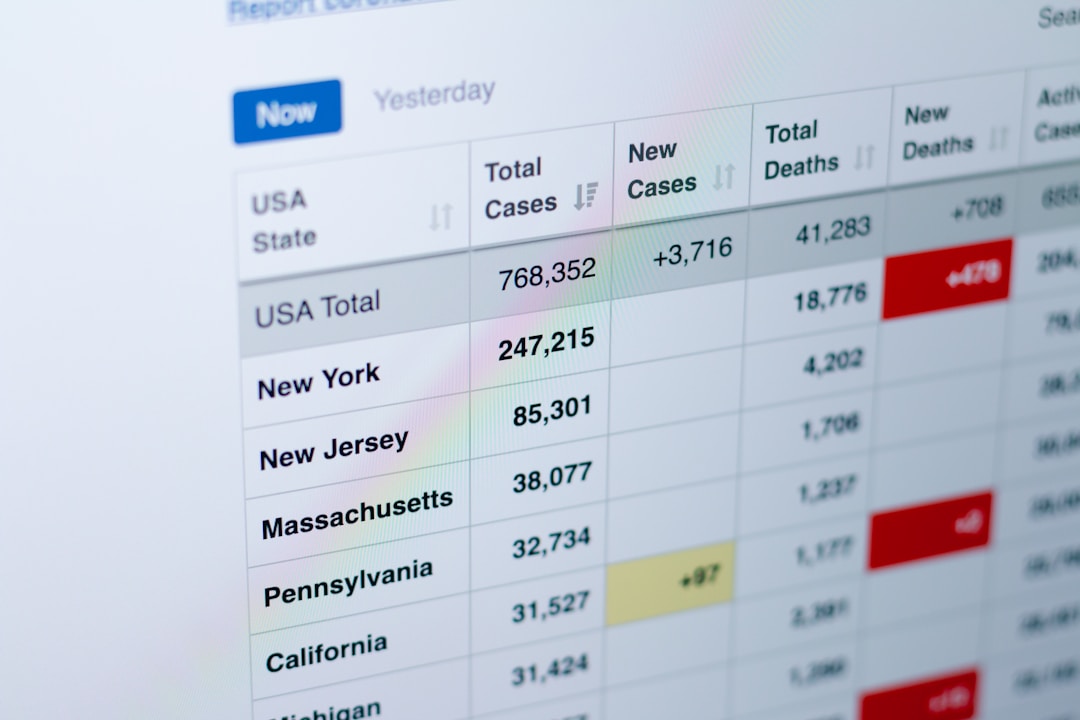

This shift reflects the dramatic expansion of data-related liability in M&A transactions. According to IBM Security’s 2024 Cost of a Data Breach Report, the average breach cost reached $4.88 million globally, with costs varying significantly by industry. Healthcare breaches averaged $9.77 million while hospitality averaged approximately $3.4 million. Buyers increasingly recognize that undisclosed breaches, inadequate security controls, and insufficient incident response capabilities can generate post-close liabilities that dwarf traditional warranty and indemnification protections.

For business owners preparing for exit, understanding how buyers interpret cyber insurance documentation is necessary for both transaction success and value optimization. Coverage limits, retention levels, covered events, exclusions, and claims history each signal specific aspects of security posture that sophisticated buyers have learned to decode. But coverage serves as a risk transfer mechanism and one data point among many, not a comprehensive security assessment substitute. Favorable insurance terms may reflect market conditions, broker relationships, or favorable claims history rather than superior security controls.

This article examines cyber insurance due diligence frameworks, identifies what coverage characteristics may suggest about security maturity, and provides actionable guidance for presenting cyber risk management through insurance documentation and supporting evidence.

Introduction

The intersection of cyber insurance and M&A due diligence reflects a fundamental shift in how buyers evaluate technology-enabled businesses. A decade ago, cyber coverage was often an afterthought: a line item verified during routine insurance diligence with little strategic significance. Today, cyber insurance analysis has become a sophisticated assessment methodology that can reveal operational maturity signals, though it requires careful interpretation alongside other diligence findings.

This change stems from buyer experience with post-close cyber incidents. Acquiring companies have discovered that pre-existing breaches, undisclosed security weaknesses, and inadequate incident response capabilities can generate liabilities extending years beyond transaction close. The IBM Security/Ponemon Institute research indicates that breaches take an average of 194-277 days to identify and contain depending on organization type and detection capabilities, meaning acquirers may inherit exposure from incidents that occurred well before the transaction. Traditional representations and warranties provide limited protection when the underlying security posture was never adequately assessed.

Cyber insurance documentation offers a unique diligence lens because it reflects both seller self-assessment and underwriter evaluation. Coverage applications require detailed security questionnaires that memorialize the seller’s representations about their security program. Underwriter pricing and terms reflect professional risk assessment incorporating loss data, threat intelligence, and actuarial modeling, though the correlation between underwriter assessment and actual security effectiveness varies significantly by carrier and market conditions. Claims history reveals actual incident experience that may not appear in other diligence materials.

We’ve observed sophisticated buyers developing refined cyber insurance analysis frameworks. These approaches go beyond coverage verification to extract security intelligence from insurance documentation that sellers often don’t realize they’re providing. Understanding this buyer perspective is vital for exit-focused business owners seeking to present their cyber risk management effectively, while recognizing that insurance positioning alone cannot substitute for substantive security practices, and insurance analysis by buyers cannot replace comprehensive security evaluation including penetration testing, control evaluation, and technical architecture review.

The Evolution of Cyber Insurance as a Diligence Tool

Cyber insurance due diligence has evolved through distinct phases that reflect both market maturation and buyer learning. Industry surveys from Marsh McLennan and Willis Towers Watson have documented this progression through annual cyber insurance market reports. Understanding this progression provides context for current buyer expectations and future trajectory.

Phase One: Coverage Verification

Early cyber insurance diligence focused simply on confirming coverage existed. Buyers verified policy presence, checked coverage limits against transaction value, and confirmed no pending claims that might affect coverage availability post-close. This approach treated cyber insurance as a binary checklist item rather than an analytical tool.

Phase Two: Coverage Adequacy Assessment

As cyber incidents became more frequent and costly, buyers began evaluating whether existing coverage adequately addressed potential exposure. This phase introduced comparison frameworks benchmarking coverage against industry norms, revenue multiples, and data volume metrics. Inadequate coverage raised questions about either security confidence or risk management sophistication.

Phase Three: Coverage as Security Indicator

Contemporary cyber insurance due diligence increasingly treats coverage characteristics as probabilistic indicators of underlying security posture. Sophisticated buyers recognize that underwriters conduct security assessments of varying depth and sophistication before pricing coverage. While some carriers employ rigorous evaluation methodologies, others rely primarily on standardized questionnaires and loss history. Favorable terms, lower premiums relative to peers, and absence of restrictive endorsements may suggest positive underwriter assessment, but they can also reflect market conditions, broker relationships, or simply lack of claims history rather than superior security controls.

Phase Four: Claims History Intelligence

More advanced diligence approaches extract intelligence from claims history that reveals incident patterns, response effectiveness, and security program change. This analysis examines not just whether claims occurred but how they were handled, what remediation followed, and whether similar incidents recurred: information that provides insight into organizational security culture.

Coverage Assessment Frameworks Used by Buyers

Understanding how buyers analyze cyber insurance in due diligence helps sellers anticipate questions, prepare documentation, and position their coverage strategically. This evaluation framework is most developed for companies handling significant consumer data. B2B service firms or manufacturing companies with limited data exposure may face simpler analysis focused on operational disruption rather than data breach costs.

Coverage Limit Analysis

Buyers typically evaluate coverage limits through multiple lenses. Absolute limits are compared against potential exposure based on data volume, data sensitivity, regulatory environment, and industry breach cost benchmarks.

To quantify exposure, buyers reference established breach cost research. The Ponemon Institute’s methodology calculates breach costs across four categories: detection and escalation costs, notification costs, post-breach response costs, and lost business costs. For mid-market companies in the $2M-$20M revenue range, the calculation typically incorporates:

- Per-record costs: Based on IBM Security’s 2024 research, average per-record costs range from $150-180 for general business data, rising to $400-450 for healthcare records and $170-190 for financial services records. These figures carry significant uncertainty depending on breach scope and organizational response capability.

- Fixed incident costs: Base costs for forensic investigation, legal counsel, and crisis management typically range from $250,000-$750,000 regardless of breach scope

- Regulatory exposure: GDPR penalties can reach €20 million or 4% of global revenue; CCPA penalties range from $2,500-$7,500 per violation; HIPAA penalties range from $100-$50,000 per violation with annual maximums of $1.5 million per category

A company holding 500,000 customer records with payment information faces estimated direct breach exposure of approximately $2.5-$4.5 million in response costs (using per-record and fixed cost estimates), plus potential regulatory penalties and business interruption losses. Total economic impact including customer churn, business interruption, and competitive disadvantage often doubles or triples direct costs, suggesting total exposure of $5-13.5 million for this scenario. A company holding 50,000 B2B contact records faces materially lower exposure: perhaps $500,000-$1.2 million in direct costs, reflecting both smaller record counts and lower per-record sensitivity.

Based on our experience with mid-market transactions, coverage ratios (coverage limits divided by estimated breach cost exposure) typically range from 0.5x to 2x annual revenue for companies handling significant consumer data. Most buyers we work with expect minimum coverage of at least 1x estimated total breach exposure (including indirect costs) for companies in data-intensive industries. Ratios significantly below these ranges prompt questions about either security confidence or risk management capability.

Sublimit analysis examines how coverage is allocated across event types. Policies often include sublimits for specific coverages like ransomware, business interruption, or regulatory defense costs. Buyers evaluate whether sublimit allocation reflects actual risk profile or generic policy structure.

Retention Level Interpretation

Policy retentions (deductibles) signal risk tolerance and security confidence. Higher retentions reduce premium costs but expose the company to greater out-of-pocket expense when incidents occur. Buyers may interpret retention choices as management statements about incident probability, though retention decisions also reflect cash flow considerations and premium optimization strategies.

Very low retentions may indicate management concern about incident likelihood: a willingness to pay premium for first-dollar coverage could suggest expectation of claims. Very high retentions may indicate either strong security confidence, budget constraints, or simply favorable loss history that enables higher retention acceptance.

For companies in the $2-5M revenue range, retentions typically run $25,000-$75,000, while $10-20M revenue companies often carry $100,000-$250,000 retentions. These ranges reflect both company size and security program maturity. Retentions significantly outside expected ranges for company size often prompt deeper security diligence.

Covered Events and Exclusions

Policy scope reveals both coverage adequacy and risk assessment sophistication. Buyers examine whether covered events align with actual threat landscape for the specific business. A company facing significant ransomware exposure should have explicit ransomware coverage without restrictive sublimits. A company handling regulated health data should have robust regulatory defense and penalty coverage.

Exclusion analysis often reveals more than coverage analysis. Common exclusions include:

- War and terrorism exclusions: Increasingly relevant as nation-state cyber activity blurs traditional boundaries. Lloyd’s of London and other major markets have implemented specific cyber war exclusions since 2023

- Infrastructure exclusions: Coverage gaps when incidents stem from cloud provider or utility failures

- Prior acts exclusions: Gaps in coverage for breaches that occurred before policy inception but are discovered later

- Failure to maintain exclusions: Coverage voidance if security representations prove inaccurate

Buyers scrutinize exclusions for alignment with actual risk profile. Significant exclusion gaps suggest either inadequate risk assessment or coverage unavailable at acceptable cost: both signals that warrant further investigation.

Premium Trends and Underwriter Assessment

Premium trajectory over time can reveal underwriter assessment of security posture change, though premiums also reflect broader market conditions that must be understood for accurate interpretation. Declining premiums relative to coverage limits may suggest underwriters view security improvements favorably. Rising premiums may indicate either market-wide hardening or specific concerns about the insured’s risk profile.

Sophisticated buyers request premium history alongside coverage documentation, examining whether premium changes correlate with coverage changes, claims experience, or security program modifications. According to Marsh’s Global Insurance Market Index, the cyber insurance market experienced significant hardening from 2020-2023, with average premium increases of 25-100% annually depending on industry and risk profile. Preliminary market data suggests stabilization in 2024, though conditions vary significantly by carrier and insured characteristics. Understanding this market context is needed for accurate premium trend interpretation.

Industry-Specific Considerations in Cyber Insurance Diligence

Cyber insurance diligence varies significantly across industries, reflecting different regulatory environments, data types, and threat landscapes.

Healthcare

Healthcare organizations face unique cyber insurance scrutiny due to HIPAA requirements and the elevated value of protected health information (PHI). Buyers typically expect coverage limits of 2-3x estimated breach exposure given regulatory penalty potential and the extended notification requirements. Key diligence focus areas include:

- Business associate agreement compliance

- PHI encryption and access controls

- Incident response plans meeting HIPAA breach notification timelines

- Coverage for HHS Office for Civil Rights investigations

Financial Services

Financial services companies face overlapping regulatory frameworks including GLBA, state insurance regulations, and industry-specific requirements like PCI-DSS. Buyers often expect:

- Higher coverage limits relative to revenue (often 1.5-2.5x annual revenue)

- Explicit coverage for regulatory defense across multiple jurisdictions

- Social engineering and funds transfer fraud coverage

- Third-party vendor breach coverage given interconnected financial systems

Technology and SaaS

Technology companies present unique diligence challenges given their role as both data processors and potential breach vectors for downstream customers. Key considerations include:

- Professional liability and errors and omissions coverage intersection with cyber

- Dependent business interruption coverage for cloud service dependencies

- Coverage adequacy for contractual liability to enterprise customers

- Security representation accuracy given technical sophistication expectations

Manufacturing

Manufacturing cyber insurance diligence has progressed rapidly with operational technology (OT) exposure. Buyers increasingly focus on:

- Coverage for operational technology and industrial control system incidents

- Business interruption coverage for production disruption

- Supply chain cyber exposure

- Property damage coverage for cyber-physical incidents

Buyer Type Distinctions in Cyber Insurance Analysis

Financial buyers and strategic buyers approach cyber insurance diligence differently, reflecting their distinct capabilities and risk tolerances.

Financial Buyers

Private equity firms and other financial buyers typically lack internal security expertise, making them more reliant on insurance analysis and third-party assessments as proxy indicators for security posture. These buyers often:

- Place greater weight on insurance coverage adequacy relative to benchmarks

- Rely more heavily on underwriter assessment as validation of security programs

- Request comprehensive third-party security assessments to supplement insurance analysis

- Focus on whether coverage can be maintained post-close under new ownership

Strategic Buyers

Strategic acquirers with existing security infrastructure often conduct direct security evaluations using internal expertise, treating insurance analysis as supplementary rather than primary. These buyers typically:

- Perform technical security assessments using internal security teams

- Evaluate target security architecture for integration compatibility

- Focus on whether target security practices meet acquirer standards

- View insurance primarily as risk transfer rather than security validation

Understanding which buyer type you’re likely to attract helps calibrate cyber insurance positioning and supporting evidence preparation.

Claims History as Security Intelligence

Claims history analysis has become perhaps the most valuable component of cyber insurance due diligence, revealing incident patterns and response capabilities that other diligence methods may miss. But claims history interpretation requires nuance: both the presence and absence of claims require contextual analysis.

Claims Frequency and Severity

Buyers examine both claims frequency and severity patterns. Multiple claims may indicate systemic security weaknesses, particularly aggressive threat targeting, or simply transparent incident reporting practices. Single high-severity claims prompt questions about root cause, remediation effectiveness, and recurrence prevention.

Zero claims history requires careful interpretation. For mature companies with significant data exposure, absence of claims may indicate excellent security controls, inadequate incident detection, high claim thresholds, or simply statistical variation. Buyers often probe detection capabilities when claims history seems inconsistent with threat environment.

Claims Resolution Analysis

How claims were resolved reveals incident response capability. Buyers typically examine:

- Detection to response timeline: How quickly was the incident identified and contained? Industry research suggests breach detection and containment typically ranges from 150-350 days, with averages around 200-280 days depending on organization type and detection capability. Mature organizations with dedicated security operations typically perform significantly better than these averages.

- Recovery duration: How long until normal operations resumed?

- Remediation scope: What security improvements followed the incident?

- Carrier relationship: Was the claim handled smoothly or contentiously?

Claims handled efficiently with rapid recovery and substantive remediation signal mature incident response capability. Prolonged resolution, disputed coverage, or absent remediation raise concerns about response maturity.

Claims Disclosure Positioning

Sellers often worry that claims history will negatively impact buyer perception. While significant claims certainly prompt additional diligence, how claims are presented often matters as much as whether they occurred.

Proactive disclosure with detailed incident documentation, remediation evidence, and security improvement narrative positions claims history constructively. Reactive disclosure discovered through diligence requests raises concerns about transparency and potentially undisclosed incidents.

Claims disclosure strategy should consider competitive dynamics. In competitive auction processes, consider selective disclosure timing or make sure all potential bidders face similar disclosure requirements. Detailed claims disclosure to a single bidder while competitors remain unaware could disadvantage you unnecessarily.

We advise clients to prepare comprehensive claims narratives that address what happened, how it was detected, what response occurred, and what improvements followed. This approach can transform potential negatives into evidence of mature security operations, though substantive remediation, not just documentation, is required.

When Insurance Diligence Doesn’t Prevent Problems

While thorough cyber insurance preparation typically improves diligence outcomes, there are scenarios where documentation and preparation prove insufficient.

Case Pattern: Undiscovered Pre-Existing Breaches

Even comprehensive insurance documentation cannot reveal breaches that haven’t been detected. In several transactions we’ve observed, acquirers discovered post-close that breaches had occurred during seller ownership but weren’t identified until months after transaction close. Insurance coverage often excludes incidents occurring before policy inception, leaving acquirers with exposure that neither insurance analysis nor traditional diligence uncovered.

To address this risk, consider comprehensive forensic assessment 6-12 months before anticipated transaction to identify any existing compromises. Implement enhanced monitoring during the deal process, and negotiate appropriate representations and indemnification terms that address the pre-close breach discovery risk.

Case Pattern: Representation-Reality Gaps

Insurance applications contain security representations that sellers sometimes cannot substantiate under rigorous diligence scrutiny. When buyers discover that represented controls don’t exist as described (even when sellers believed representations were accurate), the resulting credibility damage can exceed the substantive security concern.

Case Pattern: Coverage Gaps Discovered Post-Incident

Some coverage limitations only become apparent when claims occur. War exclusion applicability, infrastructure failure coverage scope, and “failure to maintain” provisions have all generated coverage disputes that sellers couldn’t have anticipated from policy review alone.

These scenarios underscore that cyber insurance preparation, while valuable, cannot substitute for substantive security practices and comprehensive diligence processes.

Alternative and Complementary Risk Management Approaches

While cyber insurance provides valuable risk transfer, sophisticated risk management incorporates multiple strategies that buyers may evaluate alongside insurance coverage.

Self-Insurance and Captive Structures

Larger companies may maintain self-insured retentions or captive insurance structures for cyber risk. Buyers evaluate whether self-insurance reflects confidence in security controls or simply cost management, examining whether retained exposure is backed by adequate reserves and incident response capability. Self-insurance may be superior for companies with greater than $50M revenue and strong internal security teams capable of managing incident response without carrier involvement.

Hybrid Coverage Models

Some organizations combine traditional insurance with alternative structures including parametric coverage (paying fixed amounts upon trigger events rather than indemnifying actual losses) or industry mutual arrangements. These approaches may offer coverage where traditional markets have gaps but require careful evaluation of terms and trigger definitions. Hybrid approaches may work effectively for $20-50M revenue companies with specific risk concentrations that traditional coverage addresses inadequately.

Contractual Risk Allocation

Vendor agreements, customer contracts, and service level agreements allocate cyber risk across parties. Buyers evaluate whether contractual provisions align with insurance coverage and operational reality. Gaps between contractual commitments and insured/operational capability create exposure that insurance analysis alone won’t reveal.

Security Investment as Risk Reduction

Direct security investment represents an alternative to risk transfer. Buyers increasingly evaluate whether security spending patterns suggest risk reduction strategy versus risk transfer strategy. Organizations investing heavily in security controls while maintaining moderate insurance may present lower actual risk than organizations with high insurance limits but minimal security investment. Traditional insurance typically remains optimal for companies under $20M revenue or those with limited internal security expertise, where risk transfer provides more reliable protection than self-management.

Preparing Cyber Insurance Documentation for Due Diligence

Strategic preparation of cyber insurance documentation can significantly improve buyer perception of cyber risk management while reducing diligence friction. But preparation requires meaningful time investment: organizations should budget 60-120 hours of combined effort from risk management, IT security, and legal functions over 3-4 months for comprehensive preparation. At blended rates of $200-300 per hour for these functions, comprehensive preparation typically costs $12,000-36,000 in internal time, plus external advisor costs.

Documentation Organization

Buyers expect organized presentation of cyber insurance materials including:

| Document Category | Specific Items | Buyer Focus |

|---|---|---|

| Current Policy | Full policy document with all endorsements | Coverage scope and exclusions |

| Policy History | Prior three years of policies | Coverage change and consistency |

| Premium History | Premium amounts and rate changes | Underwriter risk assessment trajectory |

| Claims History | All claims with resolution documentation | Incident patterns and response capability |

| Application Materials | Completed applications and questionnaires | Security representations made to carriers |

| Renewal Correspondence | Underwriter questions and requirements | Areas of carrier concern |

| Broker Analysis | Coverage recommendations and benchmarking | Professional assessment of adequacy |

| Supporting Evidence | Security assessments, policies, metrics | Corroboration of insurance representations |

Budget 15-25 hours for compilation and organization for straightforward situations. Companies with multiple carriers, complex claims history, or decentralized documentation may need 30-40 hours plus external coordination. Organized presentation signals professional risk management while enabling efficient buyer review.

Application Consistency Review

Insurance applications contain detailed security representations that buyers will compare against actual practices. Inconsistencies between application representations and diligence findings create significant concerns about either intentional misrepresentation or inadequate management awareness of actual security posture.

Before entering a transaction process, review recent insurance applications against current security practices. This review typically requires 20-30 hours of cross-functional effort. Address any gaps between representations and reality by either implementing represented controls or by correcting representations at renewal. Discovered inconsistencies during diligence create far more concern than proactively disclosed and addressed gaps.

Coverage Gap Analysis and Remediation

Conduct independent assessment of coverage adequacy before buyers perform their own analysis. Identify gaps between current coverage and either industry benchmarks or actual exposure. Where gaps exist, either improve coverage or prepare explanations for strategic coverage decisions.

Some coverage gaps reflect rational risk management decisions rather than inadequate protection. A company with minimal regulated data may reasonably decline robust regulatory coverage. A company with strong security controls and low claims history may rationally accept higher retentions. Preparing explanations for strategic coverage decisions prevents buyers from inferring inadequate risk management from intentional choices.

Beyond Insurance: Supporting Security Evidence

While cyber insurance analysis provides valuable diligence intelligence, sophisticated buyers supplement insurance review with direct security assessment. Preparing supporting evidence boosts the credibility of insurance-based security signals. This supporting evidence demonstrates that insurance positioning reflects substantive security investment rather than simply coverage purchasing. Insurance analysis provides valuable insights but cannot substitute for direct security assessment including penetration testing, control evaluation, and technical architecture review.

Security Program Documentation

Documented security policies and procedures corroborate insurance application representations while demonstrating program formalization. Key documents include:

- Information security policy

- Incident response plan

- Business continuity and disaster recovery plans

- Vendor management policy

- Employee security awareness training records

- Access control procedures

- Data classification and handling standards

Documentation existence matters, but documentation currency matters more. Policies last updated three years ago suggest a checkbox compliance approach rather than active security management.

Third-Party Assessments

Independent security assessments provide credibility that self-reported insurance applications cannot match. Relevant assessments include:

- Penetration testing results: Professional testing of technical controls, typically conducted annually

- SOC 2 reports: Independent validation of control environment, particularly valuable for technology companies

- Vulnerability assessments: Systematic identification of security weaknesses

- Compliance audits: Validation of regulatory requirement adherence

Recent assessment results demonstrating acceptable findings significantly boost buyer confidence. Assessment results revealing weaknesses that were subsequently remediated demonstrate security program responsiveness.

Security Metrics and Trending

Quantitative security metrics demonstrate program sophistication and enable trending analysis. Relevant metrics include:

- Vulnerability remediation timelines (industry benchmarks suggest critical vulnerabilities should be remediated within 7-14 days)

- Security awareness training completion rates (target: 95%+ completion)

- Incident detection and response times

- Patch management currency (percentage of systems current within 30 days)

- Access review completion rates

Metrics showing improvement over time signal active security management. Static or declining metrics raise questions about security investment and attention.

Common Cyber Insurance Diligence Issues and Responses

Anticipating common diligence issues enables proactive preparation and effective response.

Issue: Coverage Limits Below Industry Benchmarks

Buyer Concern: Inadequate risk assessment or security confidence issues.

Effective Response: Provide analysis supporting coverage adequacy for actual risk profile using documented breach cost methodology including both direct and indirect costs. If coverage is genuinely inadequate, improve before transaction: simple coverage limit increases may take 30-60 days, but meaningful coverage improvements including new coverages or significant limit increases often require 60-90 days, particularly for companies with claims history or complex risk profiles. If intentionally below benchmarks, document rationale based on specific security investments that reduce exposure and risk retention strategy.

Issue: Claims History Revealing Prior Incidents

Buyer Concern: Security weakness patterns, potential undisclosed ongoing exposure.

Effective Response: Provide comprehensive incident documentation including root cause analysis, remediation actions, and evidence of non-recurrence. Include specific timelines and investment amounts. Position claims as learning opportunities that strengthened security posture, but make sure the improvement narrative is substantiated by verifiable changes.

Issue: Application Inconsistencies

Buyer Concern: Misrepresentation, management credibility, potential coverage voidance.

Effective Response: Proactively identify and address inconsistencies before diligence. Where historical inconsistencies exist, document corrections made and current accurate state. Demonstrate that any gaps were inadvertent and have been remediated. Consider whether application corrections are needed at renewal.

Issue: Significant Policy Exclusions

Buyer Concern: Coverage gaps exposing buyer to post-close liability.

Effective Response: Document rationale for exclusion acceptance. Provide evidence of alternative risk mitigation for excluded scenarios. Where exclusions are problematic, pursue coverage improvements before transaction, though some exclusions (particularly war and infrastructure) may be market-standard and unavoidable.

Issue: Rising Premiums

Buyer Concern: Underwriter concern about risk profile, potential claims history not disclosed.

Effective Response: Document premium increase drivers: market hardening versus specific risk factors. Provide market data (Marsh, Willis Towers Watson, or Aon market reports) demonstrating industry-wide premium trends for context. If increases reflect specific factors, address those factors directly with evidence of remediation.

Actionable Takeaways

Conduct Pre-Transaction Coverage Assessment: Engage your insurance broker in comprehensive cyber coverage review at least 12-18 months before anticipated transaction. Budget 25-40 hours for this assessment. Identify gaps between current coverage and buyer expectations, allowing time for strategic improvement. Coverage changes typically require 60-90 days for meaningful improvements.

Audit Insurance Application Accuracy: Review all security representations made in insurance applications against actual current practices. Budget 20-30 hours for cross-functional review. Address any inconsistencies through either control implementation or application correction at next renewal. This step prevents the credibility damage from discovered inconsistencies during diligence.

Prepare Claims History Narratives: Develop comprehensive documentation for any cyber-related claims including incident details, response timeline, remediation actions, and security improvements. Include specific investments and timeline evidence. Transform claims history from liability into evidence of mature incident management.

Quantify Your Full Breach Exposure: Calculate estimated breach cost exposure using established methodologies (per-record costs, fixed incident costs, regulatory exposure) and include indirect costs that typically double or triple direct costs. Document your calculation methodology for buyer review and make sure coverage reflects total potential exposure, not just direct response costs.

Organize Insurance Documentation: Compile complete cyber insurance package including current and historical policies, premium history, claims documentation, and application materials. Budget 15-40 hours for compilation and organization depending on complexity. Organized presentation demonstrates professional risk management.

Build Supporting Evidence: Assemble security program documentation, third-party assessment results, and security metrics that corroborate insurance-based security signals. Direct evidence supplements insurance analysis with substantive validation and demonstrates that coverage positioning reflects actual security investment rather than just premium dollars.

Engage Specialist Advisors: Consider cyber-specific insurance broker and M&A counsel review of insurance positioning. Budget $15,000-$50,000 for specialized pre-transaction cyber risk advisory, with costs varying by transaction size and security complexity. Simple coverage reviews may cost $10,000-$20,000 while comprehensive security posture assessment can reach $35,000-$50,000.

Conclusion

Cyber insurance has changed from a routine diligence checkbox to a sophisticated analytical tool that buyers use to evaluate security posture, breach liability exposure, and incident response capability. This change reflects hard-learned buyer lessons about post-close cyber liabilities and the efficiency of insurance analysis as one indicator (though not a deterministic measure) of security program maturity.

For business owners preparing for exit, this change creates both challenges and opportunities. Inadequate coverage, problematic claims history, or inconsistent application representations can undermine buyer confidence and transaction value. Conversely, well-structured coverage, effectively presented claims history, and substantive supporting evidence can differentiate your business as a mature, well-managed acquisition target.

The key insight is that cyber insurance diligence examines more than insurance: it examines the security program, risk management sophistication, and management credibility that insurance documentation reveals. But insurance serves as a risk transfer mechanism and data point, not a comprehensive security assessment. Buyers who rely solely on insurance analysis without direct security diligence may miss critical risks; sellers who focus solely on insurance positioning without substantive security investment may find their coverage claims unsupported under scrutiny.

Investing in both substantive security practices and strategic insurance positioning before entering a transaction process pays dividends in smoother diligence, stronger buyer confidence, and ultimately, transaction value that reflects the security maturity your business has developed.