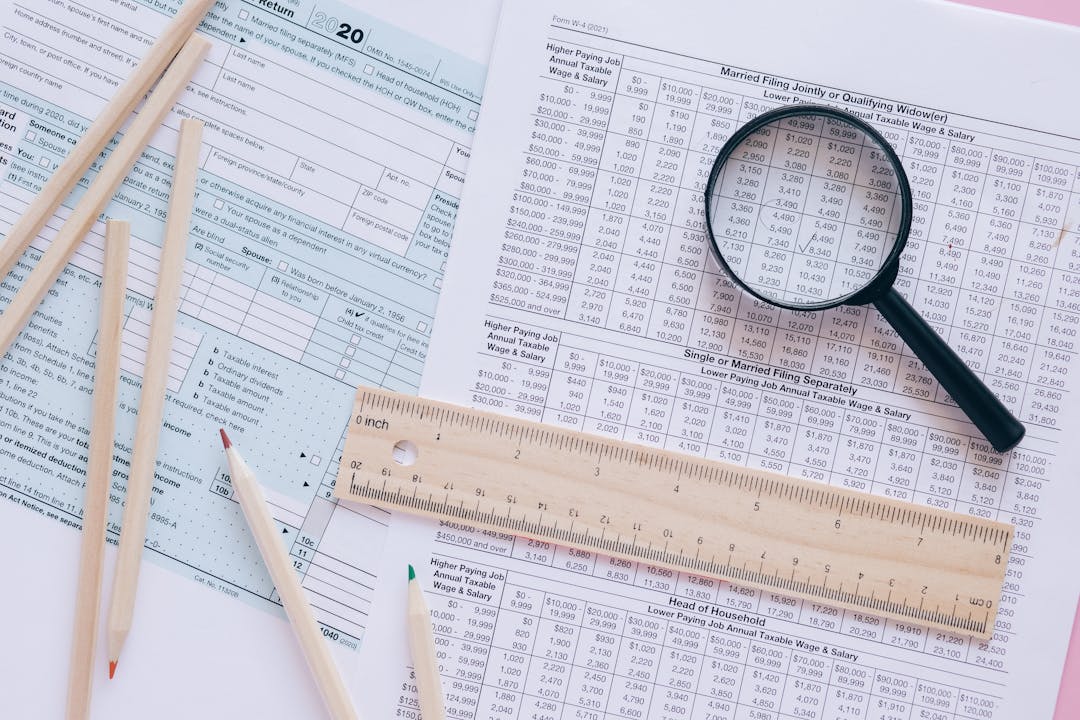

Debt-Like Items - Hidden Liabilities That Reduce Your Check in M&A Transactions

Learn how buyers characterize operating items as debt-like liabilities to reduce your sale proceeds and strategies to protect your equity value

The enterprise value your buyer quotes and the check you actually receive can differ by hundreds of thousands of dollars—and the gap often comes down to three words most sellers have never heard: “debt-like items.” These seemingly technical balance sheet classifications become powerful levers buyers use to reduce your proceeds, transforming what you’ve always considered normal operating liabilities into deductions from your sale price.

Executive Summary

When buyers present acquisition offers, they typically quote enterprise value: the total value of your business operations. But sellers don’t receive enterprise value; they receive equity value, calculated by subtracting net debt from enterprise value. The critical question that determines your actual proceeds: what counts as “debt?”

Traditional debt is straightforward: bank loans, credit lines, and formal borrowings clearly reduce equity value. But buyers increasingly characterize operating items as “debt-like,” arguing these obligations function economically like debt even without formal loan documentation. In our firm’s experience across middle-market transactions, debt-like item adjustments appear in the substantial majority of deals involving businesses with significant deferred revenue, customer deposits, or accrued compensation obligations.

Deferred revenue, customer deposits, accrued bonuses, unfunded pension obligations, and deferred compensation arrangements all become targets for debt-like treatment. This characterization battle can create significant value transfer from sellers to buyers. For service businesses and software companies, debt-like adjustments often represent 5-15% of enterprise value, though actual impact varies significantly based on business model, historical practices, and negotiating leverage.

Understanding the conceptual frameworks buyers use, identifying which items typically trigger disputes, and engaging experienced M&A advisors who regularly negotiate these provisions can help preserve sale proceeds. But market leverage, competitive dynamics, and advisor quality often determine outcomes more than seller preparation alone. This article provides conceptual grounding, but professional advisory support remains needed for navigating these complex negotiations successfully.

Introduction

Every M&A transaction involves converting the headline enterprise value into actual seller proceeds through a series of adjustments. The most significant adjustment: the net debt calculation, which seems straightforward until you examine what buyers include in their definition of “debt.”

In our firm’s experience advising sellers on exit preparation over the past decade, debt-like item disputes arise in the majority of transactions involving businesses with significant deferred revenue, customer deposits, or accrued compensation. The pattern is consistent: sellers who haven’t prepared for these discussions and who lack experienced M&A advisors often find themselves accepting characterizations that reduce their proceeds by amounts that would have justified significant preparation time.

The deferred revenue they’ve accumulated from annual contracts? Buyers frequently argue it’s debt-like. The customer deposits securing future orders? Often targeted for debt-like treatment. The accrued bonuses they pay every March? Another common area of dispute. Each successful classification reduces the check sellers receive at closing.

The challenge for sellers is conceptual asymmetry. Buyers, especially private equity firms and strategic acquirers with experienced M&A teams, have refined frameworks for debt-like characterization developed across dozens or hundreds of transactions. They understand exactly which arguments resonate and how to frame operating items as economic obligations requiring debt treatment.

Sellers, often completing their first and only significant transaction, encounter these concepts for the first time during negotiations. They lack the vocabulary to articulate why certain items shouldn’t receive debt-like treatment and the frameworks to counter sophisticated buyer arguments. This knowledge gap often contributes to outcomes where buyers successfully characterize more items as debt-like, though deal leverage, competitive dynamics, and advisor quality typically matter more than seller personal knowledge.

This article provides conceptual grounding for understanding debt-like item negotiations. We’ll examine how buyers think about debt-like characterization, identify the specific items that generate disputes, analyze the arguments supporting different positions, and provide frameworks for approaching these discussions. But engaging experienced M&A advisors who can assess your specific competitive position and market conditions remains the most important factor in achieving favorable outcomes.

Understanding the Enterprise Value to Equity Value Bridge

The mathematics connecting enterprise value to equity value appear simple: Equity Value = Enterprise Value - Net Debt + Excess Cash. But the apparent simplicity masks significant complexity in defining each component, particularly net debt.

A Concrete Calculation Example

Consider a hypothetical software company with $8 million in enterprise value based on a 4x EBITDA multiple applied to $2 million in adjusted EBITDA. The seller expects to receive close to $8 million, perhaps minus their $1 million bank loan, yielding roughly $7 million in proceeds.

Here’s how the calculation might unfold in negotiations, though actual outcomes depend heavily on deal-specific factors:

| Item | Amount | Treatment | Potential Impact on Proceeds |

|---|---|---|---|

| Enterprise Value | $8,000,000 | Starting point | — |

| Term Loan | ($1,000,000) | Clearly debt | ($1,000,000) |

| Deferred Revenue | ($600,000) | Contested: buyer seeks debt-like treatment | ($600,000) if treated as debt-like |

| Accrued Bonuses | ($200,000) | Contested: buyer argues abnormal level | ($100,000) if excess treated as debt-like |

| Customer Deposits | ($150,000) | Contested: buyer seeks debt-like treatment | ($150,000) if treated as debt-like |

| Working Capital Adjustment | ($75,000) | Below target | ($75,000) |

| Potential Seller Proceeds | $6,075,000 | After all adjustments | $1,925,000 less than enterprise value |

In this hypothetical example, the seller expected approximately $7 million but might receive $6.075 million: a 24% reduction from enterprise value and 13% less than their initial expectation. The debt-like item disputes alone could account for $850,000 of the gap. But actual outcomes vary significantly based on competitive dynamics, buyer motivation, and negotiating leverage.

Traditional net debt includes formal debt instruments: term loans, revolving credit facilities, subordinated notes, and similar borrowings. These items clearly represent financial obligations to third-party lenders and unquestionably reduce equity value. No seller disputes that their bank loan should be subtracted from enterprise value.

The controversy emerges with items that share characteristics with debt but aren’t formal borrowings. Buyers argue these items function economically like debt: they represent obligations to third parties, they’ll require cash outflows to satisfy, and they burden the business the buyer is acquiring. From the buyer’s perspective, acquiring a business with $600,000 in deferred revenue creates an obligation to perform future services, economically similar to a $600,000 liability requiring future cash deployment.

Sellers typically see these items differently. Deferred revenue represents customer relationships and contracted future work. Customer deposits indicate strong demand and customer commitment. Accrued liabilities reflect normal business operations, not financial leverage. These items have always appeared on the balance sheet, and sellers have never considered them “debt” in any meaningful sense.

This conceptual disconnect (buyers viewing items through an economic obligation lens while sellers view them through an operational lens) creates the debt-like item battleground that can significantly impact transaction proceeds.

Common Debt-Like Items and Why Buyers Target Them

Understanding which specific items trigger debt-like treatment helps sellers and their advisors prepare responses before negotiations begin. While buyers may argue for debt-like treatment of various balance sheet items, certain categories generate consistent disputes across transactions.

Deferred Revenue and Advance Payments

Deferred revenue represents the most frequently contested debt-like item, particularly for service businesses, software companies, and subscription-based models. When customers prepay for annual contracts, maintenance agreements, or future services, accounting rules require recording the payment as a liability until services are delivered.

Buyers argue deferred revenue represents an obligation to perform future services (services requiring labor, materials, and overhead costs). The buyer must deploy resources to satisfy these obligations, making deferred revenue economically similar to debt. A business with $1 million in deferred revenue hasn’t received $1 million in free money; it’s received $1 million in exchange for future performance obligations that typically cost 30-70% of the deferred amount to fulfill, depending on the business’s gross margin structure.

The buyer’s argument has economic merit in many cases. But the appropriate treatment depends critically on how deferred revenue interacts with working capital calculations. If deferred revenue is included in working capital (as it often is for businesses where it fluctuates with normal operations), treating it as debt-like effectively double-counts the item. Sellers and their advisors must understand whether deferred revenue is already captured elsewhere in the transaction mechanics before accepting debt-like characterization.

Industry context matters significantly here. For a SaaS company where deferred revenue represents 20-40% of annual revenue, debt-like treatment could reduce proceeds by a substantial percentage of enterprise value. For a professional services firm with minimal deferred revenue, the impact may be negligible. Manufacturing companies with limited deferred revenue rarely experience significant disputes in this category.

Customer Deposits and Retainers

Similar to deferred revenue, customer deposits represent advance payments requiring future performance. Construction companies holding project deposits, law firms maintaining client retainers, and manufacturers receiving order deposits all carry these liabilities.

Buyers argue deposits represent unfunded performance obligations. The business must either perform the contracted work (requiring cost outlay) or return the deposit (requiring cash outlay). Either way, the deposit isn’t “free” money available to the seller.

Sellers may counter that deposits represent normal industry practice, reflect customer relationships and backlog value, and have always been part of operating the business. The appropriate response depends on whether deposits genuinely represent unusual obligations or simply reflect how the industry operates and how working capital has been defined.

Accrued Compensation and Bonuses

Accrued salaries, earned but unpaid bonuses, and accumulated vacation obligations create debt-like item disputes, particularly when accruals are larger than typical or when bonus payments occur shortly after anticipated closing dates.

Buyers argue that accrued compensation represents obligations to employees that require cash payment. If the business has accrued $400,000 in bonuses payable next month, the buyer will write that check and they want credit for satisfying the seller’s obligation.

The key distinction involves timing and normalcy. Accrued compensation that represents normal ongoing operations (the kind of accrual that exists every day of every year at similar levels) typically belongs in working capital rather than debt. But unusual accruals, transaction-related bonuses, or amounts significantly exceeding historical patterns may warrant different treatment.

For example, if historical bonus accruals at year-end typically range from $150,000 to $200,000, but this year’s accrual is $400,000 due to retention bonuses tied to the transaction, buyers reasonably argue the incremental $200,000 represents a transaction-related expense warranting debt-like treatment or exclusion from working capital.

Unfunded Pension and Post-Retirement Obligations

Defined benefit pension plans and post-retirement benefit obligations (like retiree healthcare) create clear debt-like items when unfunded. These obligations represent contractual commitments to employees requiring future cash funding, often extending decades into the future.

Few sellers successfully argue against debt-like treatment for genuinely unfunded pension obligations. The economic reality (these are long-term obligations requiring substantial future funding) clearly resembles debt. Pension obligations can vary significantly depending on plan size, funding history, and actuarial assumptions, ranging from relatively minor amounts to multiples of annual EBITDA for businesses with mature workforces and legacy defined benefit plans.

Sellers’ best approach involves ensuring accurate actuarial valuations and understanding how discount rate assumptions affect calculated obligations. Changes in discount rate assumptions can materially change calculated pension obligations, making actuarial methodology a legitimate area for discussion with your advisors. Addressing underfunding before marketing the business may simplify negotiations, though the costs and benefits of pre-sale remediation should be evaluated against your specific circumstances.

Deferred Compensation Arrangements

Deferred compensation plans allowing executives to defer salary or bonus payments into future years create obligations the buyer inherits. Unlike qualified retirement plans, deferred compensation typically represents an unfunded promise to pay, creating a clear economic liability.

The treatment often depends on whether deferred compensation is formally documented, whether it’s been consistently applied, and whether obligations transfer to the buyer or remain with the seller. Sellers with significant deferred compensation arrangements should address treatment explicitly before negotiations rather than discovering the issue during due diligence.

Tax-Related Liabilities

Uncertain tax positions, accumulated deferred tax liabilities, and potential tax exposures from pre-closing periods create debt-like item discussions. Buyers reasonably expect protection from tax liabilities generated during the seller’s ownership period.

These items often receive treatment through specific indemnification provisions rather than debt-like classification, but the economic effect remains similar (sellers bear responsibility for pre-closing tax obligations whether through debt adjustment or indemnity). The key is ensuring consistency: if tax liabilities are addressed through indemnification, they shouldn’t also receive debt-like treatment.

The Conceptual Frameworks Buyers Use

Understanding how buyers think about debt-like characterization helps sellers and their advisors anticipate arguments and prepare responses. Buyers typically apply several conceptual tests when arguing for debt-like treatment.

The “Who Pays?” Test

Buyers ask a simple question: “Who will write the check to satisfy this obligation?” If the buyer will pay employees, return deposits, perform deferred services, or fund pension obligations, they argue the economic burden falls on them and the purchase price should reflect that burden.

Sellers can counter by distinguishing between obligations that exist because of historical operations (potentially appropriate for debt-like treatment) and obligations that represent ongoing business operations (typically appropriate for working capital treatment). The employee payroll accrued at closing will indeed be paid by the buyer, but so will next week’s payroll. The question isn’t who pays, but whether the item represents unusual obligations or normal operations.

The “Economic Substance” Test

Buyers focus on economic substance over legal form. A liability doesn’t need formal loan documentation to function like debt. If an obligation requires future cash payment to satisfy, it shares debt’s characteristic regardless of how it’s labeled on the balance sheet.

Sellers can acknowledge economic substance while arguing that working capital treatment already captures the economics. If deferred revenue is included in working capital calculations, and the working capital target reflects historical deferred revenue levels, the item’s economics may already be incorporated in the transaction structure. Double-counting through both working capital and debt-like treatment creates a windfall for buyers at sellers’ expense, though buyers may counter by arguing for exclusion from working capital precisely to make debt-like treatment possible.

The “Burden Transfer” Test

Buyers argue they’re acquiring operations, not obligations. Any obligation that burdens the business (requiring future resource deployment) should be quantified and deducted from what buyers pay for the operations themselves.

Sellers can respond that operations inherently include ongoing obligations. A service business without deferred revenue isn’t worth its enterprise value; the deferred revenue represents contracted backlog that supports that valuation. Treating deferred revenue as debt-like while maintaining enterprise value based on revenue that includes deferred amounts creates an inconsistency. But experienced buyers will have responses to this argument, and outcomes depend significantly on deal-specific leverage.

Approaches to Debt-Like Item Discussions

Understanding debt-like item concepts helps sellers engage more effectively with their advisors and participate meaningfully in negotiations. But deal leverage, competitive dynamics, and advisor quality typically determine outcomes more than seller personal knowledge. These approaches may improve your position, but guarantees aren’t possible.

Consider Working Capital Definitions Early

When leverage permits, establishing working capital definitions before debt discussions can help prevent double-counting. If an item is included in working capital calculations (with target amounts reflecting historical levels) there’s a reasonable argument against additional debt-like treatment for that same item.

Work with your M&A advisor to develop working capital definitions that address items likely to receive debt-like scrutiny. When buyers later argue for debt treatment of deferred revenue, inclusion in working capital calculations provides a framework for discussing why additional adjustment may represent double-counting.

But buyers may counter by arguing for exclusion of certain items from working capital precisely so they can receive debt-like treatment. Sophisticated buyers will anticipate this dynamic, and outcomes depend heavily on competitive pressure and deal leverage. In single-buyer negotiations or situations with limited alternatives, buyers often maintain their preferred approaches regardless of seller arguments.

Prepare Historical Pattern Analysis

Buyers have stronger arguments for debt-like treatment when items exceed historical patterns. If your business typically carries $200,000 in accrued bonuses but this year shows $600,000 due to a special retention program, the incremental $400,000 may warrant different treatment even if the base amount belongs in working capital.

Review your balance sheet items against historical patterns and be prepared to explain anomalies. Consider preparing a historical trend analysis for the 3-5 most significant liability categories showing month-end balances over 24-36 months. This analysis typically requires 4-8 weeks depending on balance sheet complexity and takes meaningful advisor time to complete properly.

Understand the Interaction Between Adjustments

M&A transactions involve multiple adjustments: working capital true-ups, debt assumptions, transaction expense allocations, and earnout calculations. These adjustments interact, and treatment of specific items in one category affects appropriate treatment in others.

Ensure your advisors analyze how debt-like treatment of specific items interacts with other transaction mechanics. Sometimes accepting debt-like treatment for an item while adjusting working capital targets produces equivalent economic results with less negotiation friction. The goal is optimizing overall proceeds, not winning every individual classification argument.

Consider Pre-Sale Remediation vs. Negotiation Trade-offs

Before engaging in debt-like item negotiations, evaluate whether addressing certain items before sale might yield better outcomes despite upfront costs. This trade-off analysis should consider:

When pre-sale remediation may be superior:

- Items are genuinely anomalous and defensible remediation is available

- Seller has time and liquidity to address issues before marketing

- Cleanup simplifies negotiations and reduces buyer uncertainty

- Removing the item eliminates negotiation entirely

When negotiation may be superior:

- Items are industry-standard and defensible as normal operations

- Pre-sale cleanup is expensive relative to likely negotiated adjustment

- Working capital definitions can appropriately capture the economics

- Seller has strong competitive position with multiple interested buyers

Your M&A advisors can help evaluate these trade-offs based on your specific circumstances and market conditions.

Recognize Negotiation Realities

Despite careful preparation, sellers should recognize several important realities:

Leverage matters significantly. In competitive sale processes with multiple interested buyers, sellers have more ability to push back on aggressive debt-like characterizations. In single-buyer negotiations or situations with limited alternatives, buyers have more leverage to insist on their preferred treatment. Market dynamics often determine outcomes more than individual negotiation tactics.

Advisor quality often matters more than seller knowledge. While understanding these concepts is valuable, experienced M&A advisors who regularly negotiate these provisions bring pattern recognition and precedent knowledge that individual sellers cannot replicate. Invest in advisors with specific experience negotiating debt-like items in your industry.

Buyer sophistication varies. Private equity firms with dedicated M&A teams typically have more refined debt-like item frameworks than strategic buyers making occasional acquisitions. Adjust your expectations and preparation accordingly.

Some battles aren’t worth fighting. Spending negotiation capital on small-dollar items may compromise your position on larger issues. Focus on items with material impact on proceeds.

Fighting aggressively can backfire. In single-buyer situations or where buyer arguments have genuine merit, adversarial approaches may damage relationships, extend timelines, or increase deal risk without improving outcomes.

When These Approaches May Not Work

Not every negotiation ends favorably for sellers, and understanding common limitations helps set realistic expectations.

Inadequate competitive leverage: Sellers who’ve already signed exclusivity agreements with a single buyer have limited alternatives if negotiations become contentious. Buyers know sellers’ walk-away options and adjust their positions accordingly. Market dynamics and competitive pressure typically matter more than preparation quality.

Buyer standardized templates: Many buyers, particularly private equity firms, use standardized templates and approaches developed across numerous transactions. They may acknowledge seller arguments but maintain positions anyway because their frameworks have been refined over many deals.

Genuine economic merit in buyer arguments: Sometimes buyers’ debt-like item arguments have legitimate economic substance. Sellers who reflexively resist every characterization may damage credibility and relationships, ultimately harming their position on items where they have stronger arguments. Recognizing when buyer positions have merit and accepting reasonable characterizations can preserve credibility for more important disputes.

Inadequate preparation time: Sellers who encounter debt-like item concepts for the first time in purchase agreement drafts have limited ability to mount effective responses. Debt-like item preparation typically requires $50,000-$100,000+ in additional advisory fees and 4-8 weeks of focused work, depending on complexity.

Inconsistent historical practices: Sellers whose financial statements show erratic liability patterns or whose working capital has varied dramatically provide ammunition for buyers arguing that “normal” levels are difficult to establish.

Misaligned advisor incentives: Advisors compensated primarily on deal completion may encourage sellers to accept unfavorable terms rather than risk deal failure over debt-like item disputes. Ensure your advisors understand your priorities and have appropriate incentive alignment.

Actionable Takeaways

Before engaging buyers (allow 4-8 weeks for preparation):

- Engage M&A advisors with specific experience negotiating debt-like items in your industry (advisor quality and experience typically matter more than seller personal knowledge)

- Review your balance sheet with advisors specifically identifying items that may receive debt-like scrutiny, including deferred revenue, customer deposits, accrued compensation, unfunded pension obligations, and deferred compensation arrangements

- Analyze historical patterns for each potential debt-like item over 24-36 months to identify and explain any anomalies

- Evaluate trade-offs between pre-sale remediation and negotiation for significant items

- Budget appropriately; debt-like item preparation and defense typically requires $50,000-$100,000+ in additional advisory fees

During negotiations:

- When leverage permits, discuss working capital definitions that address items you believe warrant operating rather than debt-like treatment

- Distinguish between your normal operating liabilities and genuinely unusual obligations, using historical data to support your position

- Focus negotiation capital on the most material items rather than fighting every classification

- Recognize when buyer arguments have legitimate merit (accepting reasonable characterizations can preserve credibility for more important disputes)

- Consider whether accepting certain characterizations might improve overall deal dynamics, particularly in single-buyer situations

Deal structure considerations:

- Consider whether addressing certain liabilities before sale simplifies negotiations and potentially improves net proceeds despite upfront costs

- Evaluate whether escrow or indemnification provisions handle tax-related concerns more appropriately than debt treatment

- Ensure representations and warranties align with however debt-like items are ultimately treated

- Maintain realistic expectations (market leverage and competitive dynamics often determine outcomes more than preparation quality)

The goal isn’t winning every debt-like item argument; it’s ensuring your proceeds reflect a fair characterization of the obligations you’re transferring, while recognizing that deal dynamics may limit what’s achievable.

Conclusion

The gap between quoted enterprise value and actual sale proceeds often surprises sellers, and debt-like item characterization frequently contributes to that gap. Items you’ve always considered normal operating liabilities (deferred revenue, customer deposits, accrued compensation) become contested terrain where buyer arguments can transfer value from your pocket to theirs.

Understanding debt-like item dynamics before entering negotiations can improve your position, but market leverage, competitive dynamics, and advisor quality typically matter more than seller personal knowledge. Well-prepared sellers in weak competitive positions may still accept unfavorable terms when deal dynamics or buyer leverage limit their alternatives.

We’ve observed sellers improve their outcomes by understanding these concepts and engaging experienced advisors before their first buyer meeting. The knowledge asymmetry that typically favors experienced buyers diminishes when sellers arrive with competent advisory teams and reasonable preparation. But we’ve also seen prepared sellers accept terms they disliked when market conditions, single-buyer dynamics, or genuine economic merit in buyer arguments limited their leverage.

Your exit represents the culmination of years building your business. Understanding debt-like item dynamics is one component of exit preparation (important, but not sufficient on its own). Invest in experienced M&A advisors who regularly negotiate these provisions and can assess what’s achievable given your specific competitive position. Focus preparation efforts on the most material items. Maintain realistic expectations about what’s achievable in your specific situation. And recognize that ensuring fair treatment of legitimate operating liabilities (rather than eliminating all debt-like adjustments) represents a reasonable goal that experienced advisors can help you pursue.