What Your Insurance Policies Reveal to Buyers - The Hidden Due Diligence Story

Insurance policies expose risk patterns and coverage gaps during M&A due diligence. Learn what buyers discover and how to prepare your insurance story

Most business owners think of insurance as a cost center—something they buy, file away, and forget until they need it. But when a sophisticated buyer opens your insurance file during due diligence, they’re reading a detailed narrative about every risk your company has faced, every vulnerability you’ve chosen to accept, and every corner you may have cut to save on premiums.

Executive Summary

Insurance documentation has become one of the most revealing components of M&A due diligence, offering buyers a window into your company’s risk management maturity, historical problem patterns, and current vulnerability exposure. What many sellers view as routine paperwork, experienced acquirers treat as a diagnostic tool that can expose operational issues, management judgment, and hidden liabilities that may not surface in financial statements or management presentations.

The story your insurance policies tell may either reinforce buyer confidence or trigger deeper investigation and potential valuation adjustments. Claims history reveals incidents that warrant investigation into whether they reflect isolated occurrences or systemic patterns. Coverage gaps expose risks the business currently runs uncovered, liabilities that transfer to the buyer upon acquisition. Policy exclusions and limitations may leave significant exposures unaddressed. The overall structure of your insurance program signals how seriously leadership takes enterprise risk management.

Lower middle market companies commonly exhibit insurance gaps that experienced buyers recognize: inadequate cyber liability coverage relative to actual data exposure, missing or insufficient employment practices liability, gaps in professional liability or errors and omissions coverage, and key person dependencies without appropriate protection. Each gap represents both a current risk and a potential negotiating point that can affect your transaction value or complicate deal terms.

For most companies, insurance preparation benefits from systematic review beginning twelve to eighteen months before a planned exit, though timeline requirements vary based on current coverage adequacy and identified gaps. This preparation allows you to address material issues, build cleaner claims history, and demonstrate the risk management maturity that institutional buyers expect. Preparation needs vary dramatically based on your current program quality, company risk profile, and expected buyer sophistication.

Introduction

When private equity firms, strategic acquirers, and sophisticated family offices evaluate acquisition targets, they deploy comprehensive due diligence processes refined through hundreds of transactions. Within these processes, insurance review has evolved from a perfunctory checklist item into a substantive analytical exercise that reveals information unavailable through other due diligence channels.

We’ve observed buyers adjust their perception of target companies based on insurance findings, though the magnitude of impact varies significantly by buyer sophistication and transaction context. Consider a scenario where a business presents well in management meetings and shows strong financials, but due diligence reveals concerning patterns: multiple employment claims over several years, cyber coverage limits that appear misaligned with the company’s data handling practices, and key person insurance that lapsed without renewal. Such discoveries can shift negotiating dynamics and lead buyers to require additional protections or price adjustments. While this represents a composite illustration rather than a single transaction, the pattern reflects dynamics we’ve seen across deals with sophisticated institutional buyers.

Insurance documentation exposes information that presentations may obscure. Claims history represents documented incidents that occurred in your business, though interpretation of that history depends heavily on context. Coverage limits and exclusions reveal conscious decisions about which risks you’ve chosen to accept. Policy structures show whether leadership thinks systematically about enterprise risk or addresses insurance reactively when problems arise.

For owners planning exits within the next two to seven years, understanding what buyers may learn from insurance diligence, and preparing accordingly, can help maintain negotiating power and avoid preventable complications. The insurance story you tell should reinforce every other positive message about your business, not contradict it.

This article examines what buyers typically discover during insurance due diligence, identifies common coverage gaps in lower middle market companies, and provides frameworks for ensuring your insurance program supports rather than undermines transaction confidence.

What Buyers Learn from Insurance Due Diligence

Experienced acquirers approach insurance review as an investigative exercise, looking for signals that reveal aspects of the business not readily apparent in financial statements or management representations. Understanding their perspective helps you anticipate what they’ll find and how they’ll interpret it.

Claims History as Incident Documentation

Every claim filed against your insurance policies creates a permanent record that buyers will review. Claims history can reveal patterns that warrant investigation, though interpretation requires context about industry norms, company size, and specific circumstances.

Employment claims draw particular scrutiny. A single wrongful termination claim from years ago might be dismissed as unfortunate but normal business experience. Multiple employment claims over time, even if all were successfully defended or settled, may prompt questions about HR practices, management approach, or cultural dynamics. Based on industry experience and employment law practitioner reports, defense costs for contested employment claims involving discrimination or wrongful termination commonly require substantial legal investment, often in the range that can significantly impact a small company’s annual budget, depending on jurisdiction, claim complexity, and whether cases proceed to trial. While specific costs vary widely, even claims that are dismissed require defense, making employment practices a material risk consideration for buyers.

Employment claim frequency that significantly exceeds what appears normal for companies of similar size and industry may warrant preparation of contextual explanations. Factors such as industry risk levels, regional litigation environment, and economic conditions also influence claim frequency, so context matters enormously in interpreting claims data.

Workers’ compensation history reveals workplace safety culture. Claim frequency that significantly exceeds industry benchmarks, available through OSHA’s published injury rates and state workers’ compensation board data, triggers questions about safety protocols, training adequacy, and potential compliance issues. Even if individual claims were routine, elevated patterns relative to peer companies may indicate operational concerns that extend beyond insurance considerations.

Product liability and professional liability claims particularly concern strategic buyers because they may indicate quality control issues, service delivery problems, or design defects that affect the core value proposition of the business. The pattern and trajectory of claims matters more than isolated incidents.

Coverage Gaps as Risk Acceptance Indicators

The risks your insurance program leaves uncovered tell buyers what management considers acceptable exposure, and those judgments reveal decision-making approaches and risk tolerance that buyers evaluate carefully.

Cyber liability coverage has become a defining indicator of management awareness. Companies handling customer data, processing payments, or relying on digital systems face cyber risks that many buyers consider fundamental. According to IBM’s annual Cost of a Data Breach Report, breach costs vary significantly based on data types, regulatory environment, breach scope, and response capabilities. While smaller, contained incidents may cost relatively little to remediate, major breaches involving sensitive personal data can generate costs in the millions when accounting for notification requirements, regulatory penalties, legal defense, and business interruption. Cyber coverage decisions should reflect actual exposure analysis, not arbitrary thresholds. A company might rationally carry minimal cyber coverage if it handles no customer data and has limited digital exposure. Buyers will want to understand the risk assessment methodology behind coverage decisions. Inadequate cyber coverage without documented risk analysis may signal either lack of awareness about modern risk landscapes or cost optimization that prioritized short-term savings over prudent protection.

Employment practices liability insurance protects against claims of discrimination, harassment, wrongful termination, and related employment issues. Companies without EPLI coverage are carrying risk that generates substantial litigation in today’s environment. EPLI coverage costs vary widely based on industry, claims history, employee count, and coverage limits, with annual premiums for companies with 25 to 100 employees typically ranging from several thousand dollars to amounts that remain modest compared to potential defense costs for even a single contested employment claim. To evaluate whether EPLI makes sense for your company, consider your annual premium cost against the probability of facing an employment claim multiplied by potential defense and settlement costs. For many companies in this size range, the math favors coverage, though your specific situation depends on industry, workforce characteristics, and claims history. Buyers interpret missing EPLI as either unfamiliarity with the risk or confidence about current employment practices that may not be warranted.

Professional liability or errors and omissions coverage gaps concern buyers evaluating service businesses. If your company provides advice, designs solutions, or delivers professional services without E&O coverage, buyers question whether you understand the liability inherent in your service model. Coverage needs vary significantly by service type: a technology services firm faces different E&O exposure than a staffing agency.

Policy Structure as Risk Management Sophistication

How your insurance program is organized reveals management’s approach to enterprise risk. Experienced buyers look for indicators of systematic thinking versus reactive purchasing.

Umbrella policies and excess coverage can demonstrate forward-thinking about catastrophic scenarios, but their appropriateness depends on actual exposure. Companies should evaluate umbrella needs based on maximum probable loss analysis rather than assuming more coverage is always better. Some companies rationally carry only primary limits because their actual tail risk exposure is limited.

Policy coordination matters to thorough buyers. They may examine whether coverage works together without gaps or overlaps. Policies with misaligned effective dates, conflicting terms, or unclear priority may suggest an insurance program assembled piecemeal without strategic oversight, though for smaller companies, some coordination imperfections are common and explainable.

Carrier quality and relationships can indicate market perception of your risk profile. Companies insured by highly rated carriers with long-standing relationships may demonstrate stability and manageable risk profiles. Frequent carrier changes or coverage through non-standard markets may indicate risk characteristics that concern quality underwriters, or may simply reflect cost optimization in a hard insurance market.

Common Insurance Gaps in Lower Middle Market Companies

Lower middle market companies between two and twenty million in revenue frequently exhibit insurance gaps that experienced buyers recognize. This revenue range often creates a specific challenge: companies are large enough to face institutional-level risks but may lack dedicated risk management staff to address them systematically. The specific gaps that matter vary significantly by industry, business model, and operational characteristics.

Cyber Liability Coverage Deficiencies

Despite increasing awareness of cyber risks, lower middle market companies often carry cyber coverage that doesn’t align with their actual exposure. Common deficiencies include:

Inadequate policy limits relative to exposure represent a frequent concern. Rather than using arbitrary thresholds, companies should evaluate coverage limits against their actual maximum probable loss, considering data types held, notification requirements, regulatory exposure, and business interruption costs. A technology company processing sensitive customer data faces different exposure than a manufacturing company with limited digital operations. Buyers will compare your coverage limits against a realistic breach cost model.

Missing coverage components also warrant attention. Comprehensive cyber policies address first-party costs like incident response, business interruption, and data restoration, plus third-party liability for customer notification, regulatory fines, and lawsuits. Many lower middle market policies lack complete coverage, leaving significant exposures.

Social engineering and funds transfer fraud exclusions create gaps many owners don’t realize exist. Standard cyber policies may exclude losses from business email compromise, fraudulent wire transfers, or social engineering schemes that don’t involve actual system breaches. Review policy exclusions carefully against the fraud risks your business actually faces.

Employment Practices Liability Gaps

Employment claims represent one of the most common litigation categories facing businesses, yet EPLI remains one of the most frequently missing or inadequate coverages in the lower middle market.

Companies without EPLI are carrying substantial risk. Even claims that are dismissed require defense, and employment litigation defense costs vary widely based on jurisdiction, claim complexity, and litigation strategy. Employment law practitioners and insurance carriers report that defense costs for contested claims can require significant legal budgets, particularly when cases proceed through discovery and trial. When you consider that employment claims can arise from management decisions that seemed reasonable at the time, EPLI provides meaningful risk transfer at relatively modest cost for most companies.

Wage and hour coverage gaps deserve specific attention. Traditional EPLI policies often exclude wage and hour claims, which have become a major litigation category. Separate coverage for wage and hour exposure requires specific attention, particularly for companies in industries with complex pay structures or significant hourly workforces.

Third-party coverage limitations matter for customer-facing businesses. Standard EPLI covers claims by employees, but companies with substantial customer interaction may need third-party EPLI covering discrimination or harassment claims from customers, vendors, or other non-employees.

Professional Liability Deficiencies

Service businesses frequently carry professional liability or E&O coverage that doesn’t adequately address their actual exposure.

Coverage scope misalignment occurs when policies don’t match actual services delivered. As businesses change and service offerings expand, E&O policies may not keep pace. Coverage purchased when the company offered narrower services may exclude newer service lines, a gap that buyers will identify when comparing your service agreements against your coverage.

Retroactive date limitations can leave historical work unprotected. Professional liability claims may arise years after services were delivered. Policies with recent retroactive dates leave prior work potentially uninsured, a concern that buyers factor into their risk assessment.

Contractual liability gaps concern buyers who review customer contracts. Many professional service firms contractually agree to indemnification provisions that their insurance policies don’t cover. This mismatch between contractual commitments and insurance protection creates liability exposure buyers must evaluate and may seek to address through deal terms.

Key Person Coverage Considerations

Companies with significant owner or key person dependency may lack life insurance or disability coverage on those individuals, a gap that concerns buyers evaluating management transition risk. The importance of this coverage scales with company structure and maturity.

Key person coverage importance depends on business structure. Owner-dependent businesses, where substantial revenue, customer relationships, or operational knowledge resides with one or two individuals, benefit most from key person coverage. Institutionally-managed companies with distributed leadership and documented processes may need minimal key person coverage if succession planning is already robust.

Disability coverage gaps represent potentially worse exposure than death for some businesses. Long-term disability of a key person creates extended uncertainty without clear resolution. Buy-sell agreements funded by life insurance often overlook disability scenarios.

Coverage adequacy questions arise even when policies exist. Key person coverage should reflect actual business value and realistic transition costs, not arbitrary amounts selected years ago when the business was smaller.

Preparing Your Insurance Story for Due Diligence

Proactive preparation can help transform your insurance program from a potential concern into a neutral element of due diligence. For most companies with identified gaps, beginning twelve to eighteen months before a planned exit allows adequate time to address issues, accounting for policy renewal cycles (typically annual), underwriting processes (which can take four to twelve weeks for complex coverages), and time to demonstrate improved practices if claims history has been concerning. Companies with already-strong programs may need minimal additional preparation, and the optimal timeline depends on your specific situation.

Conduct a Comprehensive Insurance Audit

Start with systematic evaluation of current coverage against actual exposures. This process should involve more than your regular insurance broker. Consider engaging an independent risk consultant or M-and-A-experienced insurance advisor who can provide objective assessment and understands buyer perspectives.

Comprehensive insurance preparation typically requires meaningful investment. Expect to budget for independent advisory fees (which vary based on company complexity), potential premium increases for additional coverage, and significant management time for review and documentation. Plan for forty or more hours of management time gathering and organizing materials, coordinating with advisors, and implementing recommendations. The total investment depends on current program adequacy and gaps identified. Companies with strong existing programs may need minimal additional investment, while those with significant gaps may require more substantial commitment.

Map all business risks before evaluating coverage. Consider operational risks, professional liability, cyber exposure, employment practices, product liability, property and equipment, vehicle fleets, and any industry-specific exposures. This risk inventory becomes the baseline against which coverage adequacy is measured.

Review all policy terms in detail, including exclusions, sublimits, deductibles, and conditions. Many owners carry policies for years without reading beyond the declarations page. Due diligence will examine these details. You should examine them first.

Benchmark against industry standards and buyer expectations. What coverage do comparable companies carry? What do acquirers in your industry expect? Insurance benchmarks vary significantly by sector: a technology company faces different expectations than a manufacturing business or professional services firm. Your insurance advisor should help you understand norms for your specific industry.

Address Identified Gaps Strategically

Once you understand gaps, develop a prioritized plan to address them. Not all gaps require immediate action. Some may be acceptable with proper documentation of your risk assessment methodology.

Prioritize gaps by potential deal impact and cost-effectiveness. Cyber liability inadequacy and missing EPLI typically create the largest buyer concerns for most businesses. Key person coverage gaps directly affect transition risk assessment for owner-dependent companies. Professional liability issues matter more in service businesses than product companies. Consider both the coverage cost and the potential claims exposure when prioritizing.

Be realistic about implementation timelines. Insurance underwriting takes time. New coverages may require sixty to ninety day waiting periods before becoming effective. Some carriers may decline coverage or quote prohibitive rates depending on claims history. Companies with recent significant claims may face coverage limitations. Plan accordingly and begin early enough to navigate potential obstacles.

Document your risk assessment methodology. Gaps that reflect deliberate, informed business judgment can be defended to buyers. Gaps that appear to reflect lack of awareness signal risk management immaturity. Prepare documentation showing how you evaluated each risk and why you chose your current coverage approach.

Pursue Claims Prevention and Documentation

Building cleaner claims history takes time and depends on factors beyond management control, but operational improvements can reduce claim frequency over twelve to twenty-four months.

Enhanced safety protocols, better HR processes, and stronger quality control can reduce future incidents. Be realistic: some claims are unavoidable regardless of precautions, and external factors like labor market conditions and litigation environment affect claims independently of internal improvements. Document your improvement efforts so you can demonstrate management commitment even if claims don’t immediately decrease.

Compile safety and compliance documentation that supports claims experience. Training records, safety protocols, compliance certifications, and incident response procedures all reinforce that favorable claims history results from good management practices rather than good fortune.

Prepare contextual explanations for any concerning claims. Claims history is documented fact that cannot be concealed, but interpretation depends heavily on context. Prepare explanations distinguishing frivolous claims that were successfully defended, isolated incidents that have been remedied, and patterns that required operational changes. Buyers will evaluate not just claim frequency but claim causes and your response to them.

Document Your Risk Management Program

Experienced buyers want to see systematic approaches to risk management, not just insurance policies. Documentation demonstrates maturity.

Create a risk management summary that explains your approach to identifying, evaluating, and addressing business risks. This document shows buyers that insurance purchasing happens within a strategic framework, even if that framework is relatively simple for a smaller company.

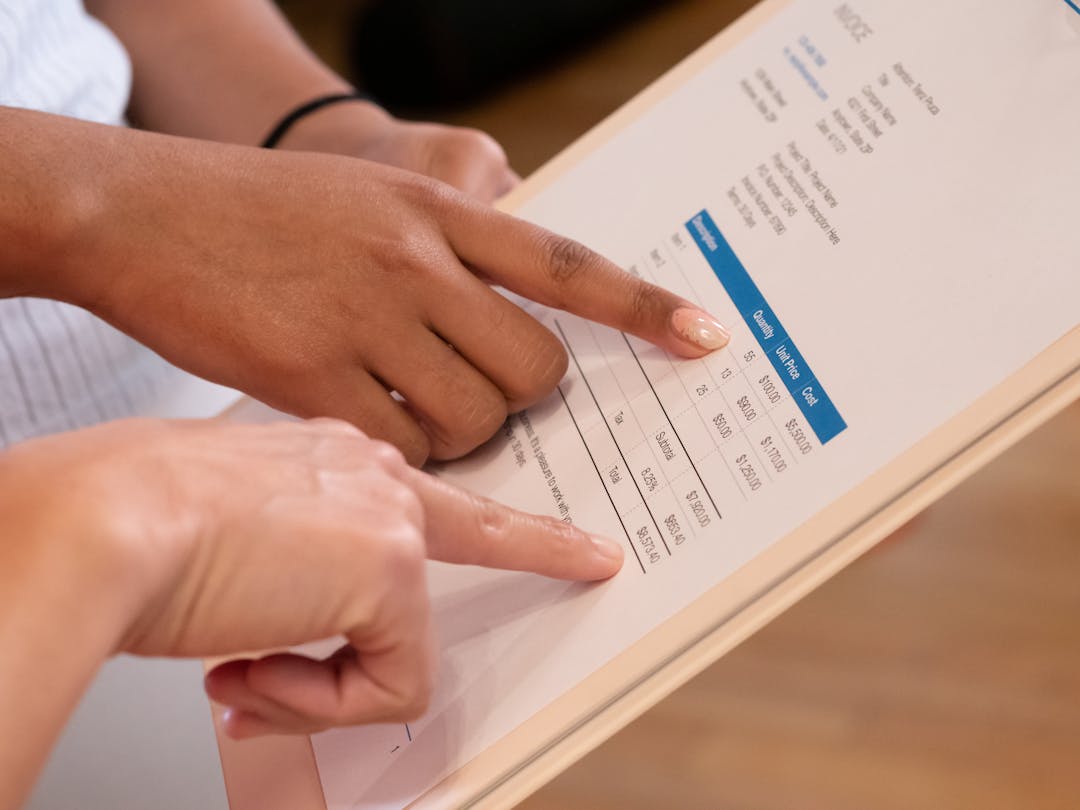

Prepare insurance history packages that anticipate due diligence requests. Buyers typically request five to seven years of policy documentation including declarations pages, policy forms, and endorsements for all coverage lines. They’ll want complete claims history including open claims, closed claims, and any incidents reported but not resulting in claims. Having organized documentation ready demonstrates preparation and professionalism.

When Insurance Preparation May Not Be Necessary

Not all companies need comprehensive insurance preparation before exit. Understanding when preparation provides limited value helps you allocate resources appropriately.

Companies with strong existing programs may need minimal additional preparation. If you’ve worked with a sophisticated commercial insurance broker, maintain comprehensive coverage, and have favorable claims history, your preparation may be limited to organizing documentation and preparing contextual explanations.

Transactions with unsophisticated buyers may not involve detailed insurance due diligence. Individual buyers, smaller family offices, or strategic acquirers without institutional backing may conduct less technical insurance analysis than private equity firms. Accurately predicting buyer sophistication before going to market can be difficult.

Sellers with power may face less scrutiny on insurance issues. In competitive auction processes or situations where the business is highly desirable, buyers may be more willing to accept insurance limitations or address concerns through post-closing mechanisms.

Alternative approaches may address insurance concerns without extensive pre-sale preparation:

-

Address gaps during transaction process: Some gaps can be remediated quickly once a buyer is identified, avoiding months of additional premium costs before you know whether they’ll matter.

-

Self-insure identified gaps: Companies with strong balance sheets may rationally retain certain risks rather than purchasing coverage, with appropriate disclosure to buyers.

-

Post-acquisition mechanisms: Escrow holdbacks, earnouts, or representations and warranties insurance can address specific concerns without requiring sellers to remediate all gaps before closing.

-

Price negotiation: Accepting modest valuation adjustments for identified gaps may be more efficient than extensive preparation costs.

The optimal approach depends on your deal timeline, company financial strength, current program adequacy, and expected buyer profile. Insurance preparation that makes sense for a company targeting private equity may be excessive for one selling to a strategic acquirer focused on synergies.

The Due Diligence Process from the Buyer’s Perspective

Understanding how different buyers conduct insurance due diligence helps you prepare for their specific concerns. Buyer types vary significantly in their approach and focus areas.

Buyer Type Variation

Private equity firms typically conduct detailed insurance analysis focused on risk-adjusted returns and cost predictability. They calculate loss ratios, evaluate claims trends, and model future insurance costs as part of their financial projections. They often employ specialized insurance due diligence advisors and may be more likely to identify subtle coverage gaps.

Strategic acquirers focus on operational risks that affect post-acquisition integration. They care most about coverage for risks that could disrupt the combined business: product liability for a manufacturing acquisition, professional liability for a services acquisition, or cyber coverage for a technology acquisition. They may care less about policy structure details.

Family offices and individual buyers often prioritize management continuity and key person coverage. They may conduct less technical insurance analysis but focus on catastrophic risks that could threaten their investment.

What Buyers Calculate

From insurance documentation, buyers typically evaluate several key metrics. Loss ratios compare claims to premiums and indicate whether the business represents favorable or unfavorable insurance risk. Claims frequency and severity trends reveal whether risk is improving, stable, or deteriorating. Coverage cost projections estimate future insurance expenses, though these projections are inherently uncertain, as costs depend on claims experience, market conditions, and carrier appetite. Gap remediation costs calculate what addressing identified coverage deficiencies will require.

How Findings May Affect Transactions

Insurance findings can affect transactions through several mechanisms, though the magnitude varies significantly based on buyer sophistication and transaction context. Purchase price adjustments may reflect identified exposures or required coverage improvements, though many transactions close without insurance issues materially affecting terms. Escrow and holdback requirements may increase if buyers identify potential claims or coverage gaps. Representations and warranties in purchase agreements may include specific insurance-related provisions. R&W insurance availability and pricing depends partly on target company insurance adequacy.

Insurance preparation is primarily defensive. It prevents potential valuation discounts and may accelerate due diligence rather than creating upside value. The benefit of preparation is maintaining full valuation, not achieving premium pricing.

Potential Risks of Insurance Preparation

Insurance preparation carries risks that warrant consideration:

Discovering unfixable issues: A comprehensive audit may reveal problems that cannot be cost-effectively remediated: significant recent claims, uninsurable risks, or exposures that concern carriers. This discovery might affect your exit timeline or force difficult conversations with buyers that wouldn’t have occurred otherwise.

Market timing risk: Insurance markets cycle between hard and soft conditions. If you begin preparation during a soft market but market conditions harden before your exit, coverage may become unavailable or prohibitively expensive despite your efforts.

Over-preparation: Extensive preparation for a buyer who wouldn’t have conducted detailed insurance due diligence wastes time and money. Sophisticated preparation for an unsophisticated buyer may address issues that wouldn’t have affected your transaction.

Opportunity cost: Time and money spent on insurance preparation could be allocated to other exit preparation activities: financial statement quality, operational documentation, or management team development that might provide greater return.

To mitigate these risks, begin early enough to navigate obstacles, work with experienced advisors who understand your specific situation, and calibrate preparation level to your expected buyer profile and current program adequacy.

Actionable Takeaways

For companies with potential insurance gaps or targeting sophisticated buyers, transform your insurance program from a potential due diligence concern into a neutral element through systematic preparation.

Assess whether comprehensive preparation is warranted for your situation. Companies with strong existing programs may need only documentation organization. Companies with known gaps, recent concerning claims, or coverage that hasn’t been reviewed strategically benefit most from comprehensive preparation. Consider your expected buyer sophistication when determining preparation scope.

Consider an independent insurance review twelve to eighteen months before your planned exit if gaps are likely. Engage advisors with M&A experience who understand buyer expectations beyond routine commercial insurance guidance. This investment should be proportional to your current program’s adequacy and identified risks.

Prioritize addressing gaps based on your industry and buyer profile. Cyber liability and employment practices liability gaps typically generate the strongest concerns for most businesses, but the relative priority depends on your specific operations. A manufacturing company should prioritize workers’ compensation and product liability; a services firm should prioritize professional liability.

Review claims history for patterns and prepare contextual explanations for any claims that might concern buyers. Distinguish between frivolous claims, isolated incidents, and patterns that required operational response. Document any remediation efforts you’ve implemented.

Create risk management documentation that demonstrates systematic thinking about enterprise risk. Buyers want evidence that favorable experience results from good management practices rather than good fortune, and that unfavorable experience has been addressed.

Prepare an organized insurance package ready for due diligence. Having documentation assembled (five to seven years of policies, claims files, and loss runs) demonstrates preparation and professionalism that creates positive impressions beyond insurance considerations.

Engage your insurance broker in exit planning discussions. Sophisticated brokers can help structure coverage to support transaction objectives, and they’ll be asked to assist with transaction processes regardless. Early engagement allows better preparation.

Evaluate alternatives to comprehensive preparation. Addressing gaps during the transaction process, using post-closing mechanisms, or accepting modest price adjustments may be more efficient than extensive pre-sale preparation depending on your timeline and situation.

Conclusion

Your insurance policies tell a story that experienced buyers may read carefully during due diligence. This narrative reveals risk management practices, historical incidents, current vulnerabilities, and management judgment in ways that can complement or complicate the story told by financial statements and management presentations.

The story your insurance tells should reinforce every other positive message about your business. Claims history should be interpretable in context, showing that favorable experience results from strong management practices, or that concerning claims have been addressed. Coverage structures should demonstrate risk awareness appropriate to your industry and operations. Gap analysis should reveal that any uncovered exposures reflect deliberate business judgment rather than oversight.

For owners planning exits within the next two to seven years, insurance preparation deserves consideration alongside financial statement quality, operational documentation, and management team development, particularly for companies with potential gaps or targeting sophisticated institutional buyers. The companies that maintain negotiating power and achieve smooth transactions are those that leave no due diligence stone unturned. Insurance represents a stone that unprepared sellers may overlook.

We encourage you to assess your insurance program now, regardless of your specific exit timeline. Understanding what your policies currently reveal, and determining whether preparation investments make sense for your situation, positions you for the transaction outcomes your business building efforts deserve.