Building a Business That Sells - The Complete Guide to Exit-Ready Operations

Transform your company into an acquisition target buyers compete for. Learn the operational and financial strategies that maximize business value before exit.

Most business owners discover their company’s fatal flaw at the worst possible moment: when a buyer’s due diligence team tears apart the very foundation they spent decades building. The business that felt like a well-oiled machine suddenly reveals itself as a collection of workarounds, verbal agreements, and processes that exist only in the founder’s head.

Executive Summary

Building an exit-ready business requires deliberate transformation across three critical dimensions: operational independence, financial transparency, and strategic positioning. This isn’t about cosmetic changes before a sale. It’s about building genuine, transferable value that benefits you whether you exit in two years or twenty.

The difference between businesses that command premium valuations and those that struggle to find buyers at any price comes down to one factor: can the business thrive without its current owner? We’ve seen companies with identical revenues receive valuations that differ by 3x or more, with the distinguishing factor being the depth of exit-ready operations.

This guide walks you through the systematic process of transforming owner-dependent businesses into acquisition-ready assets. You’ll learn specific strategies for documenting institutional knowledge, building management depth, optimizing financial presentation, and positioning your company for the buyer pool most likely to pay premium prices.

The timeline matters. Most meaningful operational improvements require 18-36 months to fully implement and demonstrate results. Starting this process early gives you optionality: the ability to exit when market conditions favor sellers rather than when personal circumstances force a sale.

Introduction

The exit planning conversation typically begins with a valuation question: “What’s my business worth?” But that’s the wrong starting point. The right question is: “What would my business be worth to a sophisticated buyer who plans to operate it without me?”

That reframing changes everything. Suddenly, your deep customer relationships become a liability if they’re tied to your personal involvement. Your flexible, intuition-driven management style becomes a red flag signaling operational risk. Your family-friendly bookkeeping becomes an obstacle to due diligence.

Exit-ready operations address these concerns systematically. According to research from the Exit Planning Institute, approximately 70-80% of businesses that go to market fail to sell, with owner dependency and inadequate financial documentation ranking among the primary deal-breakers. These aren’t businesses that lack value. They’re businesses whose value can’t be verified or transferred.

The owners who achieve premium exits share a common trait: they built businesses that didn’t need them. Not because they were absent or disengaged, but because they deliberately created systems, teams, and processes that could function independently.

We work with business owners who typically have 2-7 years until their target exit date and revenues between $2M and $20M. This window provides enough time for meaningful transformation while maintaining urgency. The strategies in this guide are calibrated for that timeline and scale, though the principles apply more broadly.

What follows is a comprehensive framework for building exit-ready operations, organized around the three pillars that sophisticated buyers evaluate most rigorously.

The Owner Dependency Problem

Owner dependency is the silent killer of business valuations. It manifests in subtle ways that owners rarely recognize until buyers point them out.

Consider the typical scenario: the owner maintains personal relationships with the top ten customers, handles all pricing decisions above a certain threshold, resolves every significant operational problem, and serves as the final arbiter of quality. From the owner’s perspective, this engagement demonstrates commitment and protects standards. From a buyer’s perspective, it represents concentrated risk.

When buyers evaluate potential acquisitions, they’re stress-testing a fundamental question: what happens when the current owner leaves? If the answer involves any form of “things would probably be fine, but…” then you have an owner dependency problem.

The financial impact is substantial. Industry practitioners and M&A advisors commonly observe that businesses with high owner dependency may sell at significant discounts compared to those with professional management teams and documented operations. This valuation differential typically affects the EBITDA multiple buyers are willing to pay. The difference between a 4x multiple and a 6x multiple on $1M of EBITDA represents $2M in enterprise value.

Measuring Owner Dependency

Before you can address owner dependency, you need to measure it honestly. We recommend tracking several metrics:

Customer Concentration by Relationship: What percentage of revenue comes from customers who would expect direct access to the owner? If a customer would feel abandoned by your departure, that relationship represents concentrated risk.

Decision Authority Distribution: How many decisions above a materiality threshold (say, $5,000) require owner approval? In a healthy organization, this should be minimal for routine operational matters.

Knowledge Monopolies: Which critical processes exist only in the owner’s head? This includes pricing methodologies, vendor relationships, quality standards, and problem-solving approaches.

Vacation Test: What happens when you take two weeks completely offline? If the answer is “I can’t” or “everything falls apart,” you’ve identified your dependency precisely.

Building Management Depth

The solution to owner dependency is building genuine management depth: not just hiring managers, but developing leaders who can make decisions you would have made.

This requires investment in three areas:

Authority Transfer: Systematically moving decision rights to capable managers. Start with low-risk decisions and progressively increase the threshold. Document the reasoning behind decisions so managers can learn your thinking patterns.

Information Access: Making sure managers have the data they need to make good decisions. This often requires upgrading financial reporting, CRM systems, and operational dashboards.

Skill Development: Building specific capabilities through training, mentorship, and experience. This is the slowest component and the one most often neglected.

The timeline for building genuine management depth is typically 18-24 months at minimum. You cannot hire your way out of owner dependency in six months. Even excellent hires need time to learn the business, build relationships, and demonstrate consistent judgment.

Financial Documentation That Survives Due Diligence

Buyers don’t evaluate your business based on what you tell them. They evaluate it based on what your financial records prove. The gap between these two perspectives derails more transactions than any other factor.

Financial due diligence is adversarial by nature. Buyers hire specialists whose job is to find problems, adjust your numbers downward, and identify risks that justify lower valuations. Your financial documentation needs to anticipate this scrutiny.

The Quality of Earnings Challenge

The centerpiece of financial due diligence is the Quality of Earnings (QoE) analysis. This process reconstructs your reported EBITDA using the buyer’s accounting standards and adjustments. The result frequently differs from seller expectations by 15-30%.

Common QoE adjustments that reduce valuations include:

Revenue Recognition Issues: Recognizing revenue before it’s truly earned, booking one-time revenue as recurring, or failing to account for customer churn patterns.

Expense Normalization: Removing owner compensation in excess of market rates, adding back expenses that would be necessary under professional management, and normalizing for one-time cost reductions.

Working Capital Adjustments: Identifying seasonal patterns that affect the cash required to operate the business, which impacts the net proceeds you receive at closing.

Customer Concentration Penalties: Adjusting valuations downward when significant revenue depends on a small number of customers.

Preparing Financials for Scrutiny

Exit-ready financial documentation requires several years of preparation. The specific elements include:

Audited or Reviewed Financials: While expensive, having a CPA firm review or audit your financials significantly increases buyer confidence. For businesses above $5M in revenue, this investment typically pays for itself through improved valuations.

Clean Separation of Personal and Business Expenses: Buyers assume any questionable expense will be added back to operating costs. The burden of proof falls on you to demonstrate business purpose.

Documented Revenue Metrics: Monthly recurring revenue, customer lifetime value, churn rates, and acquisition costs should be trackable over time. Buyers want to see trends, not snapshots.

Normalized EBITDA Presentation: Present your financials with adjustments already made, showing both GAAP results and your proposed normalization. This demonstrates sophistication and accelerates due diligence.

Three Years of Detailed Data: Most buyers want three years of comparable financial data. If you’re planning an exit in 2027, your 2025 financials need to be impeccable.

Operational Systems That Transfer

Financial performance matters, but it’s the operational systems that determine whether that performance can continue under new ownership. Buyers are purchasing future cash flows, not historical results.

Documentation Requirements

The businesses that command premium valuations share a common characteristic: you could hand the operating manuals to a competent manager and they could run the business within 90 days. This requires detailed documentation including:

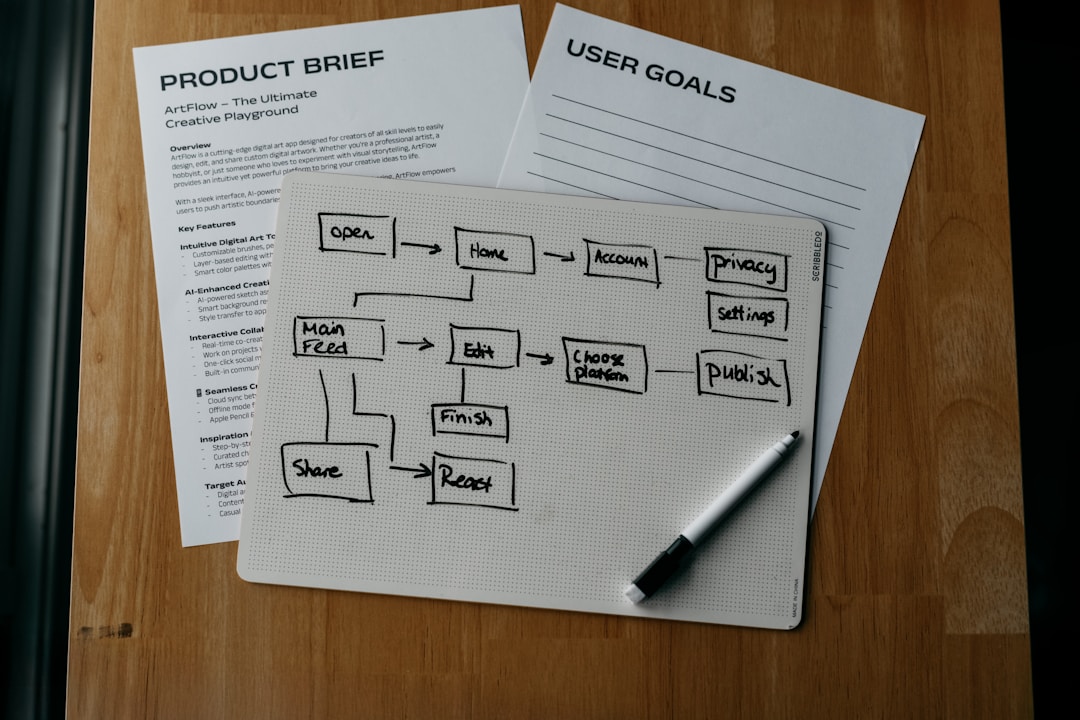

Process Maps: Visual representations of how work flows through your organization, including decision points, handoffs, and exception handling.

Standard Operating Procedures: Step-by-step instructions for recurring tasks, written at a level of detail that allows someone unfamiliar with your business to execute them.

Vendor and Customer Contracts: Organized files with renewal dates, key terms, and relationship history. Verbal agreements need to be converted to written contracts before exit.

Technology Documentation: System architecture, integration points, access credentials, and vendor relationships for all critical software.

Organizational Charts with Role Clarity: Not just reporting relationships, but clear descriptions of responsibilities, decision rights, and success metrics for each position.

The 90-Day Transfer Test

A useful exercise is imagining you need to transfer operational control to a new owner in 90 days. What would they need to know? What relationships would they need to build? What decisions would they face that aren’t covered by existing documentation?

This exercise typically reveals gaps that take 12-18 months to address properly. Common discoveries include:

- Pricing decisions that depend on the owner’s market intuition rather than documented guidelines

- Quality standards that exist as tacit knowledge rather than measurable specifications

- Vendor relationships that rely on personal history rather than contractual terms

- Customer success processes that depend on owner intervention for escalations

Strategic Positioning for Your Buyer Pool

Not all buyers are created equal, and not all businesses appeal equally to all buyer types. Exit-ready operations include strategic clarity about who will buy your business and why.

Understanding Buyer Types

The primary buyer categories for businesses in the $2M-$20M revenue range include:

Strategic Acquirers: Larger companies in your industry or adjacent spaces looking for market expansion, capability acquisition, or competitive consolidation. These buyers typically pay premium prices but have specific strategic requirements.

Private Equity Groups: Financial buyers who acquire companies as platform investments or add-ons to existing portfolio companies. They focus heavily on growth potential and management team strength.

Individual Buyers: Often former executives or entrepreneurs seeking to acquire and operate a business. They’re typically more flexible on deal terms but have limited capital.

Employee Stock Ownership Plans (ESOPs): A mechanism for selling to employees, often with significant tax advantages. Requires specific company characteristics and substantial preparation.

Positioning Strategies

Different buyer types prioritize different characteristics:

| Buyer Type | Primary Value Drivers | Key Concerns |

|---|---|---|

| Strategic | Market position, customer relationships, capabilities | Integration complexity, cultural fit |

| Private Equity | Growth potential, management depth, operational efficiency | Owner dependency, financial documentation quality |

| Individual | Cash flow stability, manageable complexity, owner transition support | Business complexity, customer concentration |

| ESOP | Employee loyalty, stable operations, company culture | Transaction costs, ongoing governance requirements |

Exit-ready positioning means understanding which buyer types are most likely to value your specific characteristics and emphasizing those elements in your operational development.

The Exit-Ready Timeline

Building exit-ready operations is a multi-year process. While every business is unique, we typically recommend the following phases:

Phase 1: Assessment and Planning (Months 1-6)

- Complete comprehensive owner dependency assessment

- Conduct detailed financial documentation review

- Identify operational documentation gaps

- Develop preliminary buyer positioning strategy

- Create prioritized improvement roadmap

Phase 2: Foundation Building (Months 7-18)

- Recruit or develop key management team members

- Implement financial reporting upgrades

- Begin systematic process documentation

- Address customer and vendor concentration

- Establish key performance metrics and tracking

Phase 3: Optimization and Proof (Months 19-36)

- Demonstrate management team performance without owner involvement

- Complete two years of clean financial documentation

- Achieve measurable improvements in operational metrics

- Build relationships with potential advisors and intermediaries

- Consider preliminary valuation analysis

Phase 4: Market Preparation (Months 37-48)

- Engage transaction advisors

- Complete Quality of Earnings preparation

- Finalize operational documentation

- Optimize working capital position

- Prepare management team for due diligence

This timeline assumes a target exit in years 4-5. Accelerated timelines are possible but typically result in lower valuations due to compressed proof periods.

Actionable Takeaways

Start the Owner Dependency Assessment Now: Use the vacation test as an initial diagnostic. If you cannot take two weeks completely offline, you have owner dependency that will impact your valuation.

Invest in Financial Documentation Quality: The cost of audited or reviewed financials is significant, but the return on investment through improved buyer confidence and reduced due diligence friction typically exceeds the expense by a substantial margin.

Document One Process Per Week: Operational documentation feels overwhelming when viewed as a single project. Breaking it into weekly increments makes steady progress achievable while maintaining normal operations.

Identify Your Likely Buyer Type: Understanding who will buy your business shapes every preparation decision. Strategic buyers value different characteristics than financial buyers.

Build Genuine Management Depth: Hiring managers isn’t enough. You need leaders who have demonstrated the ability to make decisions you would have made, under conditions you’ve observed over 12-18 months.

Consider the Timeline Honestly: If you want to exit in three years, you’re already behind on a four-year preparation timeline. Adjust your expectations or accelerate your pace accordingly.

Conclusion

Building exit-ready operations isn’t about gaming the system or creating an artificial impression of value. It’s about building genuine, transferable value that makes your business attractive to sophisticated buyers who will examine every aspect of your operations.

The businesses that command premium valuations share common characteristics: professional management that can operate independently, financial documentation that survives adversarial scrutiny, operational systems that can transfer to new ownership, and strategic positioning that appeals to the most likely buyer pool.

These characteristics don’t develop accidentally. They result from deliberate, sustained effort over multiple years. The owners who achieve exceptional exits start early, plan systematically, and execute consistently.

Whether your target exit is two years away or seven, the work of building exit-ready operations begins now. The market rewards preparation, and sophisticated buyers can distinguish between genuine operational excellence and last-minute polish.

Your business represents years of effort and sacrifice. Building exit-ready operations turns that effort into maximum value when you’re ready to transition to your next chapter.