Serial Entrepreneur Considerations - Leveraging Experience Without Overconfidence

Second-time sellers bring valuable exit experience but face pattern-matching risks. Learn frameworks for leveraging prior deals while avoiding assumption traps.

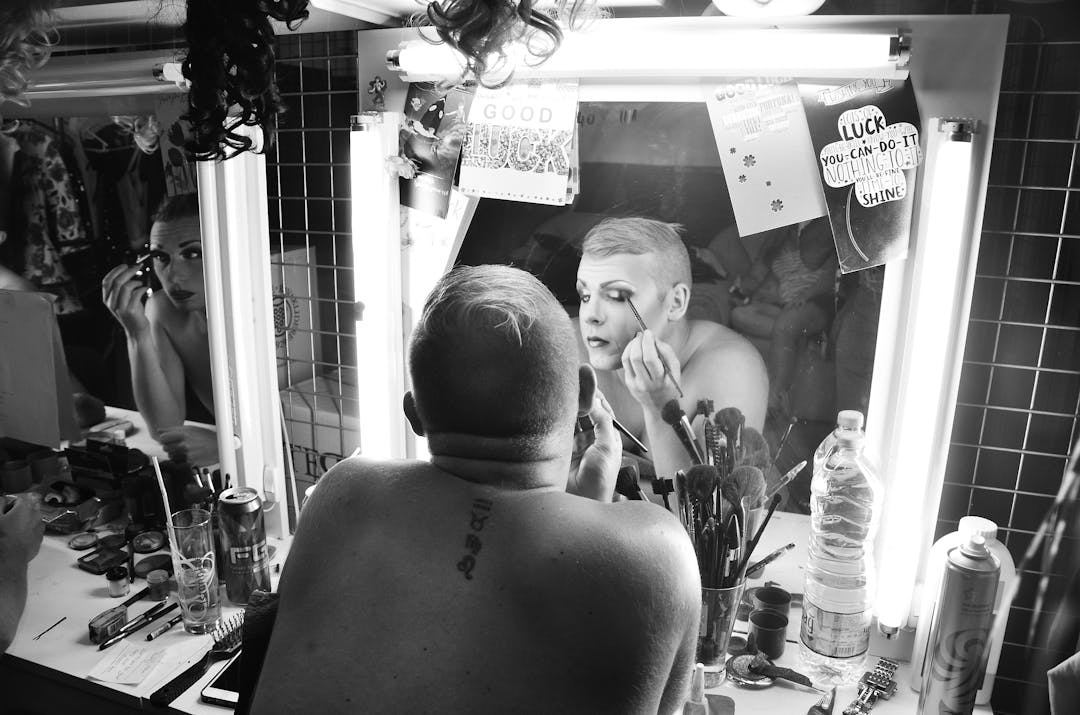

The founder across the table had sold three businesses before this one. His confidence was palpable—he’d been through the process, knew the plays, understood buyer tactics. But that same confidence led him to dismiss his advisor’s caution about applying SaaS exit playbooks to his manufacturing business. The result: a deal structure that reduced his effective proceeds by an estimated 12-15% compared to what industry-appropriate terms would have yielded. Experience is an asset, but it’s also a lens that can distort as easily as it clarifies.

Executive Summary

Serial entrepreneurs (defined here as founders who have completed at least one prior business exit exceeding $1 million in transaction value, a threshold where professional advisory typically becomes standard) represent a distinct seller category with unique advantages and potential blind spots that require adapted exit planning approaches. While second-time and repeat sellers bring valuable transaction experience, including process familiarity, realistic timeline expectations, and negotiation sophistication, they also face significant pattern-matching risks that first-time sellers never encounter.

According to a 2019 Kauffman Foundation analysis examining entrepreneurial confidence patterns across venture stages, repeat entrepreneurs demonstrate measurably higher confidence levels in subsequent ventures. But this confidence doesn’t consistently translate to improved outcomes when contexts differ substantially, a finding consistent with broader research on expert judgment in variable environments. The core challenge for experienced exiters isn’t learning the process; it’s recognizing when prior experience applies and when it misleads. Assumption errors compound when sellers project previous transaction dynamics onto fundamentally different circumstances. Industry differences, market timing, buyer composition, and deal structure variations all create situations where yesterday’s wisdom becomes today’s obstacle.

This article examines the serial entrepreneur exit dynamic comprehensively, identifying specific advantages that experience provides while cataloging the pattern-matching risks that trip up seasoned sellers. We provide frameworks for using exit experience effectively: capturing genuine learning while maintaining appropriate humility about transaction-specific variables. For serial entrepreneurs approaching another exit, the goal isn’t to forget what you’ve learned but to hold that knowledge with open hands, ready to adapt when circumstances demand different approaches.

Introduction

The conventional wisdom about business exits suggests that experience should translate directly into better outcomes. Sellers who’ve navigated the process before should outperform first-timers across every dimension: better valuations, smoother transactions, more favorable terms. The reality proves considerably more complex.

Our work with serial entrepreneurs reveals a nuanced picture. Yes, experienced sellers avoid many rookie mistakes. They understand due diligence requirements, anticipate buyer concerns, and negotiate from positions of informed confidence rather than anxious uncertainty. These potential advantages are real and meaningful when applied appropriately.

But experienced sellers also make errors that first-timers never make, errors born precisely from their experience. They pattern-match aggressively, projecting previous transaction dynamics onto situations where those patterns don’t apply. They may overestimate their negotiating power based on prior deals with different buyer dynamics. They sometimes dismiss advisor counsel because they “already know how this works.” Occasionally, they rush processes that require patience or delay when speed would serve them better.

The serial entrepreneur exit dynamic deserves dedicated examination because it differs fundamentally from the first-time seller experience. Different psychology, different risks, different optimization strategies. Treating experienced sellers like sophisticated versions of first-timers misses the unique challenges they face, challenges that can result in worse outcomes than those achieved by more cautious first-time sellers.

Understanding these dynamics matters whether you’re approaching your second exit or your fifth. The frameworks we’ll explore help serial entrepreneurs capture the genuine advantages their experience can provide while remaining appropriately humble about what each transaction can teach them. The goal isn’t skepticism about your own knowledge: it’s calibrated confidence that distinguishes transferable wisdom from situational learning.

The Experience Advantage: What Serial Entrepreneurs Can Gain

Serial entrepreneurs enter exit processes with potential advantages that shouldn’t be dismissed, though these advantages only translate to better outcomes when applied with appropriate judgment. Understanding these advantages precisely helps distinguish them from assumed benefits that don’t actually exist.

Process Familiarity Reduces Friction

First-time sellers often face what organizational psychologists call “cognitive load” from process novelty: the mental bandwidth consumed when simultaneously learning new procedures and making high-stakes decisions. Every phase introduces unfamiliar terminology, unexpected requirements, and procedures they’ve never encountered. This novelty creates friction that diverts attention from strategic decisions.

Serial entrepreneurs operate with meaningful baseline knowledge. They understand due diligence scope without extensive explanation. They anticipate representation and warranty requirements. They know what quality of earnings reports involve and why buyers request them. This familiarity doesn’t make the process easy, but it eliminates the steep learning curve that first-timers navigate.

The practical benefit often manifests in decision quality. Experienced sellers frequently make more informed real-time choices because they’re not simultaneously processing new information about what’s happening and deciding how to respond. They’ve seen the movie before, even if this particular showing involves different actors and plot variations.

Realistic Timeline Expectations

Perhaps the most valuable experience advantage involves timeline expectations. Based on the 2024 IBBA Market Pulse Report surveying lower middle-market transaction advisors, first-time sellers commonly underestimate transaction duration, sometimes projecting completion in 90-120 days for processes that typically require 8-14 months from initial marketing through closing in normal market conditions for transactions in the $2M-$20M range (with significant variation based on industry, deal complexity, buyer type, and prevailing market conditions).

Serial entrepreneurs generally understand that deals take time. They know that due diligence expands, that financing contingencies introduce delays, that last-minute issues arise predictably in “final” negotiation stages. This realistic expectation creates practical benefits: better personal planning, reduced anxiety when delays occur, and negotiating patience that first-timers often lack.

Timeline realism also reduces desperation dynamics. Sellers who expect quick closes sometimes make concessions to accelerate processes that weren’t actually at risk. Experienced sellers are often better positioned to recognize delay tactics versus legitimate concerns, responding proportionally rather than reactively.

Negotiation Sophistication

Transaction experience builds negotiation sophistication through exposure to buyer tactics, deal structure alternatives, and term sheet dynamics. Serial entrepreneurs have seen earnout proposals before. They’ve negotiated working capital adjustments. They understand how escrow holdbacks function and why buyers request them.

This sophistication often manifests in negotiating confidence. Experienced sellers may push back on unreasonable terms because they recognize them as negotiating positions rather than fixed requirements. They can propose creative structures because they’ve seen alternatives work in prior transactions. They may read buyer signals more accurately because they’ve observed those signals before.

The sophistication also enables more productive advisor relationships. Serial entrepreneurs often ask better questions, challenge recommendations appropriately, and integrate professional guidance with personal judgment. They can function as collaborators rather than dependent clients, which typically produces better outcomes.

Pattern-Matching Risks: When Experience Misleads

The same experience that creates advantages also generates blind spots. Pattern-matching (the cognitive tendency to recognize familiar patterns and apply previous solutions) serves us well in stable environments but creates errors when circumstances differ in ways we don’t recognize. As Daniel Kahneman and Gary Klein demonstrated in their 2009 American Psychologist paper “Conditions for Intuitive Expertise,” expert intuition becomes unreliable when feedback loops are weak or when environments change substantially between experiences, conditions that often characterize business exit transactions.

Industry Context Differences

Perhaps the most common pattern-matching error involves projecting industry-specific dynamics onto different sectors. The serial entrepreneur who sold a professional services firm may expect similar buyer behavior when selling a manufacturing company. The founder who exited a B2B SaaS business might assume comparable valuation methodologies for a consumer products company.

Industry context shapes every transaction dimension. Buyer composition differs dramatically: private equity firms dominating some sectors, strategic acquirers others. Valuation methodologies generally vary from revenue multiples common in high-growth software businesses with strong growth metrics to EBITDA-based multiples more standard in profitable manufacturing companies to asset-based approaches in capital-intensive industries. Due diligence focus areas depend on industry-specific risks and opportunities.

The entrepreneur who sold a marketing agency for a revenue-based multiple might anchor inappropriately when selling a distribution company where cash flow multiples apply. Their “experience” with transaction pricing can actually create confusion rather than clarity because the comparison lacks validity. We’ve observed sellers reject reasonable offers because they couldn’t translate between valuation frameworks, missing genuine opportunities in the process.

Market Timing Variations

Exit transactions occur within specific market contexts that change substantially over time. The seller who closed a deal in 2021’s favorable market formed expectations about buyer aggressiveness, valuation multiples, and competitive dynamics that may not apply in different market conditions.

Serial entrepreneurs sometimes fail to recalibrate for market timing. They may expect multiple competitive bidders because their last transaction attracted strong interest. They anticipate premium valuations because that’s what they achieved previously. When current market conditions differ, they might interpret appropriate offers as lowball attempts, miss genuine opportunities, or hold out for circumstances that won’t materialize.

Consider a founder who sold their first business during peak market conditions with six competing bidders. Their second exit, during a more normalized market, attracted two qualified buyers, an entirely reasonable outcome, but one that felt like failure compared to prior experience. This recalibration challenge led them to extend their process unnecessarily, ultimately achieving terms similar to earlier offers but with months of additional uncertainty.

Market timing affects more than valuation. Financing availability, buyer risk tolerance, due diligence intensity, and negotiating power all fluctuate with market conditions. Experience from different market contexts requires translation, not direct application.

Buyer Composition Assumptions

The specific buyers in any transaction shape dynamics fundamentally. Private equity firms negotiate differently than strategic acquirers. Family offices approach transactions differently than search funds. International buyers introduce complexities domestic acquirers don’t present.

Serial entrepreneurs often assume buyer behavior based on previous counterparties. The seller who previously sold to a strategic acquirer may expect similar integration focus when selling to a financial buyer primarily interested in operational metrics. The founder who negotiated with a private equity firm might anticipate similar term sheet structures from a family office with entirely different investment criteria.

These buyer composition assumptions create negotiating errors. Experienced sellers may misread motivations, misjudge power, or propose terms that don’t align with what this particular buyer type values. Their confidence, born from previous success, can actually undermine effectiveness when applied to different buyer categories.

Deal Structure Projection

Transaction structures vary enormously based on circumstances. The earnout percentage, escrow terms, seller financing components, and employment requirements from previous deals reflect those specific negotiations, not universal standards.

Serial entrepreneurs sometimes treat prior deal structures as templates rather than examples. They may expect similar earnout parameters because that’s what they negotiated before. They resist terms that differ from previous experience, even when current circumstances make different structures appropriate.

This structure projection creates unnecessary friction. Experienced sellers might fight battles over terms that don’t actually disadvantage them in current circumstances. They may prioritize parameters that mattered in previous contexts but carry less significance now. Their framework for evaluating deal quality, calibrated to prior transactions, may not fit current realities.

The Overconfidence Trap: Psychology of Experienced Sellers

Beyond specific pattern-matching errors, serial entrepreneurs face broader psychological dynamics that first-time sellers don’t encounter. Understanding these dynamics helps experienced sellers maintain effectiveness.

The Competence Illusion

Prior success creates confidence, and while that confidence is sometimes warranted, it doesn’t transfer uniformly across contexts. The serial entrepreneur who successfully negotiated a previous exit may overestimate their negotiating skill relative to circumstantial factors that contributed to that success. Favorable market timing, motivated buyer dynamics, strong advisor guidance, or simply fortunate matching with the right buyer might explain prior outcomes better than personal capability alone.

Research on expertise suggests that confidence and competence often diverge when environments change between experiences. What felt like skill may have included substantial luck, not a comfortable realization, but an important one.

This competence illusion can manifest in reduced openness to counsel. Experienced sellers sometimes dismiss advisor recommendations because they “know better” from prior experience. They may resist process suggestions that conflict with previous approaches, even when current circumstances warrant different tactics.

The irony is that first-time sellers, lacking confidence, often listen better. Their acknowledged uncertainty creates learning orientation. Experienced sellers must consciously maintain that learning orientation despite legitimate confidence in their capabilities.

Emotional Calibration Challenges

Serial entrepreneurs sometimes assume that emotional dynamics from prior exits will repeat. The seller who found their previous transaction emotionally manageable may underestimate the specific attachments involved in their current business. Alternatively, the seller who struggled emotionally before may over-prepare for difficulties that don’t materialize.

Each business carries unique emotional significance. The company you built over fifteen years engages different attachments than the one you grew for five. The business where you see your identity reflected differs from the one that was always primarily an investment. Prior emotional experience, while informative, doesn’t predict current emotional reality.

This calibration challenge creates practical problems. Sellers who underestimate emotional difficulty may make decisions they later regret: accepting terms under pressure that they’d reject with clearer thinking, or committing to post-close arrangements that don’t serve their actual needs. Those who overestimate emotional difficulty may delay unnecessarily or seek inappropriate deal structures to manage fears that don’t materialize.

Advisor Relationship Dynamics

The serial entrepreneur’s relationship with professional advisors differs from first-timer dynamics. Experienced sellers bring knowledge that enables collaboration but can also create friction when their views conflict with professional recommendations.

Effective advisor relationships for serial entrepreneurs require mutual calibration. Advisors must recognize client expertise while clients must acknowledge advisor value beyond basic education. The experienced seller who treats advisors as mere executors misses strategic guidance value. The advisor who treats experienced sellers like novices creates relationship friction.

Navigating this dynamic requires explicit conversation about expectations. Specific friction points to address include: decision authority on negotiating tactics, process timing recommendations that conflict with seller preferences, and valuation expectations that differ from advisor assessments. Serial entrepreneurs should articulate where their experience feels most relevant while identifying areas where fresh perspective would help. Advisors should acknowledge client experience while clearly explaining where current recommendations differ from previous approaches and why.

Practical conversation starters include: “In my last deal, we handled X this way. Walk me through why you’re recommending something different here,” and “I want to use what I know while staying open to what I don’t. Where do you see my prior experience potentially misleading me?” Balance experience-based skepticism with genuine openness to advisor expertise. When disagreeing, ask advisors to explain their reasoning rather than dismissing recommendations outright.

When Experience-Based Confidence Leads to Failure

To balance the success-oriented frameworks above, it’s worth examining how experienced sellers sometimes achieve worse outcomes than first-timers precisely because of their experience. These cautionary examples illustrate why humility remains key regardless of track record.

One pattern we’ve observed involves sellers who negotiate against their own interests by applying outdated market assumptions. A founder who achieved a premium multiple in their prior exit rejected a reasonable offer for their second business (appropriate given current market conditions and industry) holding out for terms that never materialized. The deal eventually closed at a lower multiple after the extended process raised buyer concerns about seller motivation.

Another failure mode involves dismissing due diligence findings that contradict seller expectations. An experienced seller whose prior exit involved minimal financial scrutiny resisted the detailed QofE process their current buyer required, interpreting standard requests as excessive suspicion. The resulting friction nearly derailed the transaction and created adversarial dynamics that reduced final terms.

A third pattern involves overconfident timeline compression. Sellers who previously closed quickly sometimes pressure current processes to match historical speed, missing that different deal complexity, buyer type, or financing structures require different timelines. Rushed decisions made to maintain artificial pace frequently result in unfavorable terms.

Alternative Exit Paths: Beyond Traditional Sale

While this article focuses on psychology of traditional exit transactions, serial entrepreneurs should recognize that full sale isn’t the only path, and prior exit experience may create blind spots about alternatives.

Partial liquidity events, including minority recapitalizations and dividend recapitalizations, allow founders to extract value while retaining control and upside. These structures work best when owners want to de-risk while maintaining operational involvement and believe significant value creation remains ahead. Employee Stock Ownership Plans (ESOPs) offer tax-advantaged succession that may better serve certain owner objectives, particularly when employee retention and legacy preservation matter more than maximizing immediate proceeds. Management buyouts enable transition to known operators with potentially smoother continuity. Family succession, though complex, preserves legacy considerations that traditional sale often cannot.

Full sale typically makes sense when owners seek complete liquidity, when market timing favors exit, when strategic buyers offer synergy premiums, or when personal circumstances require clean separation from the business. Serial entrepreneurs, having previously exited through sale, may unconsciously default to that path without evaluating alternatives that better fit current circumstances, personal objectives, or business characteristics. The experience advantage can become an experience constraint when it narrows perceived options.

Frameworks for Using Experience Effectively

Serial entrepreneurs can capture experience advantages while avoiding pattern-matching traps through structured approaches that distinguish transferable learning from situational knowledge. These frameworks require conscious application. They may prove challenging to implement under transaction pressure or when facing aggressive negotiating counterparts, so practice during lower-stakes phases builds the habit for when it matters most.

The Translation Framework

Rather than applying prior experience directly, use a translation framework that explicitly identifies similarities and differences between transactions. Before projecting any prior learning, ask three questions:

What’s actually similar? Identify specific dimensions where current circumstances match previous experience. Similar industry? Comparable buyer type? Equivalent market conditions? Analogous deal scale? Be precise about what matches rather than assuming broad similarity.

What’s clearly different? Explicitly catalog differences between current and prior transactions. Different sector, different buyer category, different market timing, different company characteristics. Acknowledging differences explicitly prevents unconscious projection.

How do differences affect application? For each prior learning you might apply, consider how identified differences might change its relevance. The negotiating tactic that worked with a strategic buyer might backfire with a financial buyer. The timeline expectation from a seller’s market might mislead in different conditions.

This translation framework slows the automatic pattern-matching that creates errors while preserving the genuine value of prior experience. Apply it at transaction outset when forming initial expectations, after receiving each significant piece of information that challenges assumptions, and before major negotiating decisions.

The Humble Expert Stance

Adopt what we call the “humble expert” stance: confident in your knowledge while genuinely curious about what this transaction can teach you. This stance combines two orientations that feel contradictory but actually complement each other.

The expert dimension acknowledges legitimate knowledge. You do understand transaction processes. You have seen buyer tactics before. Your negotiating experience does inform your judgment. Denying this knowledge would be false humility that wastes genuine advantages.

The humble dimension maintains learning orientation. This specific transaction involves circumstances you haven’t encountered before. This buyer has motivations you haven’t fully understood. This market context creates dynamics you’re still learning to read. Maintaining genuine curiosity keeps you adaptable.

Practically, the humble expert asks questions even when they think they know answers. They test assumptions rather than asserting them. They invite advisor perspectives they might disagree with. They treat each transaction as simultaneously familiar and novel.

This stance becomes difficult to maintain under pressure. When negotiations intensify, the temptation to rely on familiar patterns increases. Building the habit during calmer phases creates resilience for high-stakes moments.

The Assumption Audit

Before and during transactions, conduct explicit assumption audits that surface implicit beliefs you might be projecting from prior experience. Conduct these audits at transaction outset, after LOI signing, and prior to final negotiations. Document answers to questions like:

- What do I believe about how buyers will behave in this process, and where does that belief originate?

- What timeline am I expecting and why? Does my expectation account for current market conditions?

- What valuation range feels appropriate and what informs that expectation? Am I translating between valuation methodologies appropriately?

- What deal structure do I anticipate and where does that expectation originate? Have I verified that current circumstances support similar structures?

- What negotiating power do I believe I have and how might that differ from previous transactions?

For each identified assumption, trace its origin. If the assumption derives from prior transaction experience, evaluate whether current circumstances justify that projection. If you can’t articulate why the assumption applies here, treat it as a hypothesis to test rather than a fact to assert.

Conduct this audit periodically throughout the transaction, not just at the outset. As circumstances evolve, new assumptions form that may require examination. Share your assumption audit with advisors. They can help identify blind spots you can’t see.

Actionable Takeaways

Serial entrepreneurs can optimize their exit approach through specific practices that balance experience with pattern-matching risks:

Document your actual prior learning. Before entering a new transaction, write down specific lessons from previous exits. Distinguish process knowledge (how things work) from outcome expectations (what results to expect). Process knowledge transfers more reliably than outcome expectations.

Brief advisors on your experience transparently. Share not just what you’ve done before but what you believe you learned and where you feel uncertain. Enable advisors to calibrate their guidance appropriately and flag where your prior experience might mislead.

Create explicit comparison frameworks. When you notice yourself projecting prior expectations, stop and articulate the comparison explicitly. What’s similar? What’s different? Does the projection survive explicit scrutiny?

Maintain beginner’s mind practices. Despite your experience, approach certain conversations as if you’re learning. Ask questions you think you know the answers to. Invite explanations of dynamics you believe you understand. You’ll often learn something, and when you don’t, the practice maintains learning orientation.

Build in assumption checkpoints. Schedule explicit moments throughout the transaction to examine your operating assumptions, at outset, post-LOI, and pre-closing at minimum. Early assumptions may become obsolete as circumstances evolve. Regular audits prevent calcified beliefs from undermining adaptability.

Value disconfirming information. When information contradicts your experience-based expectations, treat that as especially valuable rather than dismissing it as anomalous. Disconfirming information often signals circumstantial differences that require adapted approaches.

Evaluate alternative exit paths. Before committing to traditional sale, explicitly consider whether partial liquidity, ESOPs, management buyouts, or other structures might better serve your current objectives. Don’t let prior exit experience narrow your perceived options.

Conclusion

Serial entrepreneurs occupy a unique position in exit transactions: sophisticated enough to avoid rookie mistakes but experienced enough to make veteran errors. The goal isn’t choosing between using experience and maintaining humility; it’s integrating both orientations in ways that capture advantages while avoiding traps.

Your prior exit experience can genuinely advantage you. Process familiarity, realistic expectations, and negotiation sophistication all contribute to potentially better outcomes. These advantages are real, and you should use them thoughtfully.

But experience also creates risks that first-time sellers never face. Pattern-matching, assumption projection, and overconfidence all emerge from prior success rather than despite it. Managing these risks requires conscious effort: translation frameworks, humble expert stances, and explicit assumption audits that keep experience useful without making it limiting.

The serial entrepreneurs who achieve optimal exits hold their experience with open hands. They know what they know, but they also know that each transaction teaches something new. They project prior learning where it applies and adapt where it doesn’t. They’re neither overconfident beginners nor jaded veterans. They’re calibrated experts who remain genuinely curious about what this particular transaction, with its unique circumstances, will reveal.