Reading Customer Satisfaction Through Return and Allowance Trends

Return and allowance trends reveal customer satisfaction signals that sophisticated buyers evaluate during due diligence to assess quality and relationships

Every business owner knows their revenue numbers cold. But when a sophisticated buyer sits across the table, they care more about what came back than what went out. Return and allowance trends tell a story that revenue alone cannot—a story about customer satisfaction trajectory, product quality consistency, and the true health of your customer relationships. We’ve watched owners lose hundreds of thousands in deal value because they couldn’t explain a return spike from eighteen months earlier.

Executive Summary

Return and allowance trends have become critical indicators that sophisticated buyers analyze during commercial and financial due diligence. These metrics reveal customer satisfaction trajectory in ways that surveys and retention rates often miss—they show whether customers are experiencing problems significant enough to demand credits, returns, or allowances. For business owners planning exits within the next two to seven years, understanding how buyers interpret these trends and proactively managing the underlying drivers can meaningfully impact both deal valuation and buyer confidence.

This article examines specific return and allowance patterns that frequently trigger buyer concern versus those that build confidence. We look at how buyers analyze these trends during diligence, what documentation strengthens your position, and how tracking returns with driver analysis provides satisfaction evidence that supports customer relationship positioning. Whether your current trends are favorable or concerning, the frameworks provided here will help you understand typical buyer perspectives and take appropriate action. The goal is not to hide problems but to demonstrate that you understand your customer satisfaction dynamics and have systems in place to continuously improve them.

Introduction

When private equity firms and strategic acquirers evaluate potential acquisitions, they look beyond surface-level financial metrics to understand the underlying health of customer relationships. Return and allowance trends provide a window into this health that other metrics may not fully capture. While a customer may continue purchasing despite dissatisfaction—perhaps due to switching costs or contractual obligations—returns and allowances capture moments when dissatisfaction becomes significant enough to warrant action.

We see this pattern frequently in our exit planning work. Business owners focus on customer retention rates and satisfaction surveys, believing these metrics tell the complete customer health story. Yet buyers sometimes uncover concerning return trends during diligence that paint a different picture. Consider a scenario we encountered with a distribution client: their 95% retention rate looked impressive until diligence revealed that returns had increased from 3% to 7% over three years, suggesting customers were staying but becoming increasingly dissatisfied with fulfillment accuracy.

The reverse scenario also occurs. Owners sometimes worry unnecessarily about modest return rates without recognizing that declining trends actually strengthen their position. A business with a 5% return rate that has declined from 8% over three years tells a compelling quality improvement story that sophisticated buyers value highly.

Understanding how buyers interpret return and allowance trends—and taking proactive steps to analyze and improve these metrics—positions owners for stronger exit outcomes. This requires both analytical frameworks for understanding current trends and operational approaches for driving improvement where needed.

Why Buyers Prioritize Return and Allowance Analysis

Sophisticated buyers have learned that return and allowance trends reveal truths that other metrics may obscure. The distinction between stated preferences and actual behavior drives this focus. Customer satisfaction surveys capture what customers say; return trends capture what customers do. Behavioral data proves more reliable for predicting future customer relationship health because it reflects decisions customers made with real money at stake.

During commercial due diligence, buyers typically analyze returns and allowances across multiple dimensions. They examine absolute levels relative to industry benchmarks, trend direction over time, concentration patterns across customers or products, and the documented reasons behind significant returns or credits. Each dimension reveals different aspects of customer satisfaction and operational quality.

The absolute level provides context but rarely tells the complete story. Return rates vary significantly by industry—retail return rates average 14% to 16% of sales according to industry research, while industrial distribution returns typically range from 2% to 6%. What matters more than absolute level is how your rates compare to direct competitors and how they trend over time.

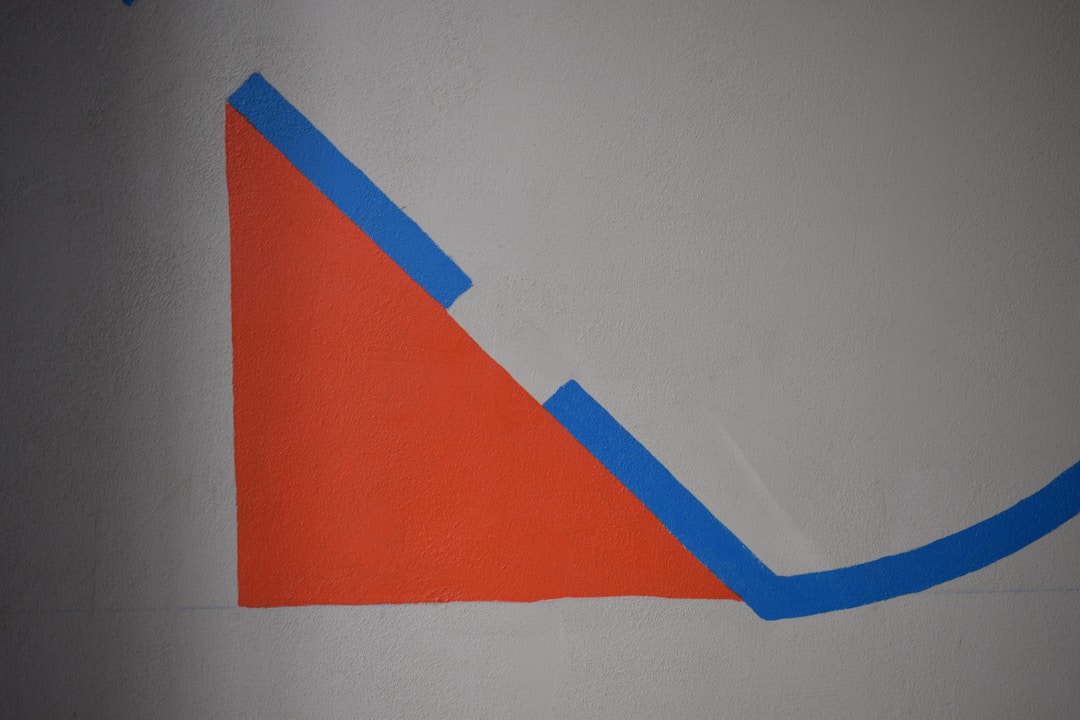

Trend direction carries significant weight in buyer analysis. Improving trends (declining return rates over time) suggest quality investments are paying off and customer satisfaction is strengthening. Deteriorating trends raise immediate questions about what changed, whether the business can reverse the trajectory, and what the trend means for future customer relationships.

Concentration analysis reveals whether return patterns reflect systematic issues or isolated problems. Returns concentrated in a single product line suggest specific quality issues that targeted investment might resolve. Returns concentrated among specific customers might indicate relationship problems, unusual customer requirements, or simply that certain customer segments represent poor fits for your offerings.

The Trend Patterns That Frequently Trigger Buyer Concern

Understanding which patterns raise red flags during diligence helps owners identify issues requiring attention before going to market. Experienced buyers recognize certain concerning patterns quickly, and they probe deeply when these patterns emerge.

Accelerating return rates represent a significant concern for most buyers. When returns increase year over year, particularly at an accelerating pace, buyers question whether underlying quality or satisfaction issues are worsening. A return rate that grew from 3% to 4% to 6% over three years suggests a problem gaining momentum rather than a temporary spike. Buyers will want to understand the root causes and see evidence that management has identified and addressed the drivers.

Sudden spikes in returns or allowances frequently trigger intensive investigation. A dramatic increase in a single quarter or year suggests something changed—a quality control failure, a supplier problem, a service delivery breakdown, or customer relationship deterioration. Buyers will want to understand exactly what happened, how management responded, and whether the spike has fully resolved. Unexplained spikes that management cannot adequately address create significant uncertainty that typically impacts valuation.

Customer concentration in returns creates acquisition risk concerns. If a significant portion of returns comes from one or two major customers, buyers worry about those specific relationships. They will want to understand whether these customers are likely to remain post-acquisition and whether the return patterns suggest relationship vulnerability that could result in customer loss.

Product concentration in returns raises questions about the affected product lines. If most returns involve specific products, buyers will probe whether those products should be discontinued, require significant investment, or represent fundamental quality issues that might extend to other products.

The Trend Patterns That Build Buyer Confidence

Just as certain patterns trigger concern, others build buyer confidence and can positively impact both valuation and deal certainty. Owners with favorable patterns should make sure their documentation clearly demonstrates these positive trends.

Declining return rates over time tell a compelling quality improvement story. When returns decrease consistently year over year, buyers see evidence that management investments in quality, service, or customer experience are producing results. This trajectory suggests the business may continue improving post-acquisition, reducing integration risk and supporting value growth.

Low absolute return rates relative to industry benchmarks demonstrate operational excellence. When a business maintains return rates significantly below industry norms, buyers recognize sustainable competitive advantage. This advantage often reflects investments in quality systems, supplier management, customer service, or product design that competitors cannot easily replicate.

Consistent return patterns across customers and products suggest systematic quality management rather than luck. When no single customer or product drives disproportionate returns, buyers gain confidence that quality systems work effectively across the business rather than depending on specific circumstances or relationships.

Clear documentation of return drivers and improvement initiatives demonstrates management sophistication. When owners can explain exactly why returns occur, what actions address each driver, and how metrics respond to those actions, buyers see a management team that understands customer satisfaction dynamics and actively manages improvement.

How Return Trends Can Impact Valuation

Understanding the potential financial impact of return trends helps owners prioritize improvement initiatives. While every transaction differs based on buyer type, industry, and specific circumstances, return trends influence valuation through several mechanisms.

Direct margin impact: Returns directly reduce effective gross margin. A business with $10 million in revenue and a 5% return rate effectively generates $9.5 million in net revenue. If return rates decline from 5% to 3%, that improvement adds $200,000 in net revenue annually. The valuation impact depends heavily on the applicable multiple, which varies by industry, growth rate, buyer type, and numerous other factors.

Risk-adjusted multiple considerations: Buyers may view businesses with improving return trends more favorably, reflecting lower perceived customer satisfaction risk. Quantifying this precisely is difficult because multiples depend on many interrelated factors. Our experience suggests that demonstrably improving quality metrics contribute positively to buyer confidence, though isolating the specific multiple impact from other factors affecting valuation is not straightforward.

Working capital considerations: High return rates require working capital to process returns, restock inventory, and manage credits. Declining return rates can reduce working capital requirements, improving cash flow and potentially reducing the capital buyers must invest at closing.

The table below shows the direct revenue impact of return rate changes, though readers should note that translating revenue impact to valuation impact requires assumptions about multiples that vary significantly by transaction.

| Return Rate Change | Net Revenue Impact (at $10M gross) | Notes on Valuation Implications |

|---|---|---|

| 8% to 5% (3-point improvement) | +$300,000 annually | Positive signal; multiple impact varies by industry and buyer |

| 5% to 3% (2-point improvement) | +$200,000 annually | Demonstrates quality improvement trajectory |

| 3% to 5% (2-point deterioration) | -$200,000 annually | May trigger diligence scrutiny and valuation discussions |

| 5% to 8% (3-point deterioration) | -$300,000 annually | Significant concern; likely impacts buyer confidence and terms |

Building Return and Allowance Trend Analysis Frameworks

Effective trend analysis requires systematic data collection, appropriate categorization, and regular review processes. Owners planning exits should implement these frameworks well before going to market, providing both time to improve trends and documentation demonstrating management capability.

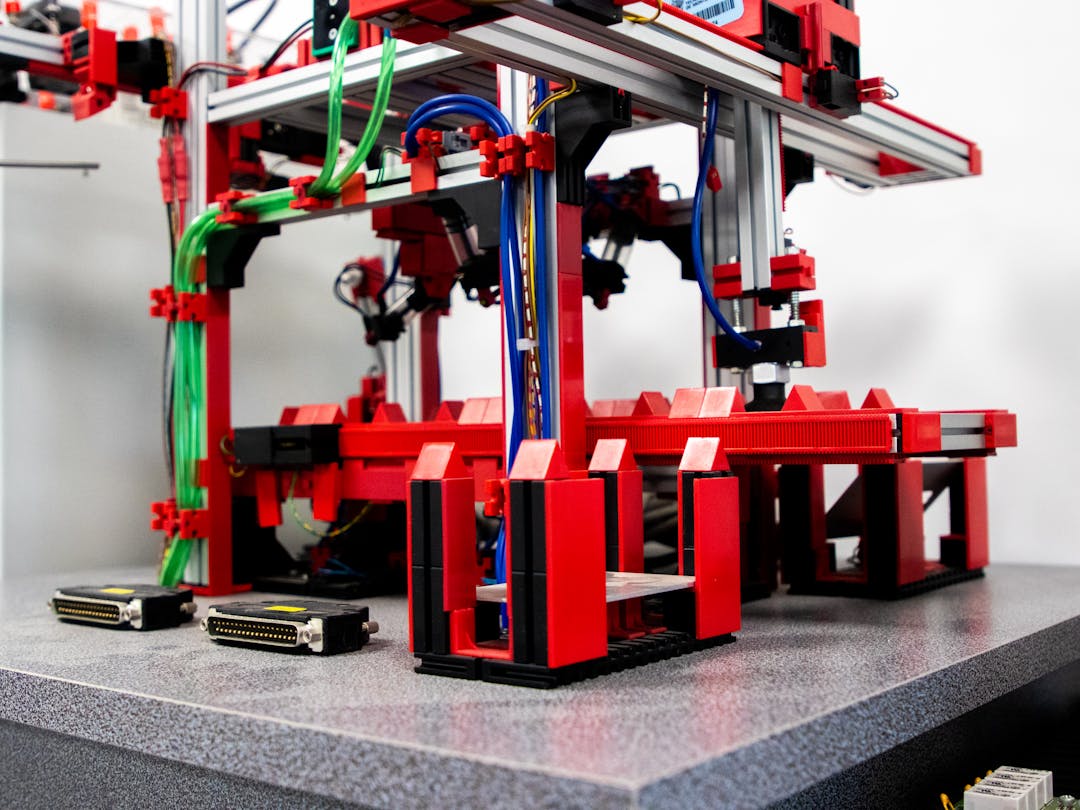

Data collection infrastructure forms the foundation. Every return, credit, and allowance should be captured with consistent categorization including the customer, product or service, dollar amount, date, and documented reason. Many businesses capture some of this information but lack the systematic categorization needed for trend analysis. Implementing proper tracking eighteen to twenty-four months before exit provides meaningful trend data while demonstrating operational discipline.

| Analysis Dimension | Key Metrics | Calculation Method | Buyer Interpretation |

|---|---|---|---|

| Absolute Level | Return rate as percentage of revenue | (Total return value ÷ Total gross revenue) × 100 | Benchmark against industry norms |

| Trend Direction | Year-over-year change in return rate | Current year rate - Prior year rate | Improving, stable, or deteriorating trajectory |

| Customer Concentration | Returns by customer as percentage of total | (Customer returns ÷ Total returns) × 100 | Relationship risk assessment |

| Product Concentration | Returns by product line as percentage of total | (Product line returns ÷ Total returns) × 100 | Quality issue identification |

| Seasonal Patterns | Monthly or quarterly variation | Standard deviation of monthly rates | Normal business cycles versus problems |

| Reason Categorization | Returns by documented cause | Count and value by category code | Root cause identification and tracking |

Reason categorization enables driver analysis that buyers find compelling. Generic categories like “customer request” or “quality issue” provide little insight. Effective categorization distinguishes between specific drivers: sizing problems, shipping damage, product defects, specification mismatches, service failures, customer operational changes, and other meaningful categories. This granularity enables targeted improvement initiatives and demonstrates management understanding of customer satisfaction dynamics.

Trend reporting should occur monthly with quarterly deep-dive analysis. Monthly tracking identifies emerging issues quickly, allowing rapid response before trends deteriorate significantly. Quarterly analysis provides the broader perspective needed to identify systemic patterns and measure improvement initiative effectiveness.

Benchmark development places your trends in appropriate context. Industry benchmarks help you understand whether your rates are competitive. Return rates vary significantly by sector: apparel and fashion retail experiences high return rates often exceeding 20%, consumer electronics sees moderate rates in the 10% to 15% range, industrial equipment typically sees low single-digit returns, and professional services usually experiences allowances of 1% to 3% of revenue. Historical benchmarks within your own business reveal whether current performance represents improvement or deterioration.

Understanding Return Complexity Beyond Simple Satisfaction Measures

While return trends provide valuable satisfaction signals, interpreting them requires nuance. Returns reflect multiple factors beyond simple dissatisfaction, and sophisticated analysis accounts for this complexity.

Product experimentation returns occur when customers purchase items to evaluate fit, function, or suitability with the intention of returning what doesn’t work. This behavior is particularly common in e-commerce apparel (where “bracketing”—buying multiple sizes—is widespread) and consumer electronics. High returns in these categories don’t necessarily indicate dissatisfaction with the product or company.

Specification uncertainty returns happen when customers aren’t entirely sure what they need. In industrial and B2B contexts, customers may order multiple options or sizes to identify the best fit for their application. These returns may indicate an opportunity to improve specification guidance rather than product quality problems.

External factor returns result from circumstances unrelated to your product or service. Economic downturns may increase returns as customers experience buyer’s remorse or cash flow pressure. Shipping carrier problems may cause damage returns. Customer operational changes may make previously appropriate products unsuitable.

Relationship-driven allowances sometimes reflect negotiation patterns rather than satisfaction issues. Some customers routinely request credits or allowances as part of their procurement strategy. High allowance rates with specific customers may indicate pricing negotiation dynamics rather than service failures.

Effective driver analysis distinguishes between these return types, enabling more accurate satisfaction assessment and more targeted improvement initiatives. Buyers appreciate this nuance: it demonstrates that management understands the complexity of their customer relationships.

Driver Analysis and Improvement Initiative Documentation

Beyond tracking trends, sophisticated exit preparation requires understanding what drives returns and documenting improvement initiatives. This driver analysis transforms raw trend data into a customer satisfaction narrative that resonates with buyers.

Root cause analysis for significant returns or allowances should become standard practice. When a meaningful return occurs, someone should understand why. Was it a manufacturing defect? A shipping problem? A customer specification that did not match the product delivered? An installation issue? A service failure? Each root cause category may require different improvement approaches, and understanding the distribution across categories guides resource allocation.

Improvement initiative documentation creates the evidence trail buyers want to see. When you identify a driver contributing to returns, document the problem, the improvement initiative implemented, the expected impact, and the actual results. This documentation demonstrates management capability and shows buyers that adverse trends reflect issues that management has addressed rather than persistent problems likely to continue.

Consider a manufacturing client we worked with that identified shipping damage as a significant return driver. Their documentation showed: shipping damage caused 35% of returns in Year 1; management implemented new packaging protocols and carrier accountability measures in Q2 of Year 2; shipping damage returns declined 60% within six months; overall return rate declined from 4.2% to 3.1%. This narrative transformed a concerning historical return rate into a quality improvement story that buyers found compelling.

But not all improvement initiatives succeed. We’ve seen businesses invest in quality systems that failed to move return metrics, often because the root cause analysis was incomplete or the solution didn’t address the actual driver. Documenting failed initiatives and subsequent course corrections can actually strengthen buyer confidence: it demonstrates honest assessment and adaptive management rather than superficial metrics manipulation.

Customer feedback integration strengthens driver analysis. Returns and allowances represent explicit customer actions, but integrating customer feedback about why they requested returns adds context that pure transaction data cannot provide. Some businesses implement brief return surveys or require customer service notes for every return authorization.

Comparing Return Analysis to Other Satisfaction Metrics

Return trend analysis works best as part of a comprehensive customer satisfaction measurement approach. Understanding how it complements other metrics helps owners build complete satisfaction narratives.

Net Promoter Score (NPS) measures customer willingness to recommend your business. NPS captures sentiment and loyalty intentions but may not predict behavior—customers may report high satisfaction while experiencing quality issues they haven’t yet acted upon. Return trends capture actual behavior, providing a reality check on stated satisfaction.

Customer satisfaction surveys gather detailed feedback across multiple dimensions. Surveys can identify specific improvement areas and track satisfaction over time. But survey response rates often skew toward highly satisfied or highly dissatisfied customers, potentially missing the moderate majority. Return trends capture the full customer base without response bias.

Customer retention rates measure whether customers continue purchasing. Retention is a lagging indicator—customers may remain due to switching costs or inertia despite declining satisfaction. Return trends may provide earlier warning of satisfaction deterioration before customers actually leave.

Customer effort score measures how easy customers find it to do business with you. This metric focuses on process friction rather than product satisfaction. Return trends complement effort scores by capturing product and service quality dimensions.

The most effective approach uses multiple metrics together. Strong retention with improving NPS scores and declining return rates tells a comprehensive positive story. Divergence between metrics—strong retention but increasing returns—signals issues worth investigating before they impact customer relationships.

Preparing Return and Allowance Documentation for Due Diligence

When buyers conduct due diligence, they typically request return and allowance data. How you present this data significantly impacts buyer perception. Proactive preparation lets you shape the narrative rather than react to buyer concerns.

Standard diligence data requests typically include return rates by period, returns by customer, returns by product or service category, allowances and credits issued, and written explanations for significant returns. Having this data organized and readily available demonstrates operational discipline. Scrambling to compile data during diligence suggests the metrics were not regularly monitored.

Trend visualization helps buyers quickly understand your return trajectory. Charts showing return rates over time, with annotations for significant events or initiatives, communicate the story more effectively than raw data tables. Visual presentation also demonstrates that management regularly reviews these metrics.

Driver analysis summaries should accompany raw data. Rather than simply providing return rates, provide analysis showing return drivers, actions taken to address each driver, and results achieved. This context transforms data into narrative, helping buyers understand not just what happened but why and how management responded.

Competitive context strengthens favorable positioning. If your return rates are below industry benchmarks, include those benchmarks with credible sources. Industry associations, trade publications, and peer networking often provide benchmark data. If your trends show improvement while you have reason to believe industry trends show deterioration, highlight that contrast.

Anomaly explanations preempt buyer questions. If any period shows unusual return activity, prepare clear explanations. A spike due to a one-time product recall differs fundamentally from a spike due to systemic quality deterioration. Buyers will investigate anomalies regardless, so proactive explanation with documentation demonstrates transparency and management awareness.

Implementation Realities for Tracking Systems

Building comprehensive return tracking systems requires more effort than many owners initially anticipate. Understanding implementation challenges helps set realistic expectations and timelines.

Technology requirements vary by business complexity. Simple businesses may achieve adequate tracking through spreadsheet systems with disciplined data entry. More complex businesses (multiple product lines, numerous customers, high transaction volumes) typically require integrated ERP or CRM systems with return tracking modules. Implementation costs vary widely based on existing systems, complexity, and vendor selection.

Staff training and adoption often represents the largest challenge. Tracking systems only work when staff consistently enter complete, accurate data. This requires clear protocols, training sessions, ongoing monitoring, and accountability for data quality. Expect three to six months before data quality stabilizes after implementing new tracking processes.

Historical data limitations constrain early analysis. New tracking systems only capture data going forward. Reconstructing historical return data from invoices, credit memos, and other records is possible but time-consuming. Start tracking immediately to maximize the trend history available by exit time.

Process integration makes things sustainable. Return tracking works best when integrated into existing workflows rather than added as separate tasks. Map return tracking steps into customer service processes, warehouse operations, and accounting procedures. Isolated tracking processes often deteriorate over time as staff prioritize primary responsibilities.

Common Mistakes Owners Make with Return and Allowance Trends

Several recurring mistakes can undermine even businesses with fundamentally healthy return trends. Recognizing these patterns helps owners avoid preventable problems during exit preparation.

Inadequate tracking represents the most common issue. Many businesses know their overall return rate but cannot analyze trends by customer, product, time period, or reason. This limitation prevents meaningful driver analysis and leaves owners unable to answer buyer questions with specificity.

Defensive posture about returns often backfires during diligence. Some owners attempt to minimize return discussion or explain away every return as a customer problem rather than a business issue. Experienced buyers recognize this defensiveness and may assume it masks larger issues. A more effective approach acknowledges returns as inevitable in any business while demonstrating systematic analysis and improvement.

Ignoring concerning trends until exit preparation begins leaves insufficient time to demonstrate improvement. If return rates have increased over several years, reversing that trend and demonstrating sustainable improvement takes time. Owners who wait until they are ready to sell often face a choice between going to market with concerning trends or delaying exit to achieve improvement.

Over-crediting to maintain relationships can mask underlying problems while creating margin pressure. Some businesses issue credits readily to avoid customer conflict, resulting in high allowance rates that suggest more significant customer satisfaction issues than may actually exist. Buyers typically analyze allowance trends alongside returns.

Failing to distinguish return types leads to misallocated improvement resources. Treating all returns as quality problems when some reflect customer experimentation or specification uncertainty wastes resources and may not improve the metrics that matter most to buyers.

Actionable Takeaways

Implement comprehensive return tracking immediately. If you cannot analyze return trends by customer, product, period, and reason, implement tracking systems now. The eighteen to twenty-four months before exit should show consistent data collection and meaningful trend analysis capability. Budget appropriate resources for technology and training based on your business complexity.

Conduct quarterly driver analysis. Move beyond tracking what returns occur to understanding why. Categorize returns by root cause, identify the largest drivers, and implement targeted improvement initiatives. Document both the analysis process and the results achieved—including initiatives that didn’t work as expected.

Benchmark your performance against industry context. Research return rates typical for your industry through industry associations, trade publications, or peer discussions. Understanding your relative position helps you identify improvement priorities and prepare competitive positioning for buyers.

Prepare diligence materials proactively. Organize return and allowance data, create trend visualizations, prepare driver analysis summaries, and develop explanations for any anomalies. Having these materials ready demonstrates operational discipline and allows you to shape the narrative.

Address concerning trends now. If return rates are increasing or allowance patterns are concerning, you have time to implement improvements and demonstrate sustainable trajectory change—but only if you start now. Waiting until exit preparation means going to market with adverse trends or delaying your timeline.

Integrate return analysis with other satisfaction metrics. Combine return trend analysis with NPS, customer surveys, and retention metrics to build a comprehensive satisfaction narrative. Alignment across metrics strengthens your story; divergence signals issues worth investigating.

Conclusion

Return and allowance trends provide sophisticated buyers with behavioral evidence of customer satisfaction that surveys and retention rates may not fully capture. These metrics reveal whether customers are experiencing problems significant enough to demand action, making them powerful indicators of customer relationship health and future revenue quality.

For owners planning exits, understanding how buyers interpret these trends enables proactive management of both the underlying operational reality and the documentation that presents it. Favorable trends strengthen valuation support and buyer confidence. Concerning trends, when addressed early and with documented improvement initiatives, can transform into positive narratives about management capability and operational discipline.

The key is treating return and allowance analysis as an ongoing management discipline rather than a diligence preparation exercise. Businesses that systematically track trends, analyze drivers, implement improvements, and document results position themselves for stronger exit outcomes. Those that scramble to compile data during diligence often find themselves explaining adverse trends without the improvement trajectory that would provide context and comfort. Start now, and you give yourself the time to shape the story that buyers will see.