Section 338(h)(10) Elections - Structuring M&A Deals for Mutual Tax Benefit

Learn how 338(h)(10) elections can create tax efficiency in M&A transactions by enabling buyers and sellers to share stepped-up basis benefits

A business owner we’d been working with received an offer much higher than expected—not because of better earnings or a bidding war, but because of a three-paragraph tax election provision buried in the letter of intent. The 338(h)(10) election had contributed to a tax-optimized transaction where the buyer’s savings helped fund a premium the seller hadn’t anticipated. This outcome represented an exceptionally favorable case, but it shows what’s possible when election economics align properly.

Executive Summary

This article focuses on U.S. federal tax law and may not apply in other jurisdictions. State tax treatment varies and requires separate analysis.

A 338(h)(10) election represents one of the most powerful yet underutilized tax planning tools in middle-market M&A transactions. This Internal Revenue Code provision allows buyers and sellers of S corporation and certain subsidiary stock to treat what is legally a stock sale as an asset sale for federal tax purposes—potentially creating tax benefits that neither party could achieve independently.

For buyers, the election provides a stepped-up basis in the target company’s assets, enabling accelerated depreciation and amortization deductions that can generate meaningful tax savings over future years. For sellers, the election changes gain characterization in ways that may be advantageous or disadvantageous depending on individual circumstances, asset composition, and existing basis positions. The key insight is that when aggregate tax savings exceed redistribution costs—which occurs in some S corporation transactions, particularly those involving asset-light businesses—both parties may benefit through negotiated purchase price adjustments.

But elections often fail to create value. In transactions involving significant inventory, accounts receivable, or fully depreciated equipment, the seller’s increased tax burden often exceeds the buyer’s benefits. This article examines the mechanics of 338(h)(10) elections, identifies circumstances where these elections are more likely to create or destroy value, and provides practical frameworks for rigorous evaluation. We’ll explore technical requirements, model the economics with explicit assumptions, and offer negotiation strategies that help sellers either capture fair value from buyer tax benefits or decline elections that don’t serve their interests. For business owners planning exits in the $2 million to $20 million revenue range—particularly in service-oriented or asset-light industries where election economics tend to be more favorable—understanding this election can meaningfully impact transaction economics.

Introduction

Most business owners spend years building enterprise value, yet few understand that how a transaction is structured can impact net proceeds as much as the purchase price itself. Tax elections—choices made about how a transaction will be characterized for tax purposes—represent a critical but often overlooked element of deal optimization.

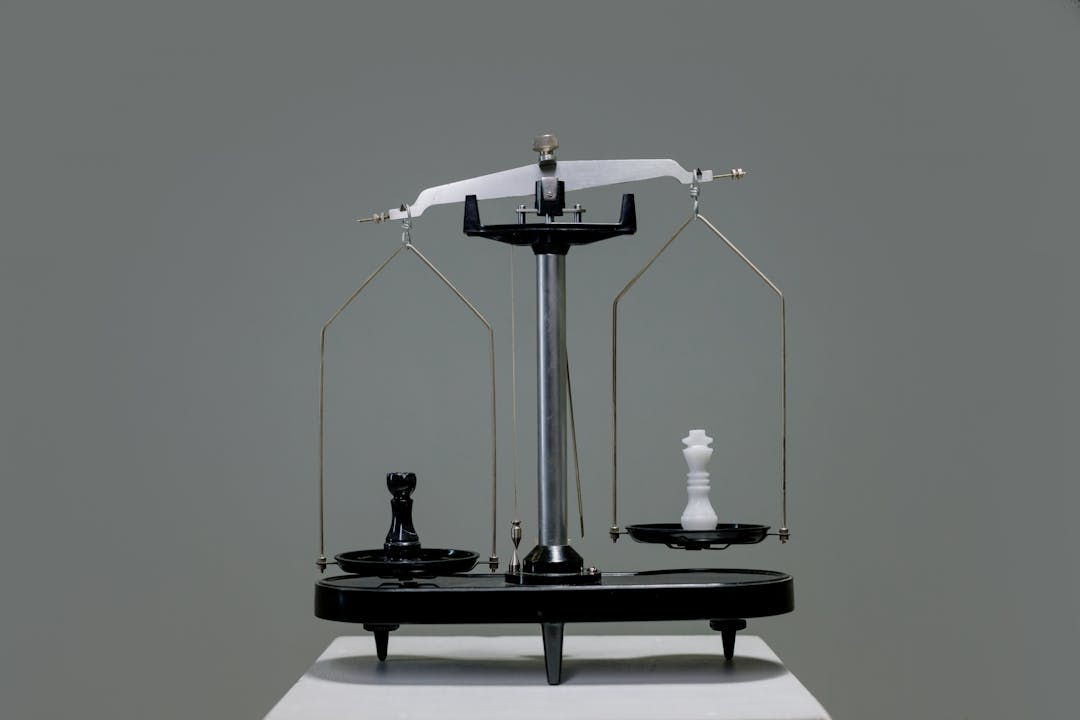

The 338(h)(10) election stands apart from other tax provisions because it can transform transaction economics when conditions are favorable. Unlike strategies that benefit only buyers or only sellers, this election may create aggregate tax savings that exceed what either party would achieve independently. When structured properly, these savings become a pool of value that buyers and sellers can share through purchase price adjustments. When conditions are unfavorable, sellers can face higher tax burdens without adequate compensation.

We regularly encounter business owners who have never heard of this election, despite its potential to add—or subtract—hundreds of thousands of dollars from their net proceeds. Equally concerning, we see owners who agree to elections without understanding the tax implications, sometimes accepting unfavorable terms because they lack the analytical framework to evaluate the proposal.

The challenge with 338(h)(10) elections lies in their complexity. The election requires joint agreement between buyer and seller, involves intricate tax calculations, and produces different results depending on asset composition, gain characteristics, and individual tax situations. Buyers typically arrive at negotiations with sophisticated tax counsel who understand election mechanics intimately—industry participants report that strategic acquirers more commonly engage specialized tax advisors than sellers do. This knowledge asymmetry puts unprepared sellers at a disadvantage.

This article aims to level that playing field. We’ll demystify election mechanics, provide tools for analyzing election economics, and offer negotiation frameworks that help sellers make informed decisions. Whether you’re years away from an exit or actively fielding offers, understanding 338(h)(10) elections should be part of your M&A preparation.

Understanding 338(h)(10) Election Mechanics

The 338(h)(10) election exists because of a tension in M&A taxation: buyers generally prefer asset purchases while sellers typically prefer stock sales. Understanding why this tension exists—and how the election attempts to bridge it—requires examining how each transaction type is taxed.

The Stock Sale vs. Asset Sale Dichotomy

In a traditional stock sale, the buyer acquires ownership interests in the target company. The company itself continues unchanged—same tax basis in assets, same depreciation schedules, same tax attributes. The seller receives capital gains treatment on the difference between stock basis and sale proceeds, typically taxed at preferential long-term capital gains rates (currently 20% federal for high-income taxpayers under IRC Section 1(h), plus applicable state taxes and the 3.8% Net Investment Income Tax under IRC Section 1411 where applicable).

In an asset sale, the buyer acquires individual assets directly. The buyer receives a new cost basis in those assets equal to the allocated purchase price—a “stepped-up basis” that enables fresh depreciation and amortization deductions. But the selling entity recognizes gain on asset disposition, and if that entity is a C corporation, shareholders face a second layer of tax when proceeds are distributed.

For S corporations, asset sales produce a single layer of tax at the shareholder level, but gain character follows the underlying assets. Inventory and accounts receivable produce ordinary income. Equipment may trigger depreciation recapture under IRC Section 1245. Only goodwill and certain capital assets produce capital gains. This blended character often results in higher effective tax rates than a straight stock sale.

How the 338(h)(10) Election Bridges the Gap

The 338(h)(10) election creates a legal fiction: although the transaction is structured as a stock sale for legal purposes, it’s treated as an asset sale for federal tax purposes. The target corporation is deemed to have sold all its assets for fair market value, then liquidated and distributed proceeds to shareholders.

This deemed asset sale provides buyers with the stepped-up basis they seek. They can allocate purchase price among acquired assets, establishing new depreciation and amortization schedules that generate tax deductions over future years. For assets with short depreciable lives or those eligible for bonus depreciation (currently 40% for qualified property placed in service in 2025 under IRC Section 168(k), declining to 20% in 2026 under current law), these deductions can produce substantial present-value tax savings.

For sellers, the election means gain is characterized based on deemed asset disposition rather than stock sale. The aggregate gain remains the same, but its character—and its tax rate—may differ from straight stock sale treatment.

Technical Requirements and Eligibility

The 338(h)(10) election is available only for “qualified stock purchases” of S corporations or subsidiary corporations in consolidated groups, as defined in IRC Section 338(d)(3). The buyer must acquire at least 80% of target stock by vote and value within a 12-month period. Both buyer and seller must jointly agree to make the election—neither party can force the other to participate.

The election must be made on Form 8023, filed no later than the 15th day of the 9th month following the acquisition month. Once made, the election is irrevocable. This compressed timeline often forces election decisions before analysis is complete, requiring early engagement of tax counsel during due diligence phases. Waiting until after closing may leave insufficient time for proper evaluation.

Comparing 338(h)(10) to Alternative Tax Strategies

Before diving deeper into election mechanics, it’s worth understanding how this tool compares to other tax optimization strategies available in M&A transactions:

Installment Sales (IRC Section 453): Allows sellers to defer gain recognition by receiving payments over time. Unlike 338(h)(10), this benefits sellers directly without requiring buyer agreement. But installment treatment is unavailable for inventory and certain recapture income, and exposes sellers to buyer credit risk.

Qualified Small Business Stock (QSBS) Exclusion: Under IRC Section 1202, shareholders who held original-issue C corporation stock for five or more years may exclude up to $10 million (or 10x basis) of gain. This requires advance planning and specific corporate structure—it cannot be elected at transaction time.

Opportunity Zone Deferrals: Investing sale proceeds in Qualified Opportunity Zone funds under IRC Section 1400Z-2 can defer and potentially reduce capital gains taxes. This strategy applies post-transaction and doesn’t affect the transaction itself.

F Reorganizations: Restructuring an S corporation before sale under IRC Section 368(a)(1)(F) can sometimes optimize tax treatment, but requires advance planning and adds complexity.

The 338(h)(10) election occupies a unique position: it’s available at transaction time, can create shared value between parties, but requires mutual agreement and careful analysis. It’s not superior to these alternatives—each serves different circumstances. Choose 338(h)(10) when asset composition favors value creation and both parties can agree on allocation. Consider QSBS instead when you’ve held qualifying C corporation stock for five or more years. Installment sales work better when you want seller-controlled deferral and can accept buyer credit risk.

Buyer Benefits and Seller Implications

Understanding why buyers value 338(h)(10) elections helps sellers evaluate proposals and negotiate effectively. The buyer’s benefit calculations directly inform how much premium might be available for seller capture—and whether the election creates net value at all.

Quantifying Buyer Tax Benefits

The buyer’s primary benefit comes from stepped-up asset basis. Consider a simplified example with explicit assumptions:

Assumptions:

- Purchase price: $10 million

- Seller’s inside asset basis: $3 million

- Buyer’s combined federal and state marginal tax rate: 25%

- Discount rate for present value: 10%

- Asset allocation: 70% to goodwill (15-year amortization per IRC Section 197), 20% to equipment (7-year per MACRS), 10% to other assets

- This simplified example excludes transaction costs, advisor fees, and time costs of election analysis, which typically reduce net benefits by $50,000-$200,000 depending on transaction complexity

Without an election, the buyer inherits the $3 million basis. With an election, the buyer receives $10 million in asset basis—a $7 million increase available for depreciation and amortization.

Under this allocation, the calculation proceeds as follows:

- Goodwill ($4.9 million step-up × 25% rate ÷ 15 years): ~$82,000 annual tax savings

- Equipment ($1.4 million step-up × 25% rate ÷ 7 years): ~$50,000 annual tax savings

- Other assets: Varies by category and life

Using present value calculations with a 10% discount rate, the equipment benefits (front-loaded over 7 years) are worth approximately $243,000. The goodwill benefits (spread over 15 years) are worth approximately $624,000. Total present-value buyer benefit in this scenario: roughly $900,000 to $1.1 million, depending on specific asset lives and bonus depreciation availability.

Important caveats: This example uses simplified assumptions. Real transactions involve more complex calculations where purchase price must be allocated among asset classes following residual methodology under IRC Section 1060. Different assets have different recovery periods—some equipment depreciates over 5-7 years under MACRS, buildings over 39 years, and goodwill amortizes over 15 years per IRC Section 197. Current bonus depreciation rules under IRC Section 168(k) (40% in 2025, declining annually through 2027 under current law) may allow accelerated expensing of certain asset classes.

Sensitivity Analysis: Small changes in assumptions affect buyer benefits:

| Assumption Change | Impact on Buyer PV Benefit |

|---|---|

| Tax rate 21% vs 25% | -16% reduction |

| Discount rate 8% vs 10% | +12% increase |

| More allocation to goodwill vs equipment | Reduces PV (longer recovery) |

| Bonus depreciation available | +15-25% increase |

The key variables driving buyer benefit include:

- Purchase price allocation: How much goes to short-lived versus long-lived assets

- Existing basis in target assets: Lower basis means larger step-up

- Buyer’s marginal tax rate: Higher rates mean more valuable deductions

- Time value of money: Near-term deductions are worth more than distant ones

- Bonus depreciation availability: Current rules allow substantial but declining immediate expensing

Seller Tax Implications Under the Election

For sellers, the election changes gain characterization but not total gain recognized. The fictional asset sale produces gain categories based on underlying asset types. The following table reflects 2025 federal rates for high-income taxpayers per current IRC provisions; state taxes vary and may add 0-13% to these rates:

| Asset Category | Gain Character | 2025 Federal Rate | Notes |

|---|---|---|---|

| Accounts Receivable | Ordinary Income | Up to 37% | Per IRC Section 1 rate schedules |

| Inventory | Ordinary Income | Up to 37% | Plus self-employment tax if applicable |

| Equipment (recapture) | Ordinary Income | Up to 37% | IRC Section 1245 recapture |

| Equipment (excess gain) | Section 1231 | 20% | May be recharacterized as ordinary |

| Real Property | Section 1231 / Unrecaptured 1250 | 20-25% | 25% on depreciation recapture per IRC Section 1(h)(1)(E) |

| Goodwill / Intangibles | Long-term Capital Gain | 20% | Plus 3.8% NIIT per IRC Section 1411 if applicable |

| Covenant Not to Compete | Ordinary Income | Up to 37% | Per IRC Section 1 |

Note: These rates reflect current law and may change with future legislation. State conformity to federal treatment varies; some states do not recognize 338(h)(10) elections or apply different rules. Consult qualified tax counsel for current rates and state-specific implications.

Compare this to a straight stock sale, where all gain typically qualifies for long-term capital gains treatment at preferential rates. The election’s impact on seller taxes depends on how much gain shifts from capital to ordinary character—and whether any negotiated premium adequately compensates for that shift.

Critical Warning: When Elections Destroy Value

Elections often fail to create net value. Sellers must understand that 338(h)(10) elections can—and often do—result in worse outcomes than traditional stock sales. Elections are more likely to destroy value than create it for asset-heavy businesses, those with inventory, or companies with fully depreciated equipment.

Before agreeing to any election, sellers must verify through rigorous analysis that aggregate value creation exists. If your analysis shows buyer benefits don’t exceed your increased tax costs, decline the election regardless of buyer preferences.

Scenarios Where Elections Often Create Value:

Software and professional services companies typically have minimal hard assets, no inventory, and low existing basis in equipment. Most purchase price allocates to goodwill—capital gain character for sellers, 15-year amortization for buyers. Buyer benefits from stepped-up goodwill basis while seller tax treatment changes minimally.

Asset-light businesses with significant customer relationship value and intellectual property often show similar favorable economics. When 80% or more of value is attributable to goodwill and intangibles, election economics tend to favor value creation.

Scenarios Where Elections Often Destroy Value:

Distribution and wholesale companies with substantial inventory, accounts receivable, and depreciated equipment often produce unfavorable election economics. Purchase price allocates to ordinary income assets. Seller faces higher taxes that may exceed buyer’s present-value benefits.

Manufacturing companies with fully depreciated equipment can face recapture exposure under Section 1245, converting what would have been capital gains into ordinary income.

Retail businesses with inventory representing substantial transaction value similarly face challenges, as inventory gain is always ordinary income.

Illustrative Case Study: When an Election Destroyed Value

In a representative example from our practice (details modified to preserve confidentiality), a distribution company sold for approximately $4 million. The buyer proposed a 338(h)(10) election. Analysis showed:

- Approximately 40% allocated to accounts receivable and inventory (ordinary income)

- Approximately 15% allocated to equipment with minimal remaining basis (substantial recapture)

- Approximately 45% allocated to goodwill (capital gain)

The seller’s incremental tax cost from the election exceeded the buyer’s present-value benefit by nearly $100,000. The election would have destroyed value. The seller declined, and the transaction closed as a traditional stock sale.

These examples show clear outcomes; many real transactions involve marginal economics requiring careful individual analysis. When our analysis shows aggregate value creation or destruction within $100,000, we typically advise intensive negotiation over allocation terms rather than automatic acceptance or rejection.

Common Failure Modes and How to Avoid Them

Before discussing negotiation strategies, sellers must understand common ways elections go wrong in practice. Anticipating these failure modes helps avoid costly surprises.

Failure Mode 1: Allocation Disputes Post-Signing

Even when parties agree an election creates aggregate value, disputes over purchase price allocation can destroy that value or shift it entirely to buyers. Allocation determines how much gain is ordinary versus capital for sellers and which depreciation schedules apply for buyers.

What happens: Buyers allocate maximum amounts to short-lived assets (maximizing their deductions) and to accounts receivable (face value allocation), shifting ordinary income to sellers. By the time sellers realize the impact, the purchase agreement may lock in unfavorable terms.

Prevention: Negotiate specific allocation caps and methodology requirements before signing. Engage independent valuation experts. Include binding arbitration provisions for allocation disputes.

Failure Mode 2: State Tax Surprises

Sellers who complete federal election analysis may discover only after commitment that state tax treatment produces different—and unfavorable—economics.

What happens: A business with operations in multiple states agrees to an election based on federal analysis. Later discovery reveals that key states don’t recognize the election, treat it differently, or impose additional taxes that eliminate net benefits.

Prevention: Complete multi-state tax analysis before agreeing to any election. Engage state tax specialists early. Consider state conformity a critical early step, not a final verification.

Failure Mode 3: IRS Challenges to Valuations

Purchase price allocations involve judgment, particularly for intangible assets. The IRS may challenge allocations that appear aggressive.

What happens: Years after closing, the IRS challenges asset valuations used for allocation. If sustained, sellers may face additional taxes, interest, and penalties on recharacterized gains.

Prevention: Use qualified independent appraisers. Document valuation methodology thoroughly. Consider whether aggressive allocations are worth audit risk.

Failure Mode 4: Changed Circumstances Affecting Economics

Elections are irrevocable, but circumstances can change between agreement and filing deadline.

What happens: Tax law changes, buyer’s tax position changes, or discovery of new information about asset basis materially affects election economics after commitment.

Prevention: Include election conditions precedent in purchase agreements. Build in mechanisms for renegotiation if material circumstances change. Consider whether election economics have sufficient margin to absorb adverse changes.

Failure Mode 5: Inadequate Analysis Due to Timeline Pressure

The election filing deadline creates urgency that can lead to poor decisions.

What happens: Parties agree to an election during LOI negotiations without proper analysis. By the time detailed tax counsel is engaged, momentum toward election has built and switching course becomes difficult.

Prevention: Engage specialized tax counsel at LOI stage, not after signing. Treat election provisions as major negotiation points requiring early attention.

Negotiating Election Provisions

When a 338(h)(10) election creates aggregate value, the negotiation centers on how that value is shared between buyer and seller. Sellers who understand election economics negotiate from strength; those who don’t often accept unfavorable terms or miss opportunities to decline elections that don’t serve their interests.

Establishing Baseline Tax Positions

Effective negotiation requires understanding both parties’ tax positions with and without the election. Sellers should model:

- Stock sale baseline: Total after-tax proceeds from a traditional stock sale

- Election scenario: After-tax proceeds with the election, before any price adjustment

- Tax impact: The difference between these positions—the seller’s election cost

Buyers should model present-value tax benefits from stepped-up basis. The difference between buyer benefits and seller costs represents aggregate value created (or destroyed) by the election. If this number is negative, there’s no economic rationale for an election unless one party is willing to accept a loss.

Structuring Premium Negotiations

Several approaches exist for sharing election value. Note that all approaches involve implementation costs—negotiation, documentation, tax counsel, and valuation fees—that typically reduce net benefits for both parties:

Purchase Price Increase: The most straightforward approach adds a premium to purchase price that compensates sellers for incremental taxes. If the election costs the seller $500,000 and benefits the buyer $800,000 (before implementation costs), a $600,000 premium might leave both parties better off—though implementation costs of $50,000-$150,000 will reduce these net gains. Negotiating this outcome requires robust analysis from both parties and willingness to share modeling assumptions.

Gross-Up Provisions: Some agreements include tax gross-up provisions that fully compensate sellers for incremental taxes. This approach gives most election value to sellers but may still benefit buyers who value stepped-up basis for non-tax reasons (cleaner accounting, simpler future transactions, or when buyers have tax attributes like NOLs that make current deductions less valuable).

Split-the-Difference: Parties may agree to split election value in predetermined ratios. A 50/50 split in the above example would produce a $400,000 premium (half the $800,000 total value created, offsetting seller’s $500,000 cost)—though again, implementation costs reduce the actual net benefit.

Common Negotiation Deadlocks and Resolution

Real-world negotiations often stall on specific issues:

Valuation disagreements: Buyers and sellers may have different views on asset values, leading to different election economics calculations. Resolution often requires engaging an independent valuation firm or agreeing to a binding allocation methodology.

Asymmetric information: Sellers may not have visibility into buyer’s tax position, making it difficult to assess true buyer benefit. While ideal, buyers often resist sharing detailed tax assumptions, requiring sellers to develop independent analysis or accept limited information. Sophisticated sellers request buyer disclosure of key assumptions or negotiate floors on buyer responsibility.

Risk allocation: Future tax law changes, IRS challenges, or state non-conformity create uncertainty. Indemnification provisions and risk-sharing mechanisms become critical negotiation points.

Integration with other deal terms: Election economics may interact with earnouts, escrows, or representations and warranties in ways that complicate analysis.

Protecting Against Allocation Risk

Purchase price allocation directly impacts both parties’ taxes under a 338(h)(10) election. Sellers should negotiate allocation protections:

- Agreed allocations: Lock in specific allocations during purchase agreement negotiation, ideally based on independent appraisals

- Methodology requirements: Specify that allocations follow IRC Section 1060 residual methodology using qualified independent valuations

- Dispute resolution: Include mechanisms for resolving allocation disagreements, potentially with binding arbitration by a neutral tax expert

- Caps on ordinary income assets: Limit amounts allocable to high-tax categories, particularly accounts receivable and inventory

Without these protections, buyers may allocate purchase price to maximize their deductions—often at seller expense. Accounts receivable allocations are particularly contentious since they’re easily valued at face value but produce ordinary income for sellers.

Practical Framework for Election Analysis

Sellers evaluating 338(h)(10) election proposals need a structured analytical approach. The following framework helps organize the evaluation process, though it does not substitute for qualified tax counsel.

Step 1: Complete State Tax Analysis Early

Before detailed federal analysis, understand state tax implications. Complete multi-state analysis for any state where the target company has nexus:

Full Conformity States: Many states (including California, New York, and Texas for franchise tax purposes) generally follow federal treatment of 338(h)(10) elections. But rate differences and unique state provisions can still produce different economics.

Partial or Non-Conformity States: Some states have their own rules that may produce different treatment. Certain states may not recognize the deemed asset sale or may apply different allocation rules.

State-Specific Considerations:

- California imposes a minimum franchise tax and has unique rules for S corporations

- New York City’s business taxes apply in addition to state taxes

- States with mandatory combined reporting may produce different results

- Some states require separate election filings

Companies with operations in multiple states face compounding complexity. An election might produce net benefits in one state while destroying value in another. State tax analysis should be a critical early step—not an afterthought.

Step 2: Compile Asset and Basis Information

Gather current information on all target company assets:

- Fair market value of each asset category (supported by appraisals where material)

- Tax basis in each asset

- Accumulated depreciation and potential Section 1245/1250 recapture

- Intangible assets including customer relationships and goodwill

- State tax nexus and positions in all relevant jurisdictions

This information enables preliminary allocation modeling. Work with your tax advisor to ensure accurate characterization.

Step 3: Model Allocation Scenarios

Develop purchase price allocation scenarios reflecting different negotiation outcomes. Most allocations follow a residual approach under Section 1060—specific assets receive fair market value in priority classes, with remainder allocated to goodwill—but discretion exists within reasonable ranges for intangible assets.

Model at least three scenarios: buyer-favorable allocation, seller-favorable allocation, and negotiated middle ground. Calculate seller tax liability under each scenario.

Step 4: Calculate Seller Tax Impact

Compare seller after-tax proceeds under each allocation scenario to stock sale baseline. This analysis reveals:

- Whether the election benefits or harms the seller before price adjustment

- How much price adjustment is needed to make the seller whole

- Sensitivity of seller outcome to allocation decisions

- Ranges of potential outcomes under different assumptions

Step 5: Estimate Buyer Benefits

Understanding buyer economics helps frame negotiations. Estimate buyer present-value tax benefits from stepped-up basis using reasonable assumptions about:

- Buyer’s marginal tax rate (request disclosure or use reasonable estimates of 21-28% combined rate)

- Discount rate for present value calculations (typically 8-12%)

- Depreciation methods and lives for each asset category per current IRS guidance

- Bonus depreciation availability under current law

This analysis identifies the value pool available for sharing—if any. If buyer benefits don’t exceed seller costs, the election destroys value and should be declined.

Step 6: Develop Negotiation Position

Armed with this analysis, develop your negotiation position:

- Minimum acceptable price adjustment (your increased tax cost, at minimum)

- Target adjustment (fair share of any value created)

- Allocation protections needed

- Deal-breaker provisions

- Conditions for accepting versus declining the election

Understanding Total Advisory Costs

Election analysis and implementation involves fees beyond basic transaction costs. Combined costs for election analysis, specialized M&A tax counsel, and independent valuations typically range from $75,000-$200,000 for middle-market transactions, depending on complexity. This includes:

- Specialized M&A tax counsel: $30,000-$100,000

- Independent asset valuations: $15,000-$50,000

- State tax analysis (multi-state businesses): $10,000-$30,000

- Allocation negotiation and documentation: $10,000-$25,000

These costs must be factored into election economics. An election that appears to create $150,000 in net value before implementation costs may create only $50,000 or less after accounting for advisory fees—and may not justify the complexity and risk involved.

We recommend engaging M&A tax specialists (not general practitioners) in addition to federal counsel, particularly for businesses with operations in multiple jurisdictions or high-tax states.

Common Mistakes and How to Avoid Them

Our experience with 338(h)(10) elections reveals recurring mistakes that cost sellers value.

Mistake 1: Agreeing Without Analysis

Some sellers agree to elections during LOI negotiations without understanding implications. They assume buyer-proposed elections must benefit both parties, or they defer to buyer’s tax counsel. By the time they engage their own advisors, election agreement may already be locked in.

Solution: Avoid agreeing to tax election provisions without independent analysis from your own qualified tax advisor. Treat election requests as negotiation opportunities, not administrative details. If an LOI references an election, respond that you’re evaluating the proposal with your tax counsel.

Mistake 2: Ignoring Allocation Provisions

Purchase agreements that include 338(h)(10) elections also include allocation provisions. Sellers focused on headline purchase price may overlook allocation terms that affect after-tax proceeds.

Solution: Review allocation provisions with the same diligence as purchase price. Negotiate specific protections and resolve allocation disputes before signing.

Mistake 3: Accepting Buyer’s Valuation

Buyers may propose allocations based on their valuations of target assets. These valuations often maximize buyer tax benefits at seller expense—for example, valuing accounts receivable at full face value while minimizing goodwill.

Solution: Obtain independent valuations of key assets from qualified appraisers. Use these valuations as basis for negotiating fair allocations. The cost of independent valuation is often recovered many times over through improved allocation terms.

Mistake 4: Focusing Only on Federal Taxes

State tax implications of 338(h)(10) elections vary. Some states fully conform to federal treatment; others don’t recognize the election at all. State-level analysis may reveal different economics than federal-only calculations suggest.

Solution: Include state tax analysis as an early step in election evaluation—not a final verification. Consider nexus in multiple states if applicable. Engage tax advisors with state-specific expertise.

Mistake 5: Undervaluing Negotiation Leverage

Sellers sometimes forget that 338(h)(10) elections require their agreement. This consent has value—buyers cannot force an election. Buyers who want elections badly enough will pay for them.

Solution: Understand your leverage. Be prepared to decline elections that don’t offer acceptable compensation. Your consent is required; exercise that leverage appropriately.

Mistake 6: Assuming Elections Always Create Value

Perhaps the most dangerous mistake is assuming that elections benefit both parties. Many transactions produce unfavorable election economics where sellers would pay more in additional taxes than buyers save.

Solution: Verify value creation through rigorous analysis before agreeing to any election. If your analysis shows value destruction, decline the election regardless of buyer preferences.

Actionable Takeaways

For business owners planning exits, understanding 338(h)(10) elections creates tangible opportunities:

Start education early. Don’t wait until you receive an offer to learn about tax elections. Understanding election mechanics before negotiations gives you time to optimize asset composition and basis positions—and to recognize whether your business profile is likely to produce favorable or unfavorable election economics.

Engage qualified M&A tax counsel. 338(h)(10) analysis requires specialized expertise. General accountants may lack M&A tax experience. Engage advisors with specific transaction tax backgrounds who have handled elections in your industry and state(s). Budget $75,000-$200,000 for analysis and implementation.

Complete state tax analysis early. State tax implications vary and can reverse conclusions based on federal-only analysis. Make multi-state analysis a priority early step.

Model multiple scenarios. Election economics depend heavily on asset composition and allocation. Develop scenarios that bracket possible outcomes so you understand your range of exposure and opportunity. Use sensitivity analysis to understand which assumptions drive outcomes.

Document your baseline. Know exactly what a standard stock sale would produce in after-tax proceeds. This baseline anchors all election negotiations and provides the comparison point for any premium discussion.

Verify value creation exists. Before agreeing to any election, confirm through rigorous analysis that buyer benefits exceed your increased tax costs. If aggregate value destruction exists, decline the election.

Negotiate allocation protections. If you agree to an election, protect yourself from adverse allocations. Specific allocation agreements, methodology requirements, caps on ordinary income assets, and dispute resolution mechanisms all reduce risk.

Quantify your ask. Don’t negotiate premiums abstractly. Know your increased tax cost and the aggregate value created (if any). Ask for specific compensation tied to specific analysis. Be prepared to share your methodology.

Consider walking away. If election economics don’t work and buyers won’t adjust, decline the election. Your consent is required. Many successful transactions close without 338(h)(10) elections—this is a negotiating tool, not a requirement.

Conclusion

The 338(h)(10) election exemplifies how transaction structure can be as important as transaction price. For business owners in the $2 million to $20 million revenue range—particularly in service-oriented or asset-light industries where election economics tend to be more favorable—these elections represent both opportunity and risk. Those who understand election mechanics and negotiate effectively can capture value when conditions are favorable. Those who agree to elections without analysis may inadvertently transfer wealth to buyers or accept value-destroying terms.

The insight is that 338(h)(10) elections can—but often don’t—create aggregate value that exceeds what either party could achieve independently. Buyers gain stepped-up basis; sellers agree to different gain characterization; when buyer benefits exceed seller costs, both parties may share in the value created. When seller costs exceed buyer benefits, the election destroys value and should be declined. The challenge lies in performing rigorous analysis and ensuring that any value sharing is fair.

As you prepare for an eventual exit, add 338(h)(10) election analysis to your due diligence checklist. Understand your asset composition and basis positions. Engage specialized M&A tax advisors early. Complete state tax analysis as a priority early step. Evaluate whether your business profile suggests favorable or unfavorable election economics. When election proposals arrive, evaluate them rigorously with qualified counsel and negotiate from informed positions—or decline elections that don’t serve your interests. The difference between accepting default terms and making informed decisions can easily reach six or seven figures. In the transaction that matters most—the sale of the business you’ve built—every dollar of optimization is worth pursuing.