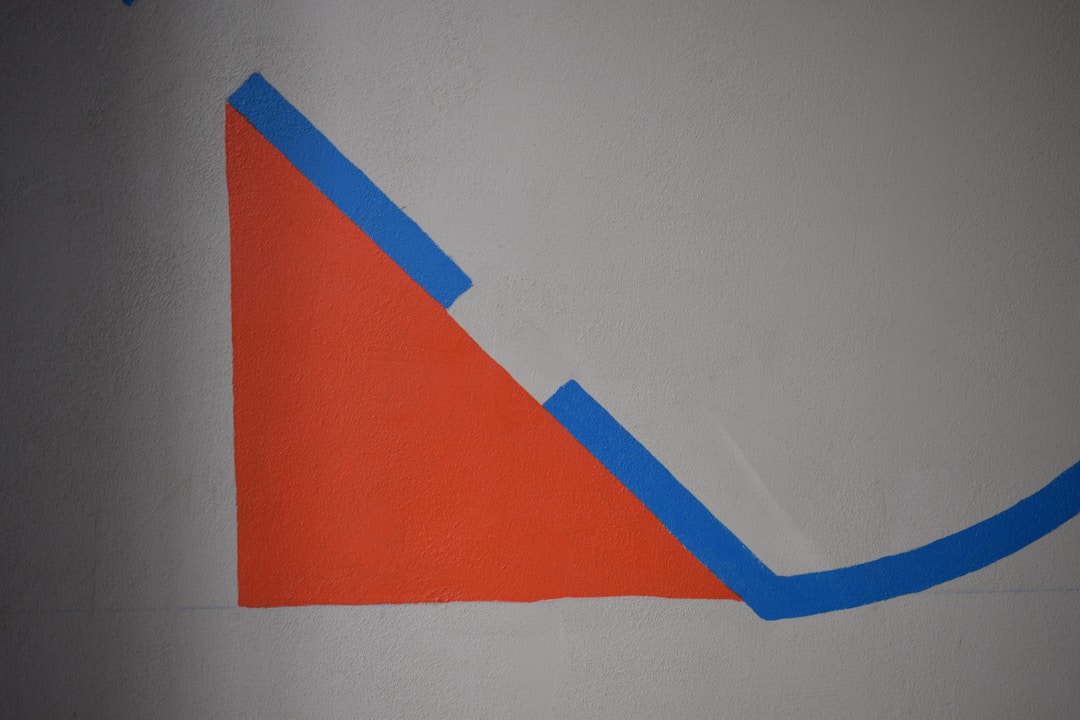

Margin Trends Over Margins - Why Direction Matters More Than Position in Exit Valuations

Learn why gross margin trajectory often matters more than absolute levels to buyers and how improving trends can influence valuations at exit

A business owner recently showed us three years of financial statements with gross margins holding steady at 42%. “Solid margins,” he said confidently. The buyer’s response surprised him—a valuation meaningfully lower than a competitor with 38% margins whose trajectory had climbed steadily from 31% over the same period. While many factors influenced this outcome, the buyer explicitly cited margin trajectory as a significant consideration in their modeling.

Executive Summary

When sophisticated buyers, particularly private equity firms, evaluate acquisition targets, they’re not just photographing your current financial position. They’re watching a movie of your business trajectory. Gross margin trends have become one of several telling indicators of business health, competitive positioning, and future potential. A company with improving margins often signals strengthening market position, effective cost management, and sustainable competitive advantages. Conversely, declining margins, even from historically high levels, can raise questions about pricing pressure, operational challenges, or market disruption that warrant investigation.

This reality creates both risk and opportunity for business owners planning exits. Those who understand how buyers interpret margin movements can take deliberate action to improve their trajectory, potentially boosting their eventual transaction value. Those who focus solely on maintaining acceptable margin levels may find themselves explaining concerning trends during due diligence, rarely a winning position.

The potential impact is meaningful, though it varies significantly by industry, buyer type, and deal size. In our experience working with mid-market transactions, we’ve observed margin trajectory influence valuation multiples, with impact potentially ranging from 0.2x to 1.0x or more depending on industry context, buyer priorities, and overall business quality. These ranges reflect our specific experience rather than comprehensive market analysis, and actual results depend heavily on context. For a business valued at $10 million, even modest multiple adjustments can represent meaningful dollars in transaction value, enough to justify serious attention to margin trajectory management alongside other value drivers.

Introduction

The traditional view of gross margins in business valuation treats them as a snapshot metric, a percentage that tells buyers what portion of revenue survives the direct cost of goods sold. Higher margins generally indicate better pricing power, more efficient operations, or both. This understanding isn’t wrong, but it’s incomplete.

This article focuses on gross margin trends (gross profit divided by revenue), as they reflect pricing power and core business efficiency. But buyers ultimately care about EBITDA margins because they reflect all-in profitability. Gross margin improvement is most valuable when it translates to EBITDA improvement, which requires cost of goods sold improvement not to be offset by rising operating expenses. Keep this distinction in mind as you evaluate your own situation.

Many institutional buyers, particularly private equity firms, have evolved their analysis to consider trajectory alongside static position. They’ve learned through experience that a business’s direction often provides context that absolute numbers alone cannot. A company improving from 35% to 40% gross margins over three years tells a fundamentally different story than one declining from 45% to 40% over the same period, even though both arrive at the same destination.

This shift in buyer thinking reflects deeper truths about business value. Improving margins may suggest a company gaining competitive advantage, successfully implementing pricing strategies, or achieving operational efficiencies that could continue generating returns. Declining margins can hint at commoditization, competitive pressure, rising costs, or management challenges that warrant investigation, though they can also reflect deliberate strategic choices like investing in market share.

For business owners, this creates an imperative to understand not just where their margins stand, but where they’re heading and why. The margin story you present to buyers, backed by data, explained with clarity, and ideally showing positive trajectory, can influence both valuation and deal structure. In the sections that follow, we’ll examine how buyers analyze margin trends, what different patterns may signal, and how you can influence your margin trajectory before exit.

Important context: The frameworks in this article apply primarily to businesses in the $2-20M revenue range where sufficient operational sophistication and customer diversity exist to implement pricing and mix strategies. Smaller businesses often lack these levers; larger businesses face additional complexity. Additionally, this analysis reflects private equity buyer perspectives, which tend to emphasize business trajectory as an indicator of future performance. Strategic buyers may weight margin trends differently depending on synergy potential and integration plans. Finally, margin improvement should be evaluated alongside growth opportunities, for many businesses, revenue growth creates more value than margin optimization, and the optimal strategy depends on your specific market opportunity and competitive position.

How Buyers Analyze Gross Margin Trends

Sophisticated buyers approach margin analysis with a structured methodology that goes beyond calculating percentages. Understanding their analytical framework helps sellers prepare for scrutiny and present their financials effectively.

The Three-Year Window

In our experience, most institutional buyers focus intensely on the trailing three years of margin data, though they’ll examine five years when available. This window captures enough data points to identify meaningful trends while remaining relevant to current market conditions. Within this window, buyers typically calculate:

Compound Annual Margin Change: Rather than simple point-to-point comparison, buyers often calculate the compounded rate of margin change. A business moving from 35% to 41% gross margin over three years shows a compound annual growth rate of approximately 5.4% applied to the margin percentage, which translates to roughly 2 percentage points of margin improvement annually. This distinction matters, buyers are looking at the rate of change on the existing base, not absolute percentage point gains.

Quarterly Trend Analysis: Annual numbers can mask concerning patterns. Buyers drill into quarterly data to identify seasonality, one-time events, and the true underlying trend. A company showing annual margin improvement might reveal concerning Q4 compression each year, suggesting end-of-period discounting or inventory issues.

Margin Volatility Assessment: Consistency matters alongside direction. Margins that bounce between 38% and 44% may raise more concerns than those steadily progressing from 36% to 40%, even if the average is similar. Volatility can suggest less control over pricing or costs.

Revenue Mix Analysis

Smart buyers don’t just analyze aggregate margins, they decompose them by product line, customer segment, and service offering. This analysis reveals whether margin trends reflect genuine improvement or shifting mix effects.

Consider a company whose overall margins improved from 40% to 45%. This could represent genuine pricing power gains, or it could mean higher-margin products grew while lower-margin products shrank. Both scenarios produce the same aggregate trend, but they carry vastly different implications for sustainability and future growth.

Buyers will ask: Can you grow the high-margin segments further, or are they mature? Are the shrinking low-margin segments strategically important? What happens to overall margins if growth patterns shift?

Customer Concentration Impact

Margin trends take on different meaning when viewed through customer concentration data. Improving margins driven by better pricing across a diverse customer base may signal sustainable competitive advantage. The same improvement resulting from a single large customer accepting price increases is far more precarious.

Buyers specifically examine whether margin trends depend on relationships that could change post-acquisition. If a significant customer, whether representing 20%, 25%, or 35% of revenue, has accepted above-market pricing, that margin contribution may not survive ownership transition. The specific threshold matters less than whether the margin improvement is structurally dependent on concentrated relationships.

What Different Margin Patterns May Signal to Buyers

Every margin trajectory tells a story. Buyers have learned to read these stories with nuance, understanding what different patterns typically indicate about business health and future prospects, while recognizing that context matters enormously.

The Improving Margin Story

Consistent margin improvement over multiple years is generally viewed as a positive signal. Buyers often interpret this pattern as potential evidence of:

Strengthening Competitive Position: Businesses gaining pricing power may show expanding margins. This can suggest customers value the offering enough to accept price increases or that competitive alternatives are limited.

Operational Maturation: Growing businesses often see margin improvement as they achieve scale economies, optimize processes, and move up learning curves. This pattern may suggest continued improvement potential.

Effective Management: Sustained margin improvement typically requires deliberate attention to pricing, cost management, vendor negotiation, and operational efficiency. Margins can improve temporarily from mix shifts or market changes, but maintaining improvement usually requires management discipline.

Sustainable Value Creation: Unlike revenue growth, which can sometimes be purchased through marketing spend or price cuts, structural margin improvement often reflects genuine value creation that compounds over time.

But margin improvement quality matters as much as magnitude. Sustainable margin improvements come from serving better customers at higher prices or from genuine operational efficiency. Margin improvements achieved by reducing service quality or firing demanding but sticky customers might improve near-term metrics while degrading long-term business quality.

The Stable Margin Story

Flat margins over time represent a more ambiguous signal that buyers interpret contextually:

In High-Margin Businesses: Stability at 50%+ gross margins may indicate a mature, well-positioned business that has optimized its model. This isn’t necessarily concerning if the absolute level is healthy and the business shows growth in other dimensions.

In Lower-Margin Businesses: Stability at 25-30% margins may raise questions about why improvements haven’t occurred. Is management not focusing on margin improvement? Are competitive pressures preventing improvement? Is the business model fundamentally constrained?

In Growing Businesses: Maintaining margins while scaling rapidly actually represents an achievement, as many businesses see margin compression during growth phases. Context matters significantly in interpreting stable trends.

The Declining Margin Story

Margin compression typically triggers questions from buyers, regardless of absolute levels. A business declining from 55% to 48% margins may face harder questions than one improving from 30% to 35%. But declining margins don’t automatically indicate problems, they raise questions about whether they reflect:

Competitive Pressure: Shrinking margins sometimes indicate competitors offering comparable value at lower prices, forcing price concessions or increased spending to maintain market position.

Commoditization Risk: Products or services becoming commoditized may show margin compression as differentiation erodes.

Cost Structure Challenges: Rising input costs not passed to customers may signal either pricing constraints or cost management difficulties.

Deliberate Strategic Investment: Some businesses intentionally reduce prices to gain market share, expecting margin recovery post-scale. High-growth companies often accept margin compression as an investment in market position.

Buyers will investigate causation carefully. A business owner who can explain that declining margins reflect deliberate market-share investment backed by strong growth may face a very different reception than one whose margins are declining due to competitive pressure with flat revenue.

Important caveat: While this example illustrates how positive margin trajectory can influence buyer perception, outcomes vary significantly. Some businesses achieve strong exits despite margin pressure due to growth rates, market position, or strategic value to buyers. Margin trends are one factor among many.

Industry Context Shapes Interpretation

Margin trends must be evaluated within industry context, a point often underappreciated by business owners preparing for exit. Based on public company benchmarks and industry reports, typical gross margin ranges vary substantially:

Software and SaaS: Gross margins typically range from 70-85% or higher in recurring revenue models. Margin improvement in these high-margin businesses typically signals strong unit economics and pricing power. Buyers in this space often pay premium multiples for businesses demonstrating margin expansion alongside growth.

Professional Services: Margins commonly range from 35-55% depending on service type and delivery model. In agency and consulting businesses, improving margins might indicate efficiency gains and pricing power, or they might reflect unsustainable cost-cutting that degrades service quality. Buyers look closely at whether margin improvement correlates with client retention.

Manufacturing: Gross margins typically range from 20-40% depending on complexity and differentiation. Margin improvement might indicate automation benefits, supply chain optimization, or pricing power. But it might also reflect reduced R&D investment or deferred capital expenditure, potentially mortgaging future competitiveness for current margins.

Distribution and Logistics: These typically lower-margin businesses (often 15-25%) operate in competitive environments where 1-2% margin improvement represents meaningful achievement. Buyers evaluate whether improvements reflect sustainable efficiency gains or temporary market conditions.

Understand your industry’s margin dynamics before assuming a common interpretation applies to your situation.

The Valuation Impact of Margin Trajectories

The financial impact of margin trends on valuation goes beyond simple multiple adjustments. Buyers build financial models projecting future performance, and margin assumptions significantly influence these projections.

Multiple Expansion and Compression

Businesses with improving margin trends may command higher EBITDA multiples than those with declining trends, even at similar current profitability levels. The magnitude varies considerably by industry, buyer type, deal size, and overall business quality.

Based on our experience with mid-market transactions, we observe patterns roughly consistent with the following framework, though actual results vary significantly and these ranges should not be assumed to apply across all industries or deal contexts:

| Margin Trend | Potential Multiple Impact | Key Qualifiers |

|---|---|---|

| Improving 200+ bps annually | Potential +0.3x to +0.8x | Strongest impact in differentiated businesses with pricing power; varies by industry |

| Stable margins | Typically baseline multiple | Context-dependent; stability at high levels viewed differently than at low levels |

| Declining 100-200 bps annually | Potential -0.3x to -0.8x | Impact depends on whether decline reflects investment or competitive pressure |

| Declining 200+ bps annually | Potential -0.5x or more | Significant buyer concern unless explained by strategic investment |

Important caveat: These ranges represent observations from our practice, not rigorous empirical research across hundreds of transactions. Actual impact depends on numerous factors including industry norms, buyer sophistication, growth rates, customer concentration, competitive positioning, and market conditions. We strongly encourage business owners to discuss expected multiple ranges with experienced M&A advisors familiar with their specific industry and situation.

For a business with $2M EBITDA valued at a 5.0x baseline multiple ($10M enterprise value), improving margin trends might support a modestly higher multiple, while declining margins might reduce the multiple. The specific impact is highly context-dependent, and valuation outcomes depend on the full picture of business quality, not margin trajectory alone.

Deal Structure Implications

Beyond headline valuation, margin trends can influence deal structure in ways that affect actual proceeds:

Earnout Provisions: Buyers concerned about margin sustainability sometimes propose earnouts tied to margin maintenance. For example, if a purchase price includes earnout components tied to maintaining specific margin thresholds, declining performance could reduce earnout payouts meaningfully, depending on earnout structure and performance thresholds.

Working Capital Adjustments: Businesses with margin pressure sometimes show working capital strain. Buyers may scrutinize inventory and receivables more closely, potentially adjusting purchase price for working capital issues related to margin challenges.

Representation and Warranty Coverage: Concerning margin patterns can prompt more extensive rep and warranty requirements around customer pricing agreements, supplier contracts, and competitive positioning.

The Projection Effect

Perhaps most significantly, margin trends affect buyer projections of future performance. A buyer modeling a $10M revenue business will reach different conclusions depending on margin assumptions:

Improving Trend Projection: Assumes margins continue improving, reaching 45% within five years. This drives significant EBITDA growth beyond revenue increases.

Stable Trend Projection: Assumes current 42% margins persist. EBITDA grows proportionally with revenue.

Declining Trend Projection: Assumes margins continue compressing, falling to 39%. EBITDA growth significantly lags revenue growth.

These different projections can produce exit value estimates varying substantially, often driven primarily by margin trend assumptions.

Important caveat: Margin trends predict future profitability of your business in its current form. Post-acquisition, buyers often implement integration changes, eliminating certain products, consolidating functions, achieving scale synergies, that alter margin economics. Don’t be surprised if post-acquisition results differ from pre-sale projections.

Margin Improvement vs. Revenue Growth - Strategic Trade-offs

Before committing to margin improvement as your primary pre-exit strategy, carefully consider whether it’s the right priority for your situation. For many businesses, revenue growth creates more value than margin improvement, or a balanced approach outperforms either extreme. This evaluation is critical: focusing on margins when growth opportunities exist may sacrifice more valuable outcomes.

Consider three hypothetical strategies for a $10M revenue business with 40% gross margins and $4M EBITDA:

Strategy A - Margin Focus: Improve margins from 40% to 44% over three years, hold revenue at $10M. EBITDA grows to approximately $4.4M. At a potential 5.5x multiple (assuming margin premium), enterprise value reaches approximately $24.2M.

Strategy B - Growth Focus: Hold margins at 40%, grow revenue to $12.5M over three years. EBITDA grows to $5M. At a 5.0x baseline multiple, enterprise value reaches $25M.

Strategy C - Balanced Approach: Grow revenue to $11.5M, improve margins to 42%. EBITDA grows to approximately $4.8M. At a 5.25x multiple, enterprise value reaches approximately $25.2M.

These simplified scenarios illustrate a critical point: margin improvement isn’t automatically the highest-value strategy. Strategy effectiveness depends on market opportunity, competitive constraints, and your business’s specific situation. Margin improvement matters most when growth is limited; growth matters most when margins are already healthy or when market opportunity is substantial.

When margin focus may be suboptimal: For businesses with strong growth opportunities and healthy absolute margins, maintaining status quo on margins while focusing resources on growth may create more value than margin optimization initiatives. Evaluate your market opportunity honestly before committing to margin-focused strategies.

Evaluate margin improvement as part of a broader strategy that also considers revenue growth and business resilience. Don’t sacrifice growth to improve margins without understanding the trade-offs.

Framework for Improving Margin Trajectory Before Exit

Business owners planning exits in 3-5 years have meaningful opportunity to influence their margin trajectory. The key is starting early enough to establish genuine trends, typically 24-36 months of consistent execution, rather than attempting last-minute improvements that buyers will view skeptically.

Investment reality check: Margin improvement initiatives require meaningful investment. Based on our experience, comprehensive margin improvement programs typically require $100,000-$300,000 or more in direct costs (consulting, technology, process improvement) plus significant management attention (300-800 hours over the implementation period). Factor these costs into ROI calculations before committing to margin improvement as a primary strategy.

Pricing Strategy Optimization

Pricing represents the highest-leverage margin improvement opportunity for businesses with sufficient differentiation and pricing power. Consider these approaches:

Value-Based Pricing Migration: Moving from cost-plus to value-based pricing can unlock significant margin improvement in differentiated businesses. But this transition is more complex than it appears. It requires understanding customer value perception through research and testing, typically takes 12-24 months for full implementation, and may require pricing expertise that most mid-market businesses need to acquire. Test pricing changes with limited customer segments before broad implementation.

Annual Price Increase Discipline: Systematic annual increases of 2-4% can materially improve margin trends over a three-year period. But this approach is most feasible for businesses with differentiated offerings, customer switching costs, or inelastic demand. Commodity or highly competitive businesses may struggle to achieve even 1-2% increases without customer loss.

Critical warning: Price increase strategies carry meaningful execution risk, particularly for businesses with customer concentration above 25% or in competitive markets. Test with limited customer segments before broad implementation, prepare retention strategies for key accounts, and honestly assess your competitive positioning before committing. Customer defection can exceed margin benefits if pricing power is overestimated, we’ve seen revenue decline 15-25% in cases where businesses misjudged their competitive position.

Customer Segmentation Pricing: Different customer segments often support different price points. Implementing segmented pricing captures value from customers willing to pay more while maintaining volume from price-sensitive segments.

Product/Service Bundling: Strategic bundling can improve effective pricing by combining offerings in ways that increase total transaction value while providing perceived customer value.

Cost Structure Improvement

While often less impactful than pricing optimization, cost improvement contributes to margin trends:

Supplier Consolidation and Negotiation: Consolidating purchases with fewer suppliers often yields volume discounts. Regular renegotiation of supplier agreements should be standard practice. This approach offers relatively quick wins with lower execution risk than pricing strategies.

Direct Labor Efficiency: Process improvement, automation investment, and productivity improvement reduce direct labor cost per unit. Even modest improvements compound over multiple years.

Material Yield Optimization: Manufacturing businesses often find margin improvement through reduced scrap, better material utilization, and quality improvement that reduces rework.

Timeline consideration: Cost reduction initiatives through automation typically require 12-24 months of implementation time and 2-3 years for payback. For pre-exit margin improvement with shorter timelines, focus on quick-win initiatives (supplier renegotiation, pricing discipline, product mix shifts) that impact margins within 12 months. Reserve larger capital investments for exit timelines of 3+ years.

Product and Service Mix Management

Strategic decisions about which products and services to emphasize can significantly impact margin trends:

High-Margin Offering Investment: Allocating growth investment toward higher-margin offerings shifts mix over time, improving aggregate margins even without improvement in any individual product.

Low-Margin Product Rationalization: Eliminating or de-emphasizing low-margin products can improve aggregate margins and often reveals hidden complexity costs that further boost profitability.

Service Attachment Strategy: Adding services to product sales often improves overall margins, as services typically carry higher margins than physical products.

Implementation caution: Product mix optimization can improve aggregate margins but comes with implementation risks. Reducing investment in lower-margin offerings sometimes eliminates customer anchors and volume that subsidize fixed costs. Make sure strategically important products aren’t disguised as “low-margin” offerings to cut. Test mix strategies with one customer segment before full implementation.

Understanding Sustainable vs. One-Time Improvements

Not all margin improvements carry equal weight with buyers:

Sustainable improvements from structural changes, pricing optimization, product mix shifts toward higher-margin offerings, operational process improvements, typically persist post-acquisition and are valued accordingly.

One-time improvements from initiatives like one-time supplier renegotiations, asset sales, or reduced R&D spending often don’t sustain and may be discounted in buyer projections.

Buyers distinguish between recurring and one-time margin drivers. Focus your efforts on structural improvements that demonstrate ongoing competitive advantage.

Documentation and Narrative Development

Margin improvement means little if buyers don’t understand it. Prepare to explain your margin story with:

Clear Trend Documentation: Prepare quarterly margin analysis showing trend progression with clear explanation of drivers.

Initiative Attribution: Document specific initiatives driving margin improvement, pricing changes, cost reduction programs, mix shifts, with quantified impact.

Sustainability Evidence: Demonstrate why improvements will persist post-acquisition rather than reverting to prior levels.

Market Conditions and Buyer Behavior

This analysis reflects market conditions and buyer priorities in 2024-2025. Buyer focus on margin trajectory tends to be strongest when growth rates are moderate and financing is readily available. In down markets or periods of capital scarcity, buyers may focus more heavily on absolute margin levels and cash generation, regardless of trajectory.

Additionally, not all buyers weight margin trends equally:

Private equity buyers typically emphasize trajectory because they’re modeling future performance and eventual exit value. Improving trends support optimistic projections.

Strategic buyers may weight margin trends differently depending on synergy potential and integration plans. A strategic buyer integrating your operations into larger infrastructure might care more about absolute margins and synergy potential than historical trajectory.

Turnaround specialists and distress investors focus on undervalued assets and turnaround potential rather than historical trajectory. For these buyers, declining margins might actually signal opportunity.

Understand your likely buyer pool and tailor your margin story accordingly.

Actionable Takeaways

Audit Your Current Trajectory: Pull three years of monthly gross margin data. Calculate annual trends, quarterly patterns, and volatility measures. Understand your current story before trying to change it.

Decompose by Segment: Break margins down by product line, customer segment, and service offering. Identify where improvement is occurring or possible, and where headwinds exist.

Assess Your Pricing Power Honestly: Before committing to pricing increases, evaluate your competitive position rigorously. Consider customer concentration, competitive alternatives, and switching costs. For businesses with customer concentration above 25% or in commodity markets, alternative margin improvement approaches may be preferable to aggressive pricing strategies.

Evaluate Margin vs. Growth Trade-offs: Model outcomes under different scenarios, margin focus, growth focus, balanced approach. Determine which creates most value given your market opportunity and competitive constraints. For many businesses, growth creates more value than margin optimization.

Budget for Implementation: Margin improvement initiatives typically require $100,000-$300,000 or more in direct costs plus significant management time. Make sure ROI justifies the investment before committing.

Implement Quick Wins First: For exit timelines under three years, focus on supplier renegotiation, pricing discipline, and mix optimization, initiatives that impact margins within 12 months with lower execution risk.

Start Early: Margin improvement trends need 24-36 months to establish credibility with sophisticated buyers. Begin focusing on trajectory at least three years before your anticipated exit window.

Document Everything: Keep records of margin improvement initiatives, their timing, and their measured impact. This documentation becomes valuable during buyer due diligence.

Understand Industry Context: Research how margin trends are typically interpreted in your industry. What’s impressive improvement in distribution might be unremarkable in software.

Consider When “Do Nothing” Is Optimal: If your margins are healthy in absolute terms and significant growth opportunities exist, maintaining margin status quo while focusing resources on growth may be the higher-value strategy.

Conclusion

The increased buyer attention to margin trends, particularly among private equity firms, reflects a sophisticated understanding of business value creation. Static snapshots, however favorable, tell buyers less than dynamic trajectories about future performance potential. A business demonstrating consistent margin improvement may signal competitive strength, operational quality, and management capability, attributes that can support improved valuations.

For business owners planning exits, this reality creates clear imperatives. Understanding how buyers analyze margin trends is the first step. Evaluating your own trajectory honestly, acknowledging both strengths and concerns, allows targeted improvement efforts. Implementing pricing optimization, cost improvement, and mix management strategies can meaningfully change your margin story over a multi-year period.

But margin trajectory is one of many value drivers, and not always the most important one. Revenue growth rate, customer stability, competitive position, and management quality often matter as much or more. For businesses with strong growth opportunities and healthy absolute margins, focusing on growth rather than margin optimization may create more value. Pursue margin improvement as part of a balanced strategy, not as a singular focus that sacrifices other value creation opportunities.

The financial stakes justify thoughtful evaluation but require perspective. Valuation impacts from margin trajectory can translate to meaningful dollars in transaction value for businesses in the $2-20M revenue range, though specific impacts are highly context-dependent. Perhaps more importantly, a positive margin story, backed by data and sustainable improvements, can reduce buyer concerns, smooth due diligence, and support cleaner deal structures.

Start examining your margin trajectory today. The story those numbers tell will influence your exit outcome, and you have more ability to shape that narrative than you might think. Just remember that margin trends are part of a larger picture, and the most successful exits come from businesses that strengthen across multiple dimensions simultaneously. Consult with experienced M&A advisors familiar with your specific industry to understand how these dynamics apply to your situation.